Weekly Summary: August 16 – 20, 2021

Key Observations from the Past Week:

- Federal Open Market Committee minutes show an inclination of the Federal Reserve to taper its asset-purchase program this year. We believe that the Delta variant effects might delay the beginning of taper.

- Although it has generally been more impactful than first thought, we continue to believe that the Delta variant’s impacts will be relatively short-lived.

- Higher EPS but lower P/E ratios have led equities higher this year.

- We expect that Q3 earnings will be at risk due to Delta variant effects and possible margin compression.

The Upshot: We remain optimistic as we look past the relatively short-term effects from the Delta variant that should slow economic growth and increase the rate of inflation. We continue to favor Value and Cyclical stocks on pullbacks, as we patiently wait for economic growth to become more apparent and for more investors to believe in the manageability of the Delta variant. We expect an eventual rebound in consumer sentiment/confidence.

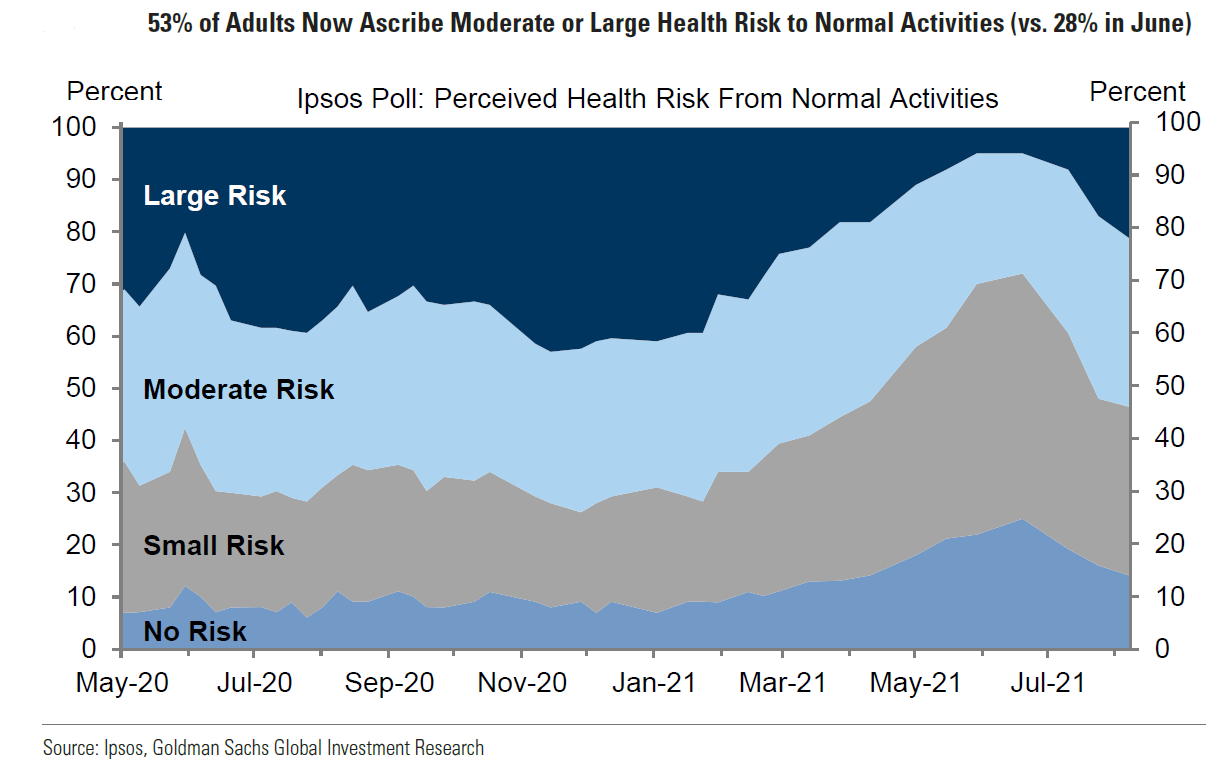

The Delta variant continues to wreak havoc with any forecast. Its impact varies by town, city, region and country. Vaccination rates appear to be a critical factor in lessening its impact. Government policies in regard to restrictions vary widely. People’s reactions, independent of government policies, also show great dispersion. The variant’s effect on mobility is still indeterminate. Although many people have moved back to their offices, many companies have delayed office reopenings due to rising levels of coronavirus infections.

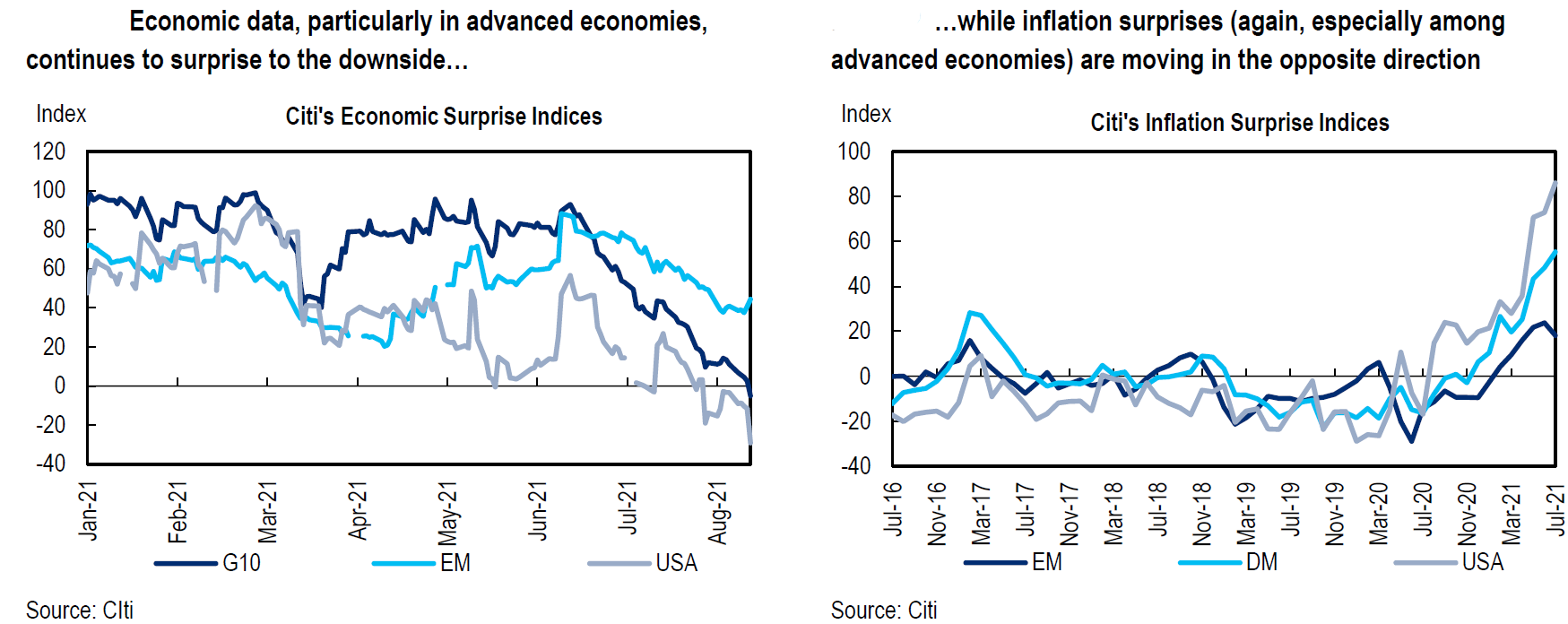

The latest U.S. Bureau of Labor Statistics data show that in those industries where work is primarily performed in offices, the percentage of employees working from home has dropped from over 60% in May of last year to just under 30% in July of this year. As economic growth rates have slowed, rates of inflation have increased. Hopefully, in the words of singer Marvin Gaye, we “can see what’s going on” presently with the Delta variant’s infections and their effect on economies, inflation and financial markets.

Source: Goldman Sachs, US Economic Recovery Tracker: August 18 Update: Virus Resurgence Weighs on Activity, (8/18/2021)

Source: Citi, Global Economic Outlook & Strategy: Waiting for supply, (8/18/2021)

Fed Minutes — Timing of Taper and Market Reaction

The minutes of the Federal Open Market Committee for their July 27-28 meeting were released this week. From the minutes: “Looking ahead, most participants noted that, provided that the economy were to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace of asset purchases this year because they saw the Committee’s ‘substantial further progress’ criterion as satisfied with respect to the price-stability goal and as close to being satisfied with respect to the maximum-employment goal.”

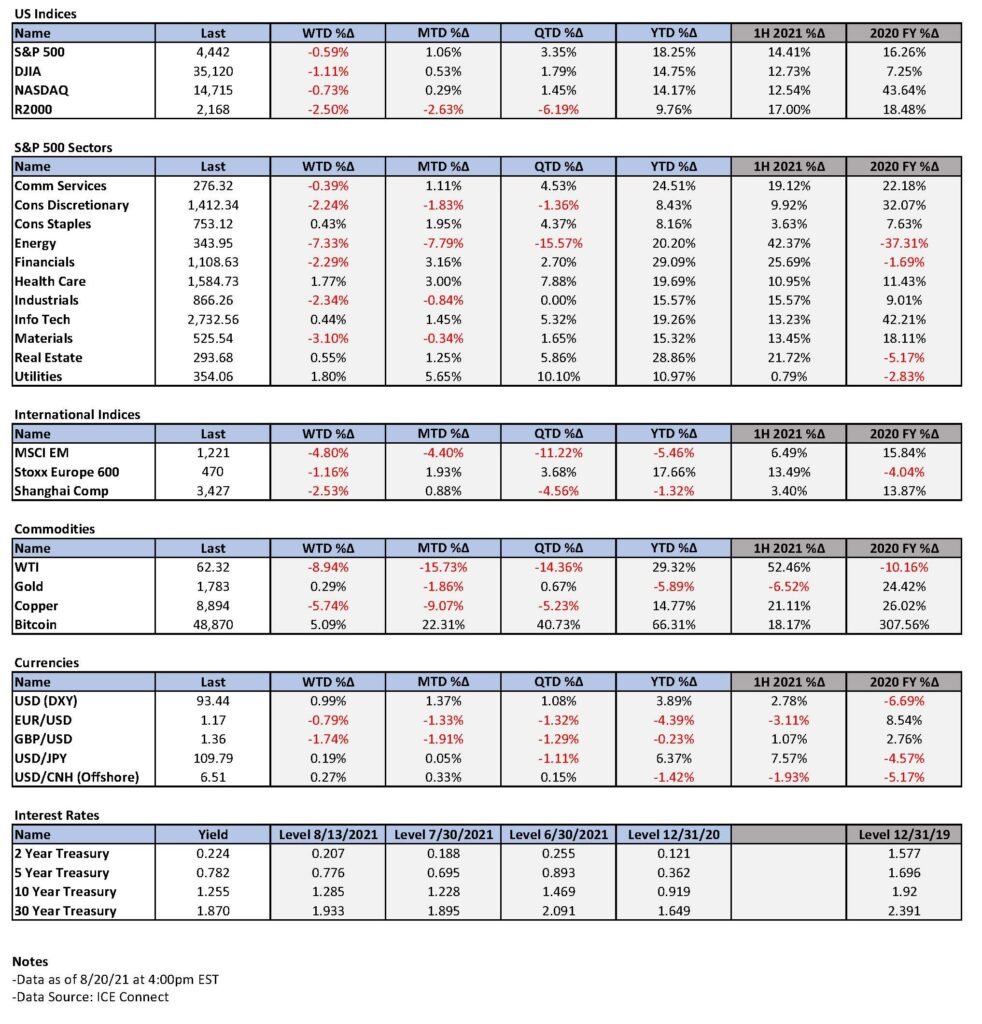

Many financial market participants interpreted these minutes as increasing the odds of a faster-than-anticipated taper of the Fed’s asset-purchase program. The major U.S. stock indexes all closed lower that day. Both interest rates and USD were very little changed. The best-performing S&P 500 sectors were mixed but with a defensive bias. The only positive sector was Consumer Discretionary, but only slightly so.

The first four days this week showed a very strong favorable bias toward Defensive and Growth sectors. The VIX (volatility index of U.S. stocks based on S&P 500 options) spiked up from the 18 level at the time of the release of the Fed minutes to over 23 early the next morning. It closed slightly below 21.7 that day.

Given that the Delta variant’s impact on economic growth and inflation has been greater than was anticipated at the time of the Fed’s July meeting, it would not be surprising if the Fed became more willing to gain increased certainty about this impact before announcing a change in its policies.

Delta Variant Impact — Relatively Short-Lived

We maintain our belief that the Delta variant’s impact will be relatively short-lived. It could be weeks or as long as two to three months, given the experiences of India, the U.K. and other countries. The longer that virus infections continue to occur, the more economies could become “distorted” and make it more difficult to interpret economic data.

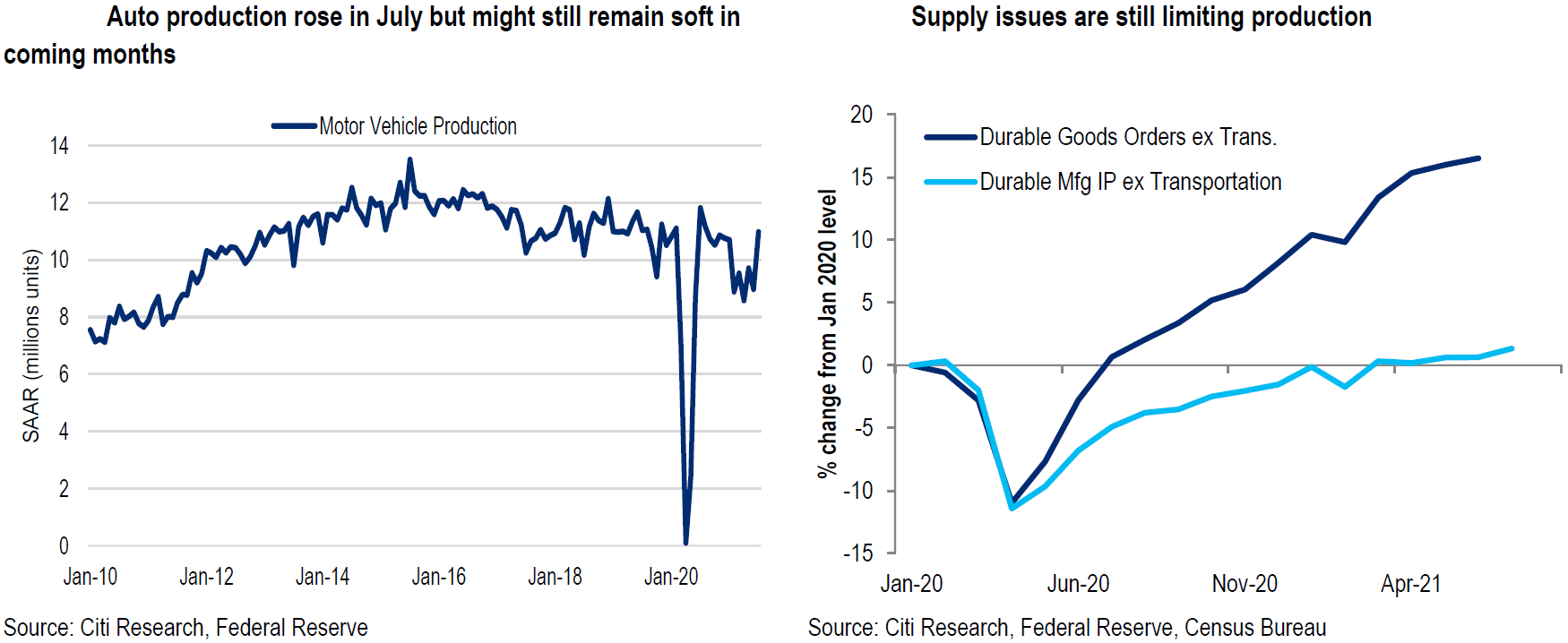

Examples of possible distortions occurred with a disappointing U.S. July retail number and a better-than-expected U.S. July industrial production result. In both cases, at least part of the “surprise” was vehicle-related. Retail was especially hard hit by the decline in vehicle sales due mostly to low inventory levels, with the accompanying high prices. But the increasing manufacturing rates of automakers as they reduced or canceled their typical July shutdowns helped give a big boost to July’s industrial production growth. In the short term, we anticipate that auto production will slow again until semiconductors are available on a more sustainable basis. Retail sales should then rebound as well.

Source: Citi, US Economics: Manufacturing production rises on autos, but might not last, (8/17/2021)

Impact on Inflation, Confidence and Employment Trends

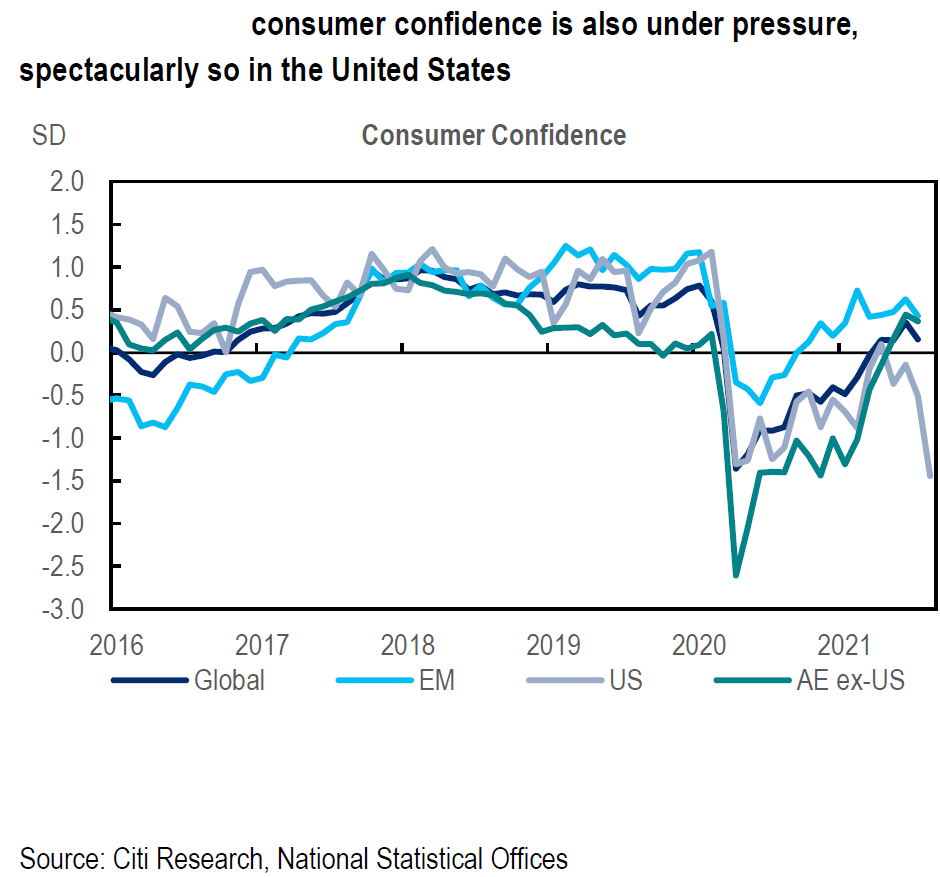

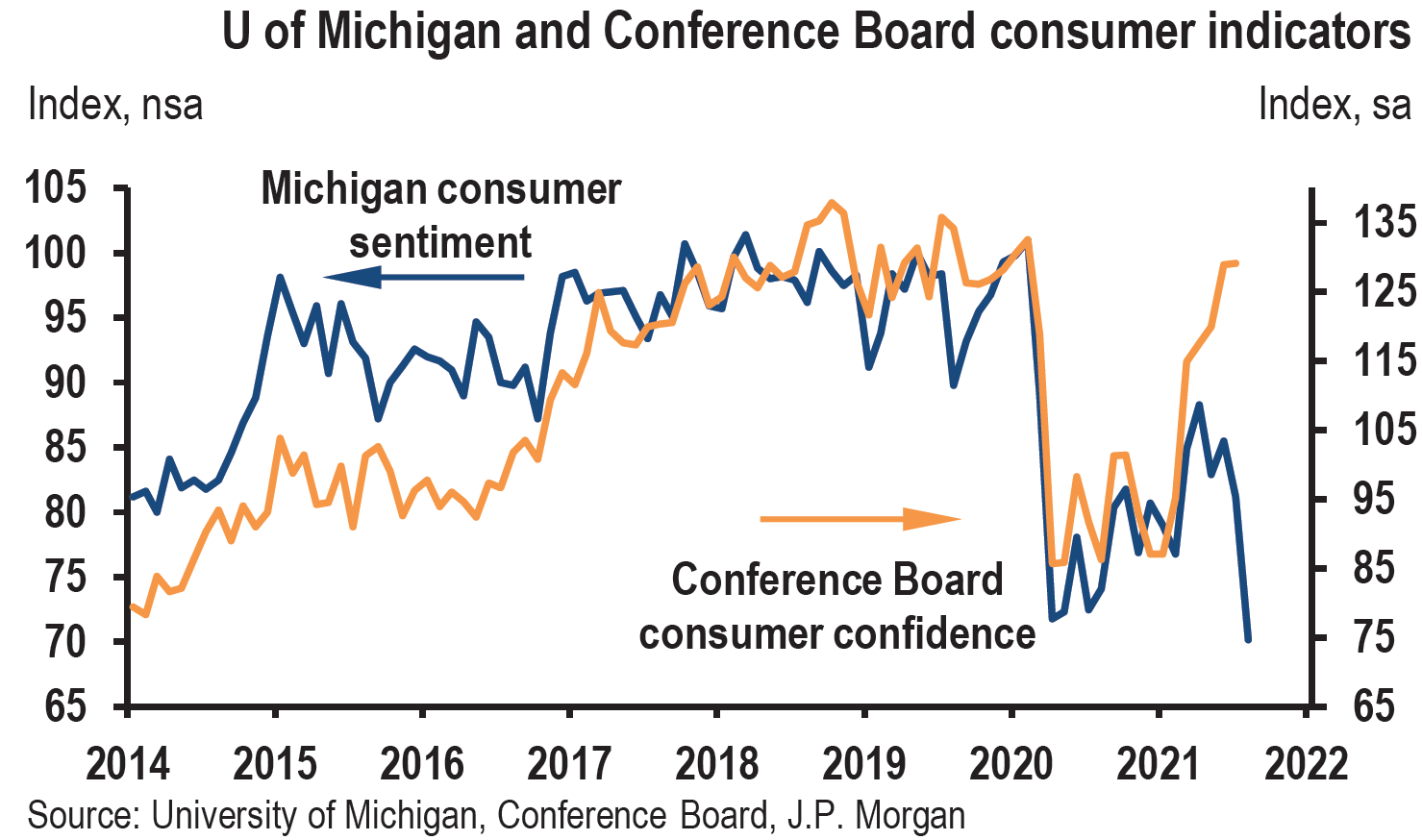

As we have noted in prior letters, we believe that the reopening of economies will be delayed but not derailed. But the longer the delays, the greater the potential for more lasting effects. We have previously highlighted how various surveys show that consumer confidence has been adversely affected by Delta variant concerns and uncertainties, as well as higher prices. Business confidence has also been affected by higher input costs, uncertainty about continuing pricing power, margins, wage inflation and difficulty in finding qualified workers.

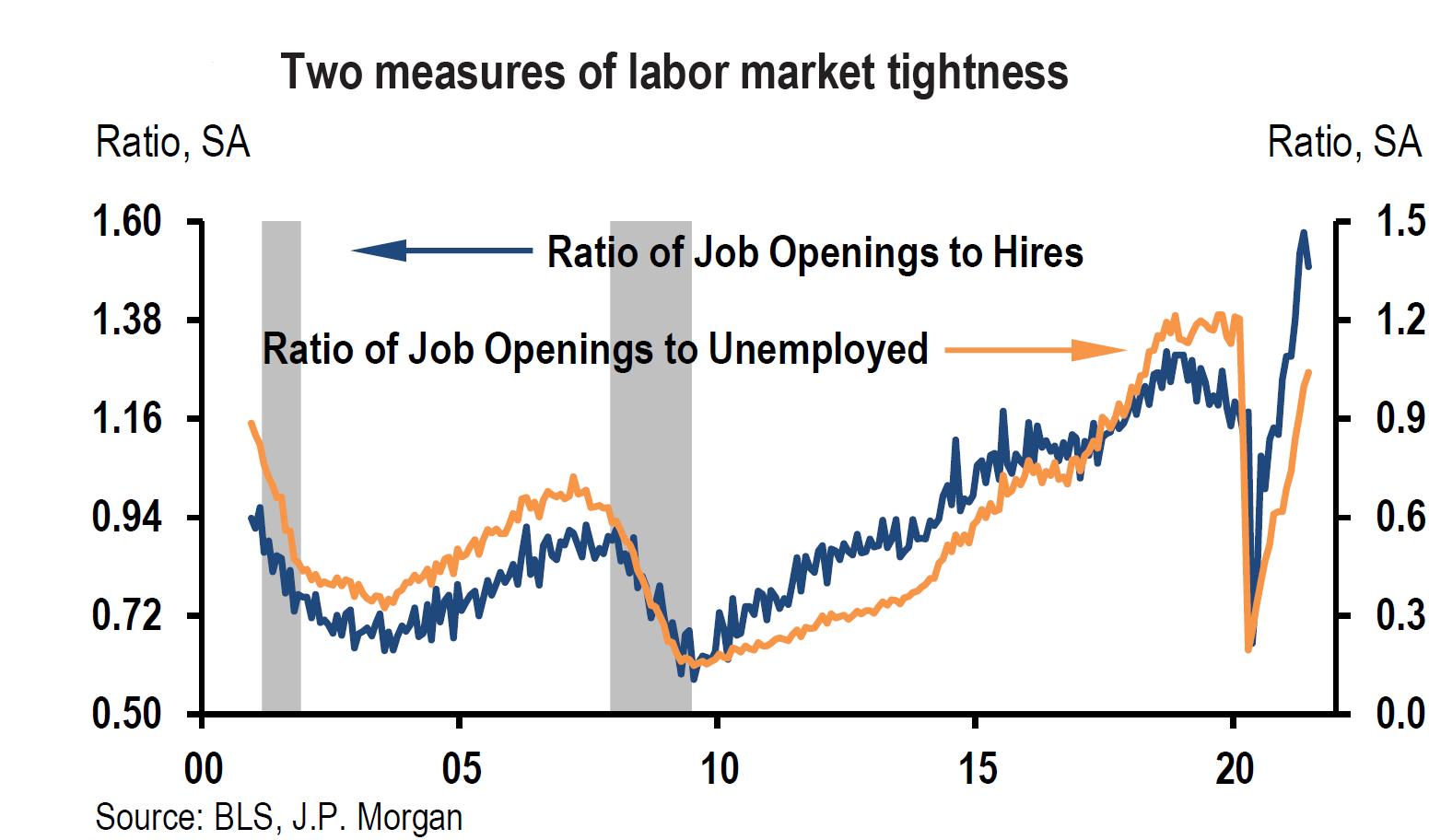

Perhaps the pandemic has even caused a more permanent and structural mismatch between jobs and potential employees. The accelerated pace of digitization of many economies was at least partially responsible for such job mismatches. According to recent official U.S. data, there were 1.3 million more jobs available than there were unemployed workers. This was the largest such disparity since 2000.

Several participants at the last Fed meeting seemed to share these views as they “commented that the pandemic might have caused longer-lasting changes in the labor market and that the pre-pandemic labor market conditions may not be the right benchmark against which the Committee should assess the progress toward its maximum-employment objective.” Perhaps because of labor mismatches, “full employment” is now achieved at a higher unemployment rate than pre-pandemic levels.

Source: JPMorgan, US Weekly Prospects, (8/13/2021)

Confidence could continue its downward trajectory for consumers, business owners and executives, to the extent that the coronavirus infections continue to increase and result in slowing economic growth and higher inflation. Consumers could cut their spending plans, while businesses might cut their hiring plans and capex and expansionary plans. It is rather easy to envision a negative feedback loop taking hold. But we don’t believe that the Delta variant’s negative effects will persist long enough to cause such lasting effects. In our opinion, confidence levels should rebound quickly once consumers and businesspeople believe that the Delta variant is manageable.

Source: Citi, Global Economic Outlook & Strategy: Waiting for supply, (8/18/2021)

Source: JPMorgan, US Weekly Prospects, (8/13/2021)

Greater Economic Concentration

As we have observed previously, the pandemic tends to exacerbate trends already in place. A prominent example of this is that it has rewarded “bigness.” According to a Goldman Sachs report on August 13, the five “FAANG” stocks accounted for 24% of Russell 3000 (cap-weighted stock market index, considered as benchmark of entire U.S. stock market) gross buybacks and 36% of net buybacks in 1H 2021.

The Russell 3000 companies that accounted for 85% of 2019 buybacks reported that their gross buybacks grew by 122% in Q2 y/y and by 27% over Q2 2019. Buybacks in Q2 2021 were also concentrated by sectors: Info Tech (29%), Financials (26%) and Communication Services (15%). Utilities, Energy, Real Estate and Industrials buybacks remained below their pre-pandemic levels.

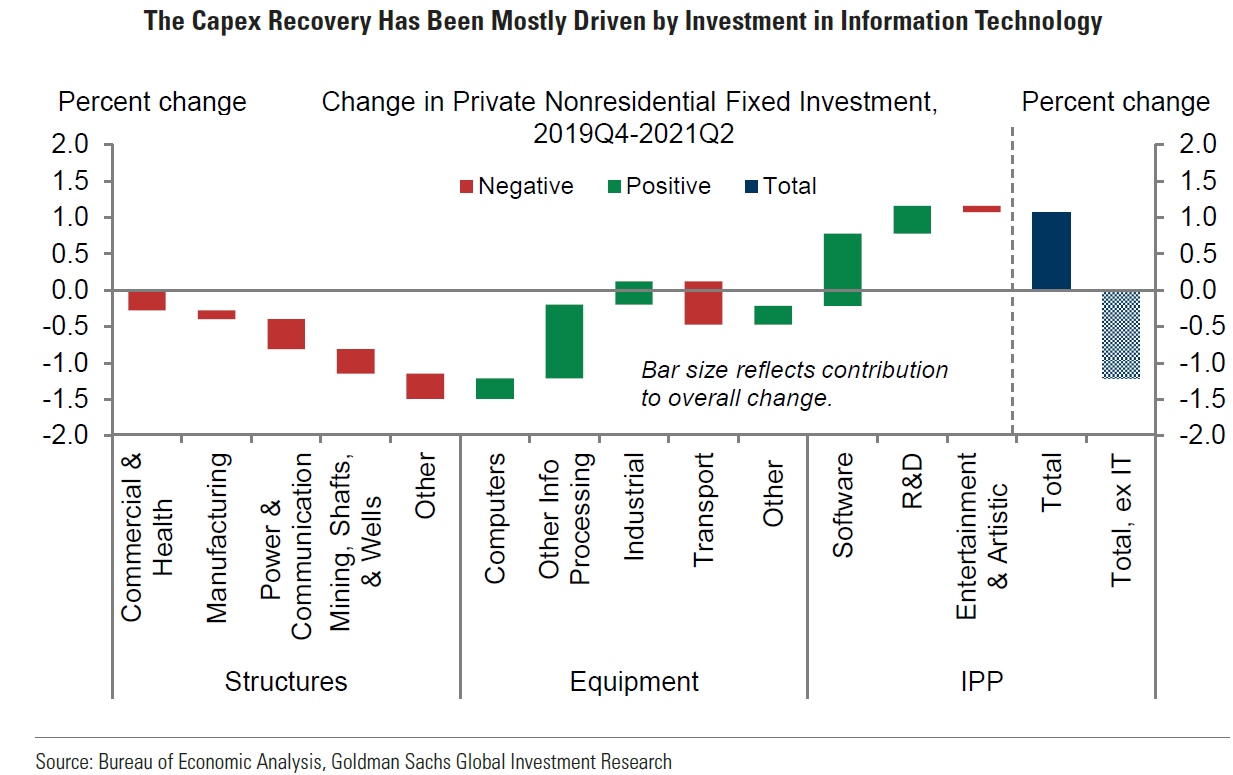

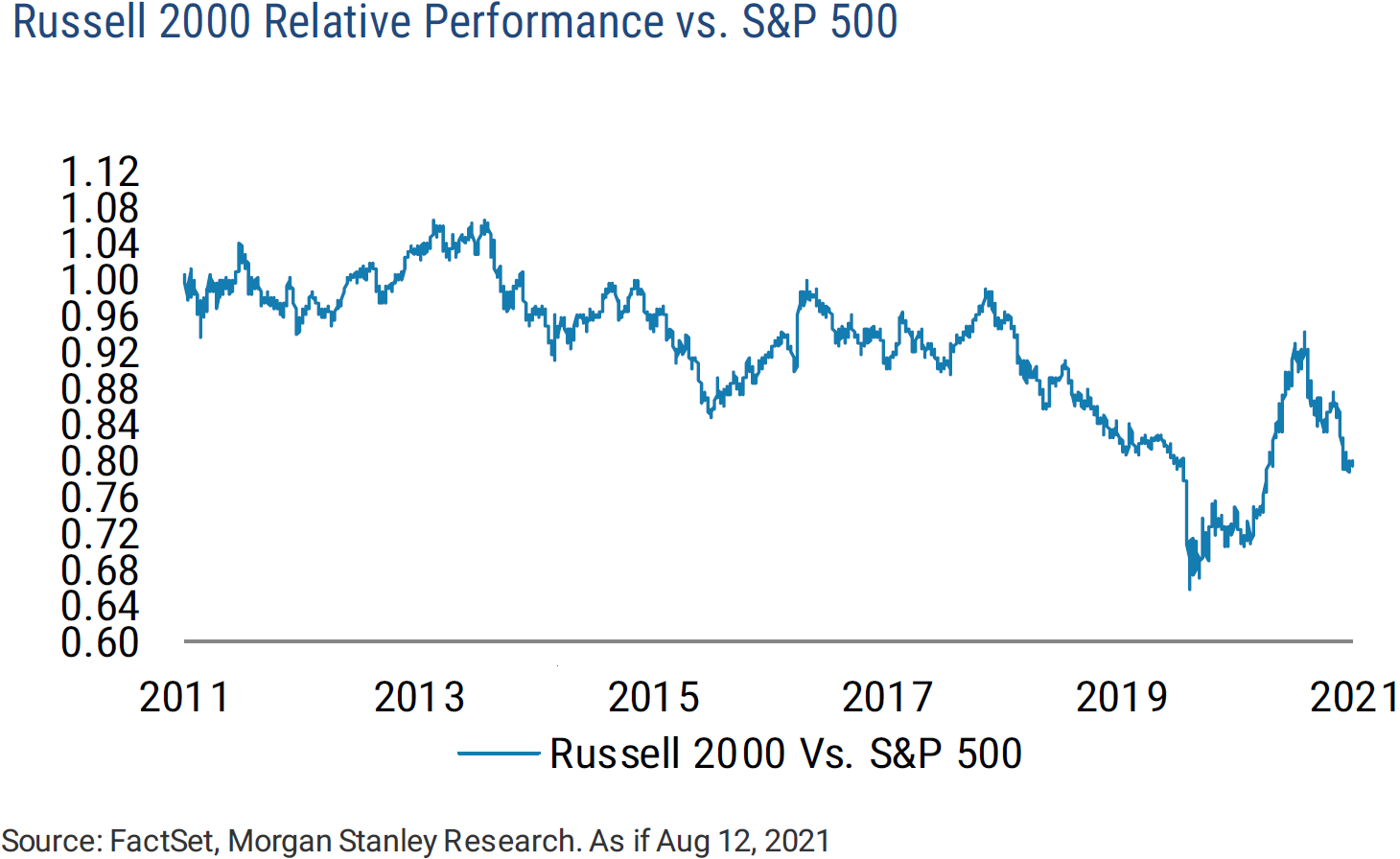

Similarly, the capex recovery has been concentrated in Info Tech. Investment in most other sectors remains depressed. Bigger companies’ dominance has also been on display in obtaining needed inputs. Their more powerful bargaining power most likely has enabled them to obtain needed inputs over smaller rivals, as supply chains have become disrupted. This could be a principal reason for the underperformance of smaller companies’ stock prices (Russell 2000) vs. the larger S&P 500 companies over the last couple of months.

Source: Goldman Sachs, The Capex Reset: New Investment for the New Work Environment, (8/16/2021)

Source: Morgan Stanley, Weekly Warm-up: Strong Earnings vs Mid Cycle De-Rating, (8/16/2021)

Liquidity Helps Counterbalance Concentration

The excessive liquidity created by very easy monetary policies and the generation of excess savings has been somewhat counterbalancing to the trend toward more concentration of economic power in already large companies. Many startup and relatively small companies were able to raise money through both public and private markets, as investors became more willing to take risks in their efforts to obtain excess returns.

Goldman Sachs estimates that the total U.S. equity issuance from follow-ons (issuance of stock subsequent to an IPO), IPOs and SPACs amounted to $330 billion in 1H of this year. As liquidity is removed from the financial system, the large, cash-rich companies with access to even more credit could dominate even more. We believe that this could be one of many lasting effects from the pandemic.

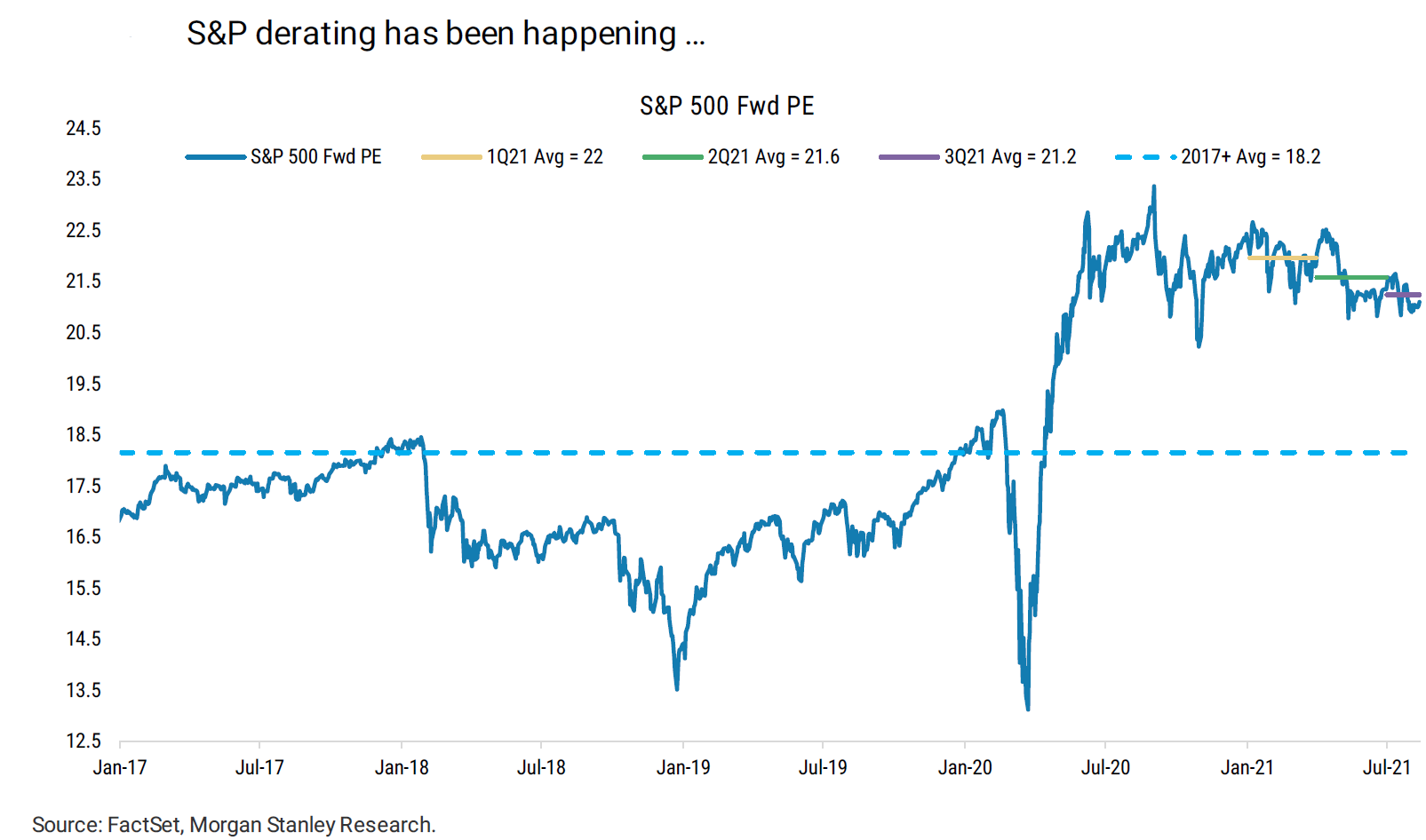

Lower P/E Ratios but Higher Earnings

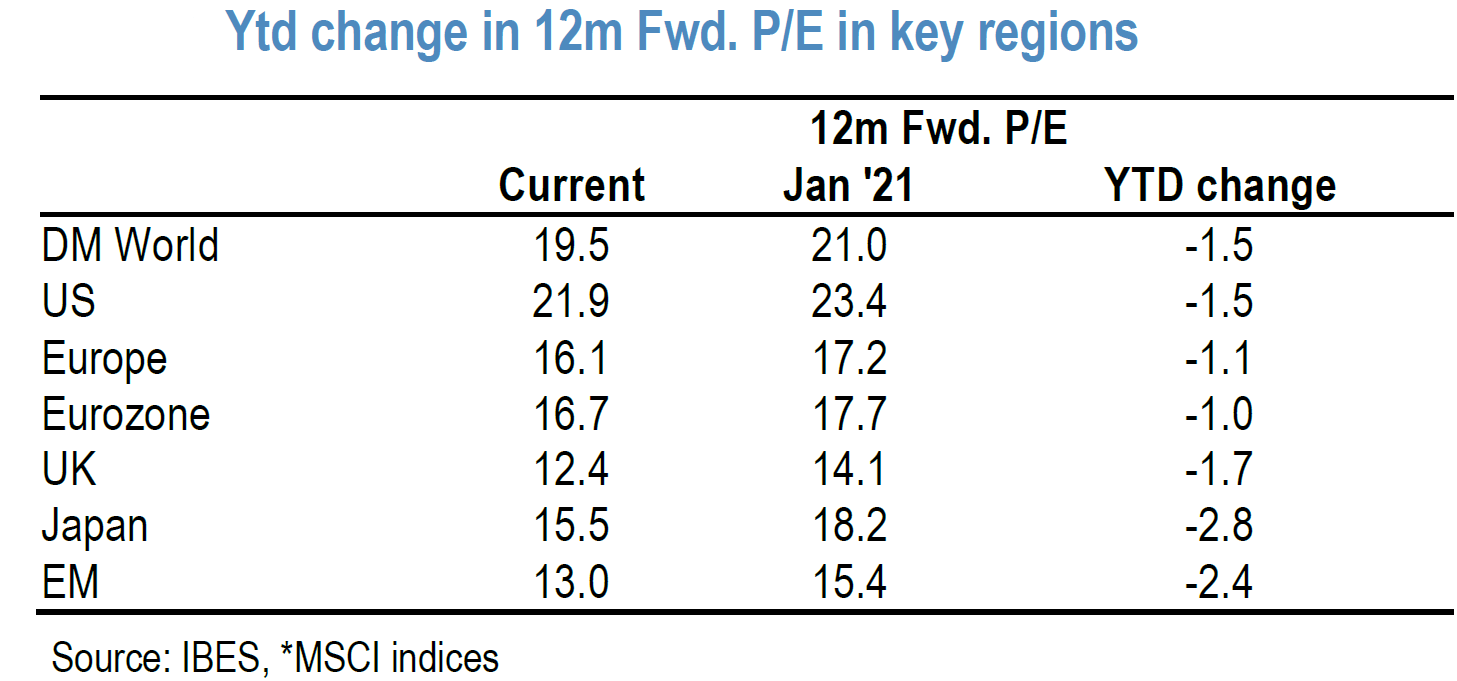

While most U.S. major stock indexes have continued to make new highs throughout most of this year (not including the Russell 2000, a small-cap index of the smallest 2,000 stocks in the Russell 3000 index), few investors have focused on the decreasing P/E ratios of 12-month forward earnings across many global markets, in spite of U.S. interest rates recently peaking in March.

Lower rates, of course, are generally considered a basis of higher P/E ratios. Excess liquidity also contributes indirectly to high P/E ratios by helping to lower rates, as well as directly by providing investors with easier access to capital. But many global equity markets, especially the U.S., have been catapulted higher by some of the largest positive earnings revisions on record.

According to a J.P. Morgan report on August 16, earnings-per-share (EPS) revisions tend to stay in positive territory as long as composite PMIs (purchasing managers’ index of economic trends in the Manufacturing and Services sectors) remain above 54. The latest (July) composite PMI readings from IHS Markit were 59.5 for the U.S. vs. 63.7 in June, and 60.2 for the eurozone vs. a 15-year high of 59.5 in June. We believe that increasing estimates of EPS are needed to maintain an upward trajectory of stocks. We don’t expect that rates decreasing from their current low levels will be sufficient to expand P/E multiples.

Source: Morgan Stanley, Weekly Warm-up: Strong Earnings vs Mid Cycle De-Rating, (8/16/2021)

Source: JPMorgan, Equity Strategy Stay bullish on equities – updating our index targets, (8/16/2021)

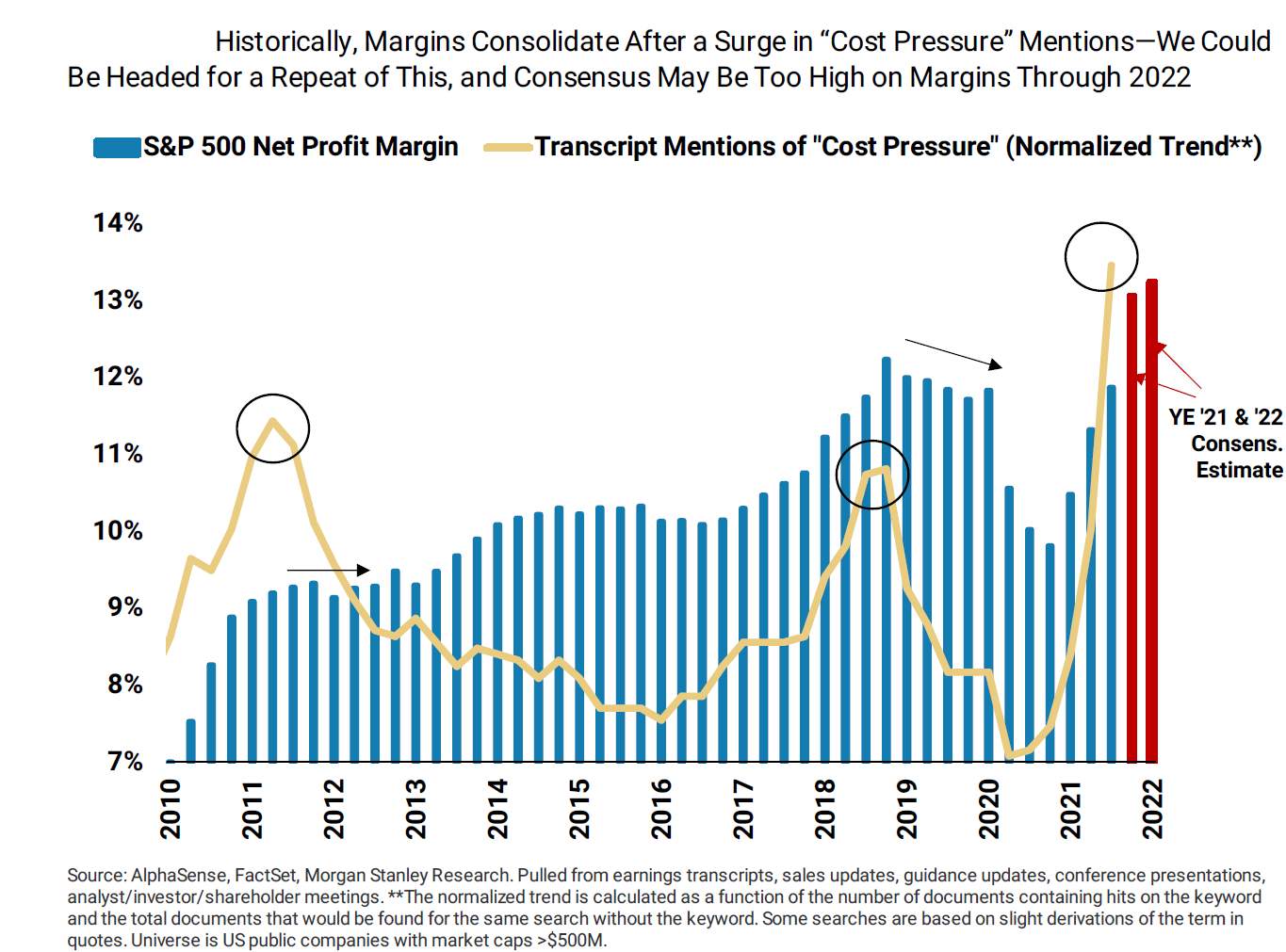

Q3 Earnings at Risk Amid Likely Margin Compression

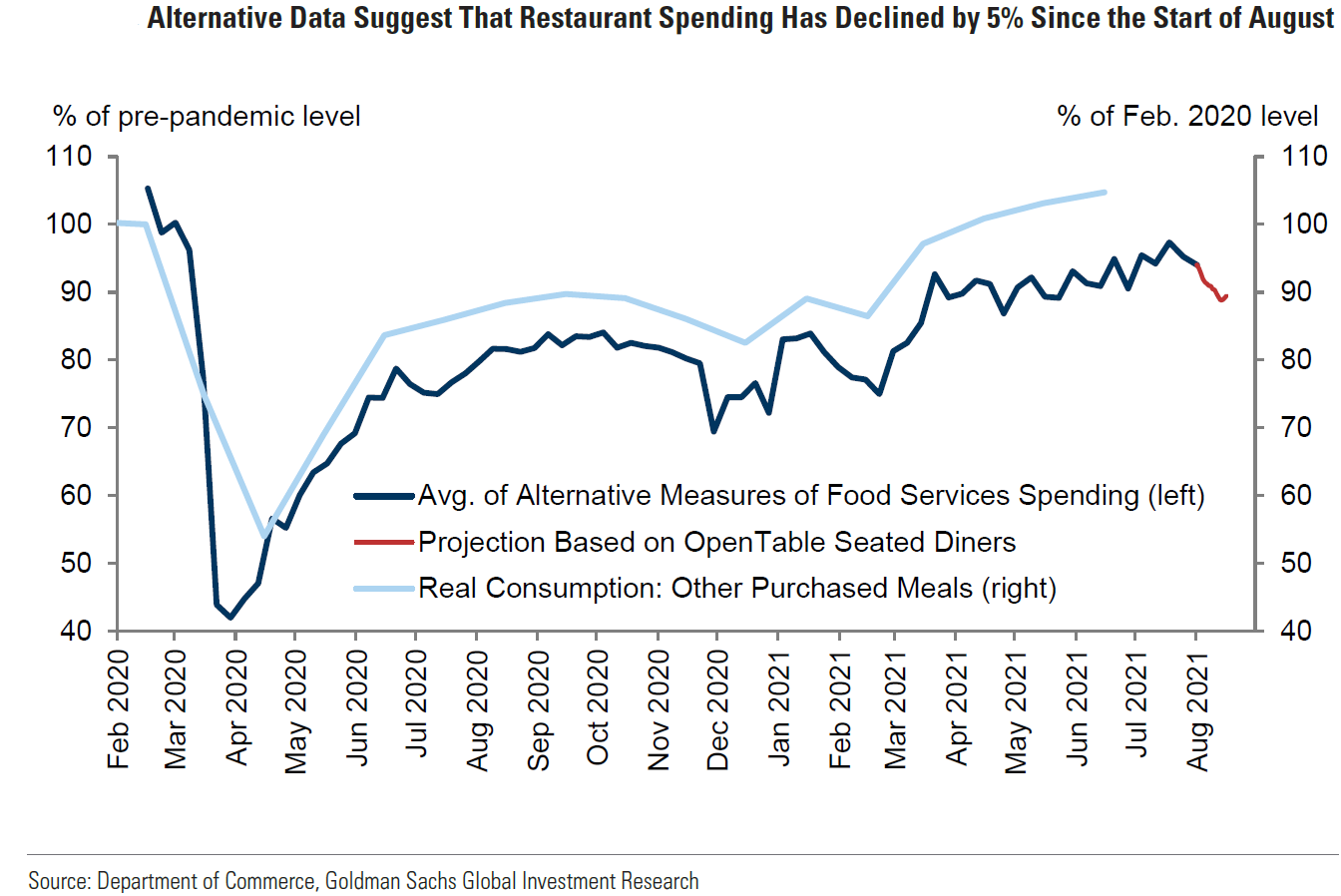

As economic growth rates are projected to slow in the short term due to increasing Delta variant infections, we believe that Q3 EPS and revenue estimates are at risk. In our opinion, margin compression is becoming increasingly likely for Q3 results. We surmise that margin expectations are simply too high. Continued supply disruptions caused by Delta should continue to pressure input costs higher. We expect that these costs will become increasingly difficult to pass on to consumers.

Recent surveys of consumer sentiment (discussed in our prior weekly letters) have shown that consumer confidence has been adversely affected over the past month due to rising rates of inflation and Delta-related uncertainties. In that context, we expect consumers to be much more hesitant in the short run to absorb higher prices.

According to its August 9 U.S. Equity weekly, Morgan Stanley reported that the consensus estimates for margins in the Industrials, Consumer Discretionary and Technology sectors for 2022 would be 10-15% higher than their all-time peaks. In this market environment, stock selection will become increasingly important. Supply chains for inputs and the pricing power of each company should be examined closely.

Source: Morgan Stanley, Weekly Warm-up: Strong Earnings vs Mid Cycle De-Rating, (8/16/2021)

Encouraging Optimism

Although many surveys have shown declines in such categories as headline business conditions, they remain very robust. A recent example of this was the New York Fed’s Empire Manufacturing Survey whose headline showed an unexpectedly sharp decline. This survey (data compiled during week of August 2-9) also showed that input prices continued to rise sharply and the pace of selling prices set a new record.

Nevertheless, companies generally remained optimistic and expected business conditions to improve over the next six months. Substantial increases in employment and prices were also expected. We share this optimism as we look through the relatively short-term effects of the Delta variant. We remain resolute in our continuing stance to buy value and cyclical stocks on pullbacks. We expect financial market volatility to continue in the short to medium term.

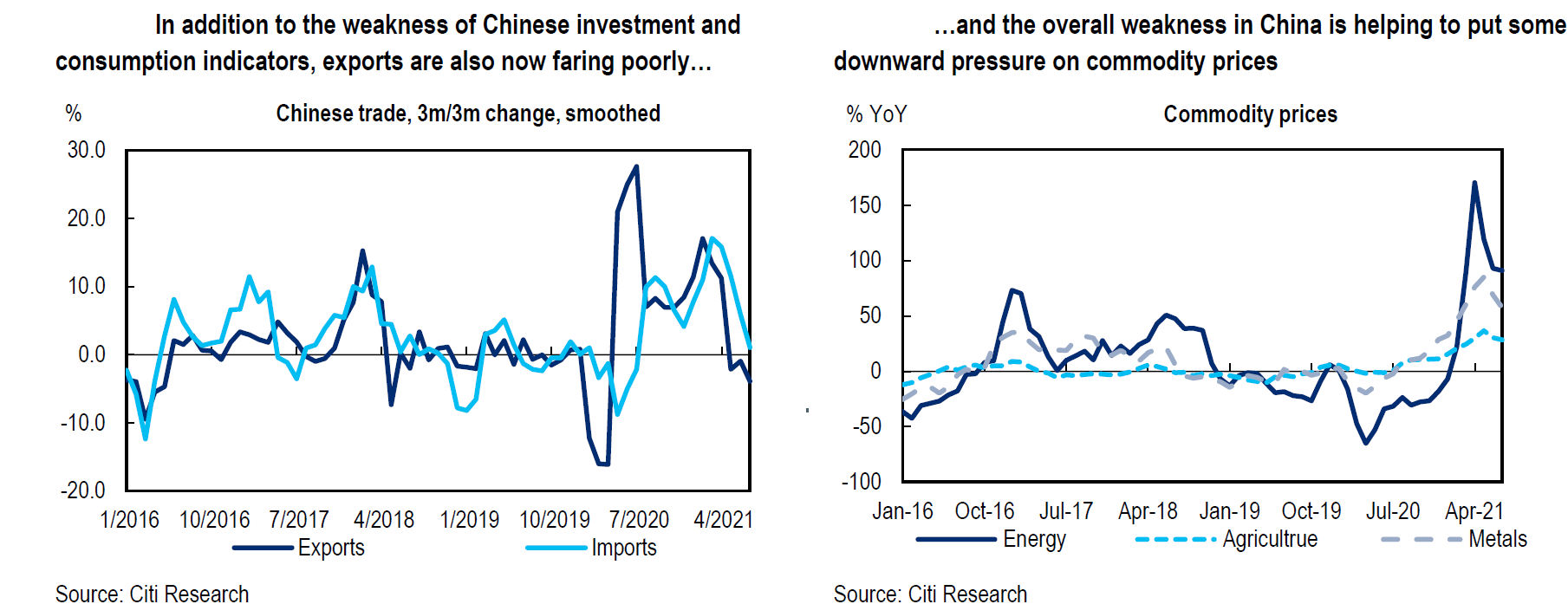

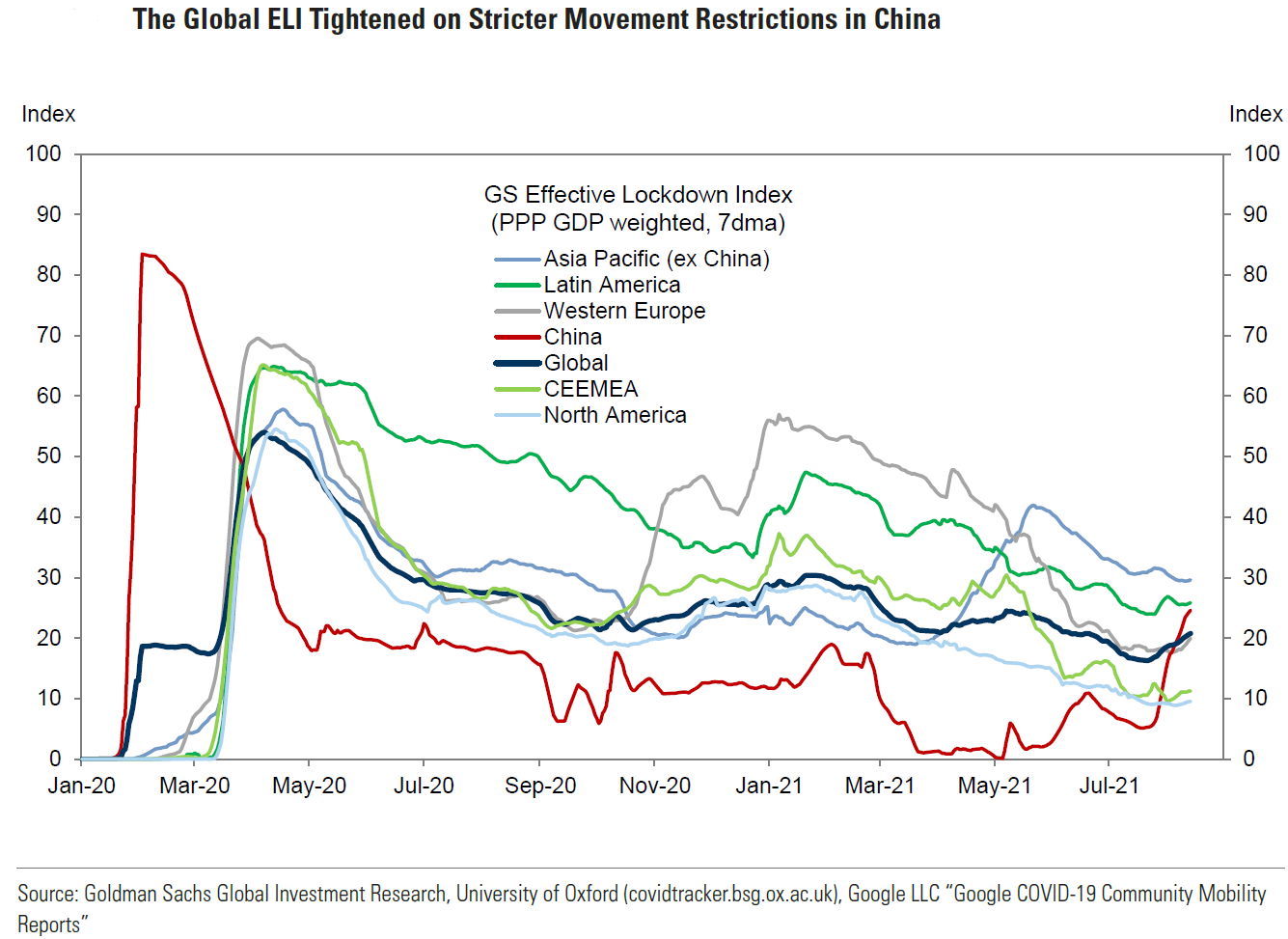

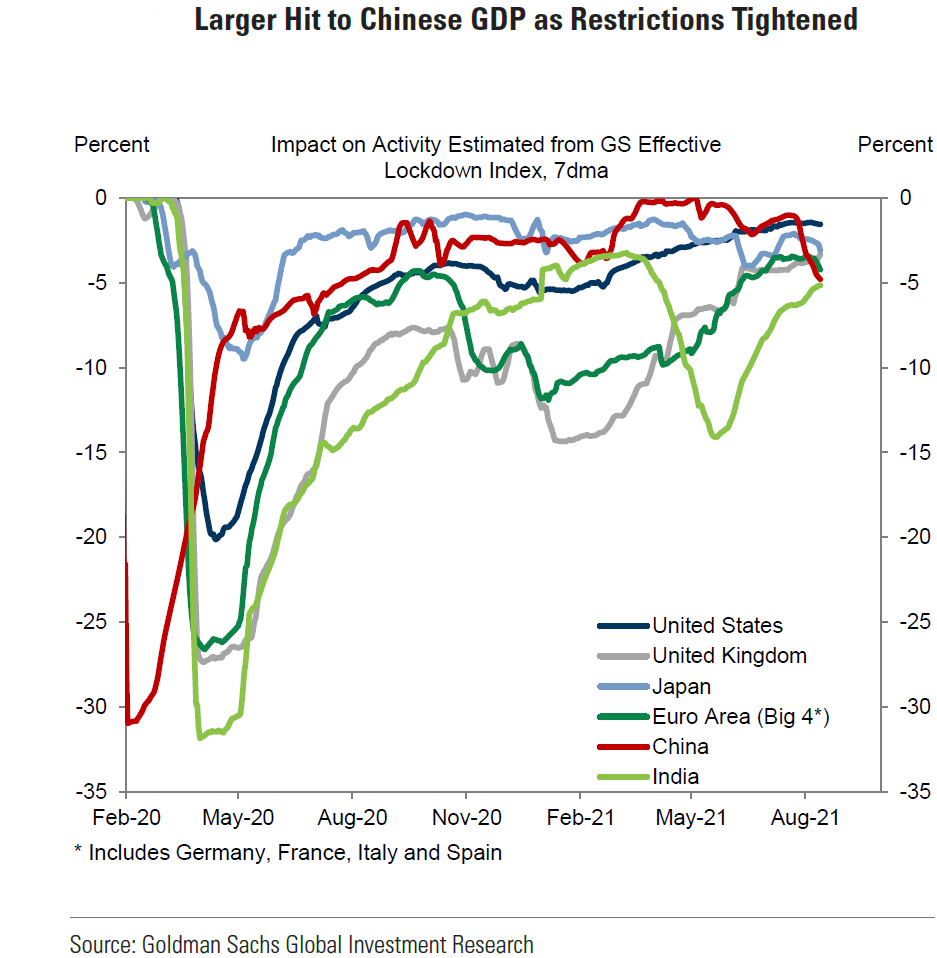

China Rebound Expected

We expect a rebound from China’s recently disappointing economic data announced over the August 14-15 weekend. Industrial production, retail sales and fixed asset investments all disappointed. Regional lockdowns in China continued to pressure supply chains. One of the world’s largest ports was temporarily closed due to a negligible number of coronavirus infections. We anticipate that China will ease monetary policy in the near future and implement a more effective and targeted fiscal policy that will favor small and intermediate sized enterprises.

Prior to the negative Delta variant effects and recently slowing exports, much of China’s slowdown was self-induced due to more restrictive credit policies, especially in regard to properties, as well as its zero-carbon emissions policies and crackdowns on various businesses. The materialization of a Chinese economic rebound would enhance the valuation of Cyclical and Value stocks.

Source: Citi, Global Economic Outlook & Strategy: Waiting for supply, (8/18/2021)

Source: Goldman Sachs, Effective Lockdown Index: August 17 Update, (8/17/2021)

PPP = Purchasing Power Parity

Goods-to-Services Spending Transition

The transition from spending on goods to a more-focused services spending mentality will most likely be prolonged due to the Delta variant. Before the pandemic, it was generally accepted that millennials were more interested in “experiences” than material possessions. The acceleration in demand for goods during the pandemic obviously showed that most people remain interested in material things.

But we are of the belief that the longer that the Delta variant prolongs the reopening of economies, the more powerful the impulse and desire for new experiences will become. We therefore are especially optimistic about a very powerful recovery in the services industries … eventually. Increasing wage and inflationary pressures would soon follow in these sectors.

Bottom Line

We maintain our belief that the Delta variant effects will be relatively short-lived. Our view continues to favor Value/Cyclical stocks on pullbacks based on a favorable risk/reward profile. More investors appear to be factoring slower economic growth rates into their analysis. We assume a strong economic rebound from a Delta-induced slowdown.

We believe that Q3 earnings will be at risk due to Delta-related issues and possible margin compressions. Consensus margin expectations remain at very high levels. We anticipate near- to medium-term volatility. Attractive entry points for future investments should ensue.

The goods-to-services spending will most likely be somewhat delayed due to Delta variant issues. We expect a very strong recovery in services spending eventually, as more consumers follow through on their now-enhanced desires for new experiences.

Possible lasting effects from the pandemic might include a structural change in employment, so that full employment could be perceived as a higher rate of unemployment compared to pre-pandemic levels. This situation will hopefully be rectified as potential workers become better aligned with available job opportunities.

We believe that supply disruptions related to the pandemic have further advantaged larger companies due to their more powerful bargaining power. The accelerated digitization of economies has also increased the economic advantage of larger companies. Luckily, however, excess liquidity and very easy monetary policies have enabled smaller companies to access capital more readily on favorable terms.

INDEX DEFINITIONS

KBW Nasdaq Bank Index (BKX): The KBW Bank Index is designed to track the performance of the leading banks and thrifts that are publicly-traded in the U.S. The Index includes 24 banking stocks representing the large U.S. national money centers, regional banks and thrift institutions.

MSCI EM Value Index: The MSCI Emerging Markets Value Index captures large and mid cap securities exhibiting overall value style characteristics across 27 Emerging Markets (EM) countries.

MSCI EM Index: The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries.

NASDAQ: The Nasdaq Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange.

PCE: Personal Consumption Expenditures (PCEs) refers to a measure of imputed household expenditures defined for a period of time.

Russell 1000 Growth: The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted and historical growth values.

Russell 1000 Value: The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

S&P 500: The S&P 500 Index, or the Standard & Poor’s 500 Index, is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S.

VIX: The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options.

Z-Score: A Z-score (also called a standard score) gives an idea of how far from the mean a data point is. It is a measure of how many standard deviations below or above the population mean a raw score is.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC