You can go your own way

Go your own way

You can call it

Another lonely day

-“Go Your Own Way”, Fleetwood Mac

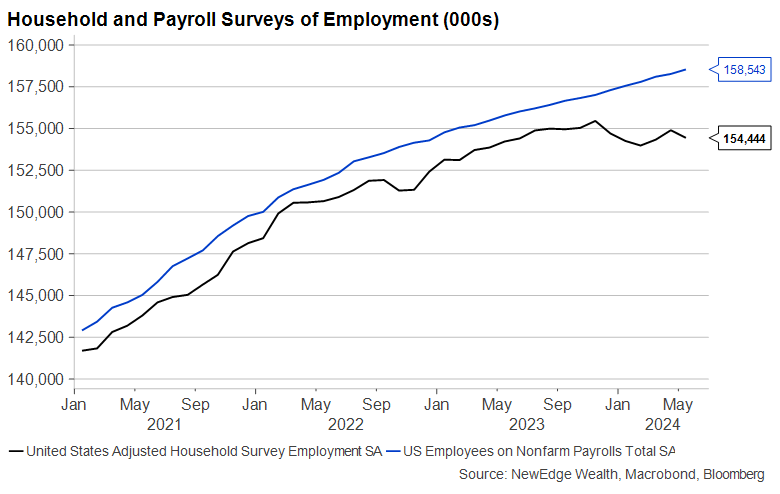

There may be only one duo that is more at odds than 1977 Stevie Nicks and Lindsay Buckingham, and that is the Payroll and Household Surveys for employment in the U.S.

Like the quarrelsome rock n’ roll couple, these two measures of U.S. labor data “went their own way” in the jobs reading for May.

The Establishment/Payroll survey blew consensus expectations out of the water, with +272k jobs added (vs. +180k expected), but this contrasted the Household survey that showed -408k lost.

(The biggest difference between the two surveys is that the Payrolls report surveys businesses, while the Household report surveys household; here is a Bureau of Labor Statistics overview).

As of 6-7-24

As the chart above shows, these surveys have been disagreeing of late (the Household Survey has been painting a weaker labor picture than the Payroll Survey), but the May divergence was an extreme. There were quite a few statistical quirks and points to pick at, including:

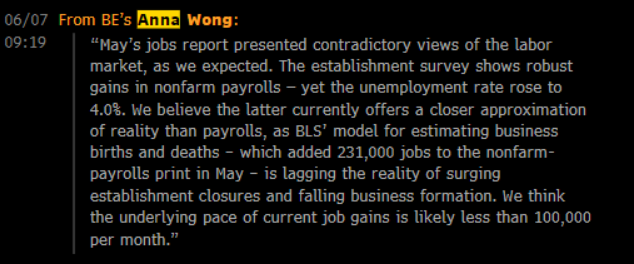

• The 230k contribution to the Payroll Survey from the “Birth-Death Ratio”, which is an adjustment to payrolls data that attempts to capture the impact of businesses opening and closing. It is often considered a “black box” and the source of future revisions to the data.

• The entirety of the weakness in the Household Survey coming from job losses in the 16-24 year old age cohort, which suggests some kind of seasonality could be at play given the end of the school season and the start of summer jobs.

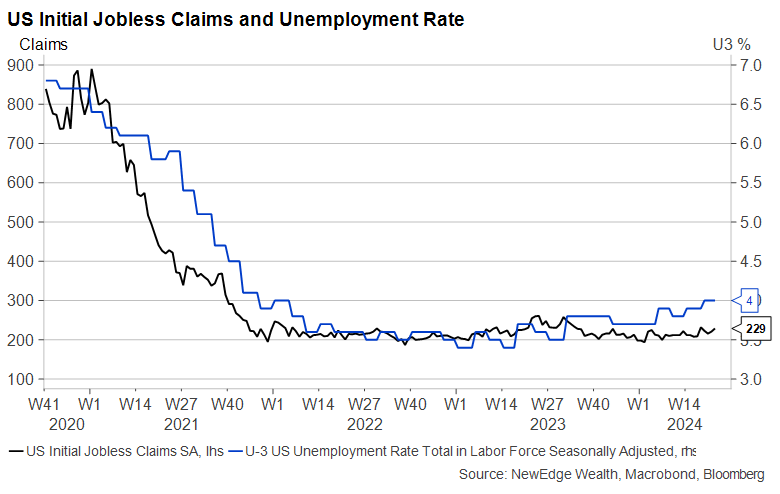

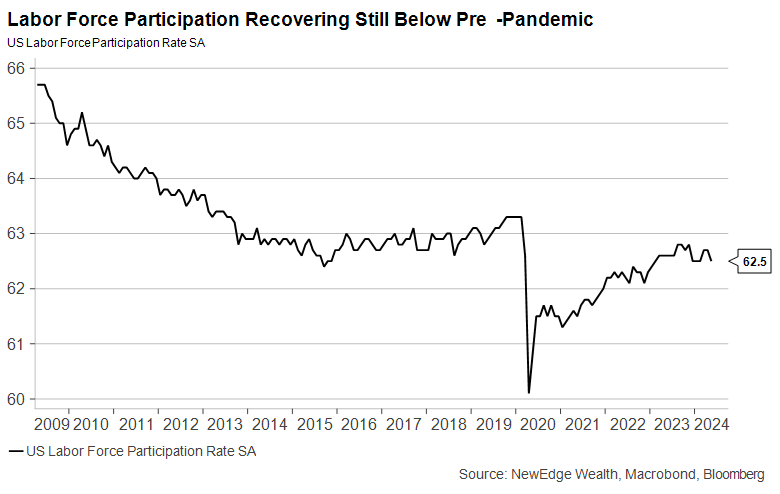

• The Unemployment rate ticking higher to 4.0% despite a drop in Labor Force Participation, reflecting the weak Household Survey, on which the unemployment calculation is based.

• Full-Time jobs fell again in May (-620k), while Part-Time jobs rose again +286k. Over the last year, Part-Time job additions have significantly outpaced Full-Time job additions, however the classification for Part-Time work has not been for “economic reasons”. The BLS defines economic reasons as those that would like full-time work but have to settle for part-time.

As of 6-7-24

As of 6-7-24

Clearly, this was a messy and confusing jobs report that resembled a Rorschach test more than a statistically sound economic data release. We think the reality is somewhere in between the two surveys. Bloomberg Economics’ Anna Wong estimates that the real job additions are likely running less than100k a month. Note that 100k job additions is what the Federal Reserve considers “neutral”, so this deceleration in job additions might spook markets but wouldn’t necessarily cause an immediate change in Fed policy/commentary.

Source: Bloomberg Top Live Blog, as of 6-7-24

Looking forward, the accuracy of either report will be judged in coming months by data revisions and, more importantly/empirically, by consumer spending. If the Establishment Survey is to be believed, then we should see consumer spending hold up through the summer (Hot Girl Summer Part Two?), while if the Household Survey is to be believed, we could see consumer spending begin to soften.

For now, our must-watch-measure of the equity market’s assessment of the consumer continues to show signs of resilience. The ratio of equal weight Consumer Discretionary vs. Consumer Staples stocks has rebounded heartily in the last two weeks, continuing its uptrend and avoiding a key warning (when it happens, we’ll write an Incubus themed Weekly Edge) that the consumer could be weakening.

Equal Weight Consumer Discretionary vs. Consumer Staples &

Forecasts for 2023 and 2024 Household Consumption in GDP (Bloomberg Consensus)

Source: Bloomberg, NewEdge Wealth, as of 6-7-24

There are, of course, signs of fraying for some consumers, as consumer-focused companies call out spending habits being more selective and responding well to price cuts (companies like McDonald’s, Target, and Walmart have all announced recent price cuts on select products).

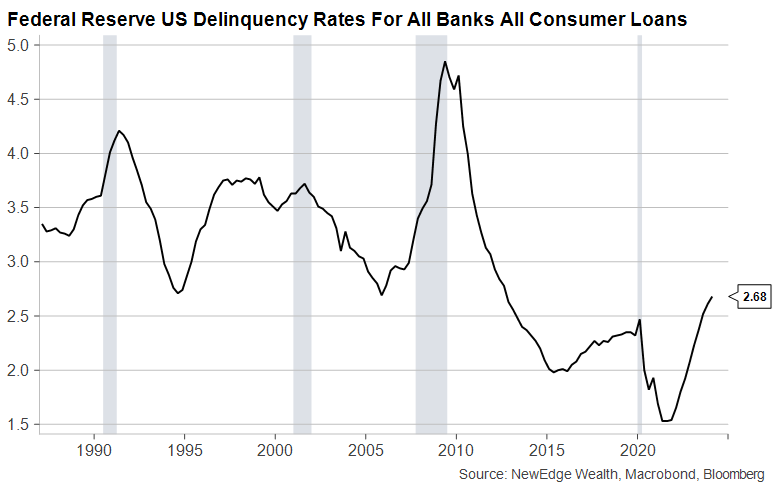

This reflects how consumers in upper- and lower-income cohorts are also “going their own way”, with lower income consumers feeling the pinch of sticky prices and depleted excess savings (notably we have seen delinquency rates for credit cards spike higher, likely reflecting this lower income stress).

As of 6-7-24

Overall, our assessment of the labor market is one of continued normalization but not necessarily of outright weakening. Normalization comes in the form of measures like Job Openings to Unemployed Workers falling back to its pre-pandemic peak, and Quits moderating to its pre-pandemic range.

This does not mean that there are not any signs of weakness. Factors like falling full-time employment are a notable concern, while we don’t think that the headline employment data can be fully trusted given the statistical quirks.

Again, think the best way to make sense of these Strange Landing data conflicts is to assess the impact of the data on consumer spending (consumer sentiment will also reflect these trends, but can be heavily distorted by political party affiliation, gas prices, and other non-jobs factors).

So, as much as we would like to “tell you why everything turned around”, we will have to watch consumer spending closely in the coming months to assess the underlying health of the U.S. jobs market.

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC