What the Proposals Mean for Ultra High Net Worth Individuals

As the 2024 presidential election approaches, tax policy has taken center stage, particularly for ultra high net worth (UHNW) individuals with significant wealth. Both candidates, Kamala Harris and Donald Trump, are proposing tax plans that could drastically reshape the financial landscape. This whitepaper will break down the key proposals from each candidate and their potential impact on your wealth, including estate taxes, income taxes, and corporate structures.

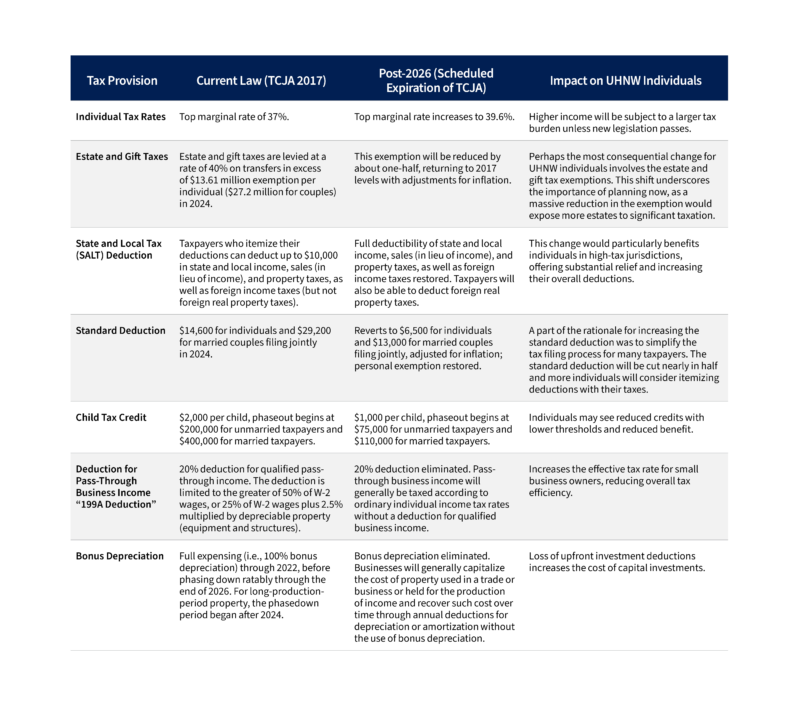

Tax Law Set to Expire in 2026¹

With the 2017 Tax Cuts and Jobs Act (TCJA) set to expire December 31, 2025, several provisions important to UHNW individuals will revert to pre-2017 levels unless Congress acts. Trump and Republicans broadly aim to extend and possibly enhance the existing 2017 tax cuts.

Harris has aligned with Biden’s proposals, pledging not to increase taxes for individuals earning less than $400,000. The chart below outlines some of the key provisions under the TCJA.

Comparing Harris and Trump Tax Proposals

Kamala Harris’ Tax Proposal

Vice President Kamala Harris has largely echoed the Biden administration’s stance on taxation, promising not to increase taxes on households earning less than $400,000, but may also introduce significant changes such as raising the top capital gains tax rate from 20% to 28% as well as significant changes to the estate tax landscape. Kamala’s focus is on enhancing social programs and revising credits and exemptions.5 Her key proposals include:

Individual Income Taxes

- Exempt tip wages from income taxation; payroll taxes for Social Security and Medicare would remain.2

- Raise the Medicare tax to 5% for income above $400,000.2

Capital Gains and Qualified Dividend Taxes

- Raise the top tax rate on long-term capital gains from 20% to 28% for households with taxable income over $1 million.3

- Increase the net investment income tax (NIIT) from 3.8% to 5% for income above $400,000.3

- Impose a 25% minimum tax on total income, including unrealized gains, or asset growth, exceeding $100 million.17

- Taxpayers with wealth above the $100 million threshold would have to report unrealized gains for each asset class annually, including the basis, or original purchase price, and market value.

Credits, Deductions, and Exemptions

- Increase the Child Tax Credit to $3,600 for children aged 2-5 and $3,000 for children aged 6-17 and provide a

- $6,000 child tax credit for newborns in the first year of life. This credit is currently $2,000 per eligible child.2

- Extend ARPA Earned Income Tax Credit for workers without children. The existing credit is designed to benefit workers and families with low-to-moderate incomes.2

- Extend the Affordable Care Act Premium Tax Credit in an effort to make health insurance more affordable for those who purchase coverage through the ACA marketplace.2

- Boost housing tax credits, including those for low-income housing, first-time homebuyers, and the construction of new homes. The Harris campaign proposes providing an average of $25,000 for all eligible first-time homebuyers, with additional support for first-generation homebuyers.2

- Expand Section 195 Startup Expenses Deduction from $5,000 to $50,000.2

- Limit depreciation and interest deductions for certain large property investors. The Harris package would further penalize rental housing construction by peeling back depreciation and interest deductions for certain large property investors, reducing investment incentives.2

Estate and Gift Taxes

Harris’ campaign has endorsed the estate tax reforms contained in the American Housing and Economic Mobility Act of 2024 (the “Proposed Act”). The Proposed Act would dramatically affect the current estate tax laws and could drive a need to engage in estate planning between the November 2024 election and the inauguration in late January 2025.18,19

Increased Estate Tax Rates

- Current Law: The estate tax rate is a flat 40% for amounts in excess of $13.61 million for 2024 (less any gift tax exemption used during life).

- Proposed Act: The estate tax rate would be graduated as follows, (i) estates between $3.5 million and $13 million taxed at 55%, (ii) estates between $13 million and $93 million taxed at 60%, and (iii) estates in excess of $93 million taxed at 65%.

Reducing Gift and Estate Tax Exemption Threshold Amount

- Current Law: The current estate and gift tax exemption amount for 2024 is $13.61 million per person.

- Proposed Act: The estate and gift tax exemption amount would be reduced to $3.5 million per person.

Surcharge on High-Income Estates and Trusts

- Current Law: No surcharge on high-income estates and trusts.

- Proposed Act: The bill introduces a new surcharge on high-income estates and trusts, consisting of a 5% tax on the portion of the modified adjusted gross income (MAGI) that exceeds $200,000, and an additional 3% tax on the portion that exceeds $500,000. Notably, charitable trusts are exempt from this surcharge.

10% Surcharge on Billionaires

- Current Law: No surcharge on estates in excess of $1 billion dollars.

- Proposed Act: If an estate exceeds $1 billion dollars, the total estate tax would be increased by an additional 10%.

Corporate Taxes

- Increase corporate income tax rate to 28%. Harris seeks to increase the corporate tax rate from 21% to 28%, generating substantial revenue for federal programs. For UHNW individuals with large corporate holdings, this could reduce profits and lower after-tax returns.4

Donald Trump’s Tax Proposal

Former President Donald Trump’s plan includes imposing a universal baseline tariff on all imports, implementing a substantial 60% tariff on goods from China, and making the tax cuts from the Tax Cuts and Jobs Act (TCJA) permanent. Trump also proposes lowering the corporate income tax rate, taxing large private university endowments, and potentially replacing income taxes with tariffs. Additionally, he suggests exempting tip income and Social Security benefits from taxation and expanding the child tax credit to a universal $5,000. These proposals reflect a significant shift in tax policy and have potential implications for various sectors and taxpayers.5 His key proposals include:

Individual Income Taxes

- Make the expiring individual income tax cuts from the 2017 Tax Cuts and Jobs Act permanent. This would keep the top marginal rate at 37%, rather than increasing it to 39.6% under current law.6

- Consider replacing personal income taxes with increased tariffs.7

- Exempt tip wages from income taxes.8

Payroll Taxes

- Exempt Social Security benefits from taxation.9

Capital Gains and Qualified Dividend Taxes

- No tax policies have been proposed. If none are introduced, the highest long-term capital gains rate will remain at 20%.

Credits, Deductions, and Exemptions

- Vice President candidate JD Vance has discussed increasing the child tax credit to $5,000.10 This credit is currently $2,000 per eligible child.

Estate and Wealth Taxes

- Make the expiring estate tax cuts from the 2017 Tax Cuts and Jobs Act permanent.11 The estate tax rate is a flat 40% for amounts in excess of $13.61 million for 2024 (less any gift tax exemption used during life).

Business Taxes

- Lower the corporate income tax rate from 21% to 20%.12

- Lower the corporate income tax rate to 15% for companies that make their products in the US.13

Excise Taxes

- Tax large private university endowments.14

Tariffs and Trade

- Impose a universal baseline tariff on all US imports of 10% to 20%.15

- Impose a 60% tariff on all US imports from China.16

- Consider replacing personal income taxes with increased tariffs.7

Estate and Gift Tax Proposals: Harris vs. Trump and the Need to Act Now

The estate and gift tax is a crucial area of differentiation. Harris’ endorsement presents a significant reduction in the estate tax exemption and increase in estate tax rates, which would result in more estates being subject to higher taxes. Trump, on the other hand, has expressed an interest in maintaining the elevated exemption levels introduced by the TCJA, allowing more wealth to be passed on to future generations without significant tax burdens.

Comparison of Key Estate Tax Elements

- Current Law: $13.61 million exemption per individual, reverting to $5 million, adjusted for inflation, in 2026.

- Harris’ Position: Kamala Harris’ campaign has endorsed the estate tax reforms proposed in the American Housing and Economic Mobility Act of 2024. If enacted, these reforms could necessitate urgent estate planning between the November 2024 election and the January 2025 inauguration. Key changes include: (i) graduated estate tax rates with a maximum of 65% for estates over $93 million, (ii) a reduction in the estate and gift tax exemption amount from $13.61 million to $3.5 million per person, (iii) a new surcharge on high-income estates and trusts of 5% tax on the portion of the modified adjusted gross income (MAGI) that exceeds $200,000, and an additional 3% tax on the portion that exceeds $500,000, and (iv) a 10% surcharge on estates exceeding $1 billion. These changes would significantly impact current estate tax laws and planning strategies.

- Trump’s Position: Push to maintain or even expand the higher exemption levels, keeping estate tax burdens lower.

UHNW individuals should prepare for either scenario by engaging in estate planning strategies that leverage current exemptions while they are still available. Even if the 2017 Tax Cuts and Jobs Act is extended and the estate and gift tax exemptions remain unchanged, it is still more efficient to transfer assets and remove future appreciation from your taxable estate while valuations are lower. Acting now by making taxable gifts, removing future appreciating from your taxable estate, can provide significant tax advantages rather than taking a “wait and see” approach that could lead to missed opportunities for wealth preservation.

Corporate Tax Differences

Another major difference between the two candidates is corporate tax policy. Trump is advocating for a significant reduction in the corporate tax rate, potentially as low as 15%. This may be particularly relevant for UHNW individuals who own large corporations or hold significant equity in privately held firms. Harris, in contrast, has not proposed major changes to the current corporate tax structure but would likely maintain or increase the current rates to support funding for government programs.

Overall Impact on Ultra High Net Worth Individuals

Both tax plans offer benefits and challenges. As the tax landscape continues to evolve, staying informed and engaging in proactive planning will be crucial for maximizing opportunities and mitigating risks.

The Trump proposals aim to maintain advantageous tax benefits for the wealthy, including preserving the lower marginal top income tax rate, retaining all-time high estate and gift tax exemptions, and implementing corporate tax reductions, all of which could bolster wealth accumulation. Conversely, Harris’ proposals emphasize expanding social safety nets, potentially requiring higher income and estate taxes on wealthy individuals to support these initiatives. Each approach will influence financial strategy and planning based on how these policies develop.

The 2024 election will have far-reaching implications for tax policy, particularly for ultra high net worth individuals. Harris and Trump offer starkly different approaches to taxation, from personal income to estate and corporate taxes. UHNW individuals should closely monitor these developments, as the next administration’s policies will shape the future of wealth management, estate planning, and business structuring.

By preparing for potential changes, engaging with financial advisors, and taking advantage of current tax laws, UHNW individuals can mitigate risk and optimize wealth transfer strategies.

SOURCES

1 Expiring Provisions in the “Tax Cuts and Jobs Act” (TCJA, P.L. 115-97)

2 https://taxfoundation.org/research/all/federal/kamala-harris-tax-plan-2024/

3 https://www.nytimes.com/2024/09/04/us/politics/harris-tax-break-small-business.html

4 https://taxfoundation.org/blog/trump-harris-corporate-tax-proposals/

5 https://taxfoundation.org/research/federal-tax/2024-tax-plans/

6 https://www.bloomberg.com/news/articles/2024-01-06/trump-considers-making-2017-personal-tax-cuts-permanent

7 https://www.cnbc.com/2024/06/13/trump-all-tariff-policy-to-replace-income-tax.html

8 https://www.washingtonpost.com/politics/2024/06/09/trump-tipped-wage-tax-cut/

9 https://taxfoundation.org/blog/trump-social-security-tax/

10 https://www.cbsnews.com/news/jd-vance-child-tax-credit-5000-what-to-know/

11 https://www.bloomberg.com/news/articles/2024-01-06/trump-considers-making-2017-personal-tax-cuts-permanent?embedded-checkout=true

12 https://subscriber.politicopro.com/article/2024/06/trump-says-he-wants-20-percent-corporate-tax-rate-00163358

13 https://www.c-span.org/video/?538141-1/president-trump-remarks-economic-club-york

14 https://www.politico.com/news/2023/11/01/trump-free-online-university-00124905

15 https://taxfoundation.org/blog/donald-trump-10-percent-tariff/

16 https://taxfoundation.org/blog/trump-china-trade-war-proposal/

17 https://taxfoundation.org/blog/harris-unrealized-capital-gains-tax/

18 https://www.forbes.com/sites/matthewerskine/2024/08/22/kamala-harris-endorses-american-housing-and-economic-mobility-act-tax-proposals/

19 https://www.taxnotes.com/research/federal/legislative-documents/proposed-legislation/h.r-9245-american-housing-and-economic-mobility-act-2024/7kjh0

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC