“What the Most You Ever Lost on a Coin Toss?”

Spring has barely sprung, but our expectations for wide and choppy ranges in both interest rates and stock prices in 2025 have already been met…and then some. What markets do on a day-to-day basis – and what new policy announcements may drive them – has begun to feel like a coin toss.

Investors may look at the risks that still lie ahead and worry they “can’t stop what’s coming.” And they “need to know what they stand to win” by taking risk in this market. Whether the next few months come up heads or tails will depend largely on economic data and corporate earnings. Today, we’ll focus on the economy. Where are we seeing promising signs, and where are cracks beginning to emerge?

This week’s pop culture inspiration is the 2007 Best Picture Oscar winner, No Country for Old Men, and the 2005 Cormac McCarthy novel from which it was adapted. Bleak in its subject matter but rife with much-needed gallows humor, the story encapsulates the fear and frustration of not knowing exactly what we are confronting as we try to assess the risks we face.

Revisiting the Uncertainty from Our 2025 Outlook

“I don’t want to push my chips forward and go out and meet something I don’t understand.”

As we wrote two weeks ago, erratic U.S. trade policy been the key catalyst of market volatility so far this year. We are chiefly interested in how tariff policy is affecting the key sources of economic and market uncertainty we identified coming into 2025: Will U.S. consumers continue to spend? Will U.S. businesses continue to hire? And can U.S. equity markets continue to rise on healthy risk appetite and growing earnings?

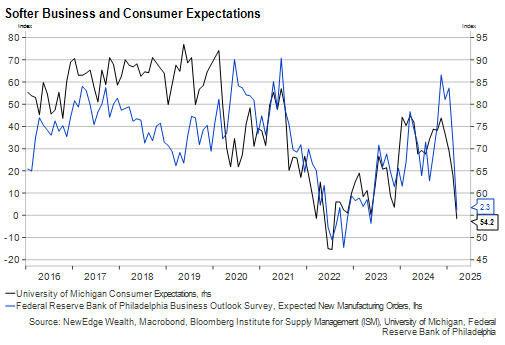

Of these three, investor risk appetite has been by far the wobbliest, which we see in lower equity valuations and falling long-term Treasury yields. The haphazard application of trade taxes – and retaliation on U.S. exports – has weakened consumers’ and businesses’ outlooks just as it has exacerbated equity market volatility:

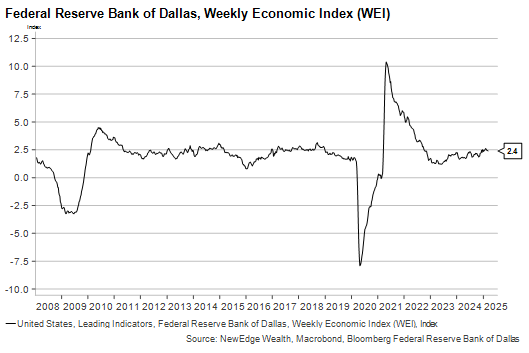

Thankfully, real world economic activity appears to still be humming. The Dallas Fed’s weekly economic series, which includes initial jobless claims, retail sales, and electricity and railroad usage, among other series, continues to grow at a 2% to 2.5% pace, comfortably above stagnation or recession territory.

Sentiment polls, including the equity market itself, have clearly deteriorated, but the so-called hard data that feeds into broad measures like GDP is generally holding up well. In the following sections, we’ll explore both the bad and the good data points we’re seeing and dive deeper into what these mixed signals mean for investors.

Survey Data Providing Causes for Concern

“Is that what you’re asking me? Is there something wrong with anything?”

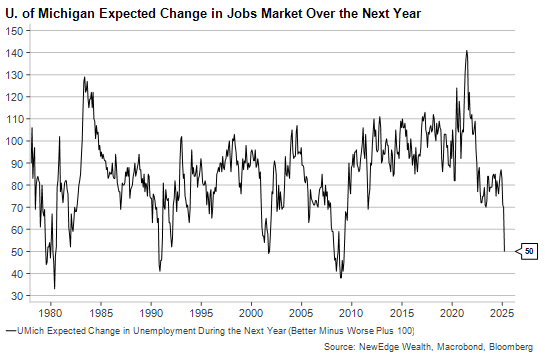

We don’t have to go back too far to recall the last time consumer sentiment plunged. In 2022, the onset of the worst inflation in generations brought higher interest rates and an S&P 500 bear market. Not surprisingly, consumers called it the worst economic environment of their lifetimes. But that was not true of their attitudes toward the labor market at the time, because job openings were at all-time highs, wage growth was soaring, and hiring was robust. Today, those conditions are no longer present, and people have noticed:

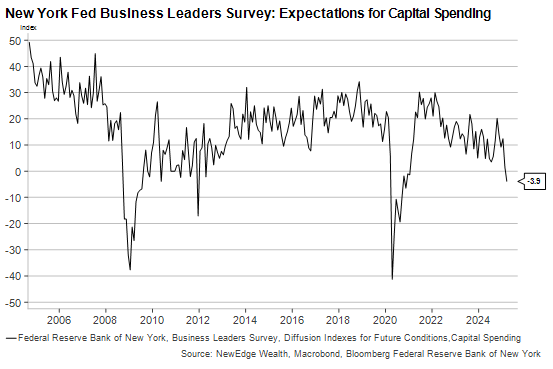

The share of consumers expecting higher unemployment over the next year is the largest it’s been since the 2008 financial crisis. Right or wrong, these expectations can become self-fulfilling if they lead cautious households to save more of their earnings. And a slew of new business surveys indicate companies may be planning to do the same:

Capital spending plans are one of the most obvious casualties of trade-related uncertainty. Business must now factor in the potential for higher raw materials costs into any upcoming project. As we have pointed out earlier this month, the 2018-19 trade war with China lead to a clear pullback in private nonresidential investment. A similar but even larger trend could begin to show up in the data as soon as next month.

On the Bright Side, the Economy Still Looks Pretty Good!

“I got a bad feeling. Llewellyn.”

“Well, I got a good feeling, so that should even out.”

Survey-based data captures sentiment or expectations but not actual economic activity. This is the difference between hard and soft data that we wrote about back in November, when survey data was coming in hot, and the hope was that hard data would eventually catch up.

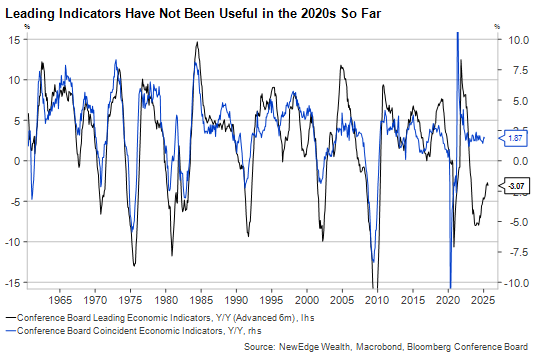

Survey-based data is often used as a leading indicator, but its predictive power has waned in recent years. In the late 2010s, survey data began moving in tandem with hard data rather than leading it, while in the 2020s it has failed to either track or predict real time activity:

Back in November, we flagged this decoupling to caution against the idea that an economic boom was right around the corner. Now that the soft data has turned lower, we find ourselves trying to reassure market bears that hope is far from lost.

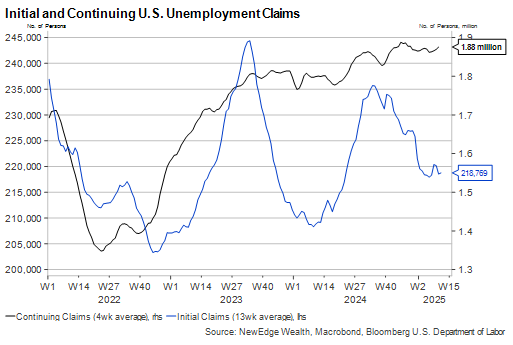

Let’s start with initial jobless claims, the “hardest” of the leading indicators. Despite high-profile cuts to federal agencies and headlines about tariff-related layoffs at private firms, the number of people applying for unemployment insurance each week remains low and shows no signs of a sharp increase. Continuing claims, or the total number of workers collecting state-level unemployment assistance, are higher than they’ve been for several years (a reflection of weaker hiring) but are not breaking out:

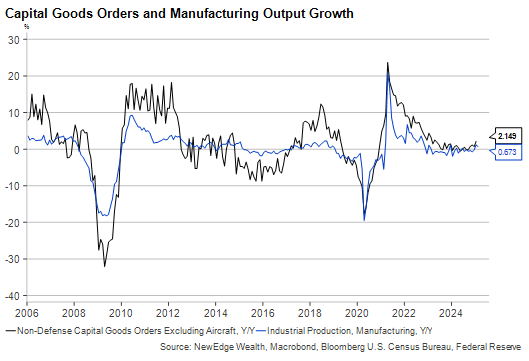

Capital goods orders, another leading indicator, tell us what to expect from manufacturing, which is among the most cyclical sectors of the economy. This series has been growing solidly despite new taxes on imports of raw materials and other inputs. And manufacturing output grew nearly 1% in February, its best month in a year:

The list of encouraging economic data points goes on. Vehicle sales, housing starts, and new home sales all came in stronger than expected in February. Private payroll growth remains solid, and retail sales bounced back. If this economy is about to tip into recession, the descent will have to be steep and sudden.

What Investors Should Do (and Not Do)

“Just how dangerous is he?”

“Compared to what? The bubonic plague?”

As we wrote in last week’s Weekly Edge, investors need to get comfortable with being uncomfortable for the foreseeable future. Staying the course amid noisy headlines and volatility runs the risk of being exposed just as the economy begins to unravel. But as we covered above, the evidence suggests that unraveling is still some way away if it ever happens at all.

What strategies can work for cautious investors? The mild softening in economic data has helped higher-rated parts of the bond market like U.S. Treasuries rally from their early January lows.

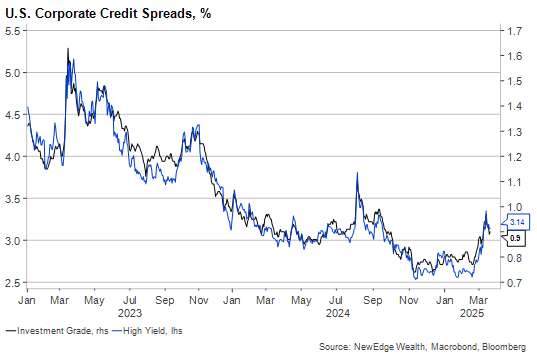

Corporate credit spreads have stayed remarkably tight amid the equity market chaos, and investors looking to trim risk from their portfolios could consider moving into higher-quality segments of the bond market as an inexpensive hedge against further losses on risk assets:

Investors can also consider buffered or hedged strategies in the equity market, which often involve giving up some upside in exchange for a measure of downside protection. These strategies can become more or less attractive depending on how volatile markets are behaving, but limited exposure to the equity market in times of turmoil is nearly always better than none at all.

Conclusion

“You know how this is going to turn out, don’t you?”

“Nope.”

Diversification has emerged from a multi-year slumber to help investors manage through a tough first quarter. A 70-30 portfolio of global equities and U.S. bonds has returned 1.2% through March 20th. That’s probably better than anyone who’s been following financial news over the past few months would have guessed. Investors can thank the long-overdue performance of international equities – helped by a weaker U.S. dollar – as well as the rally in high-grade bonds.

Uncertainty needn’t lead to tactical paralysis or foregone returns. As markets whipsaw from exuberance to despair on a weekly and often daily basis, investors who hold a wide variety of assets often see better risk-adjusted returns. It’s true that we can’t stop what’s coming. But we can prepare for it and be ready to adjust as needed if the mess gets here.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC