“Hey Curly, what all happens in a hurricane?” – Introduction

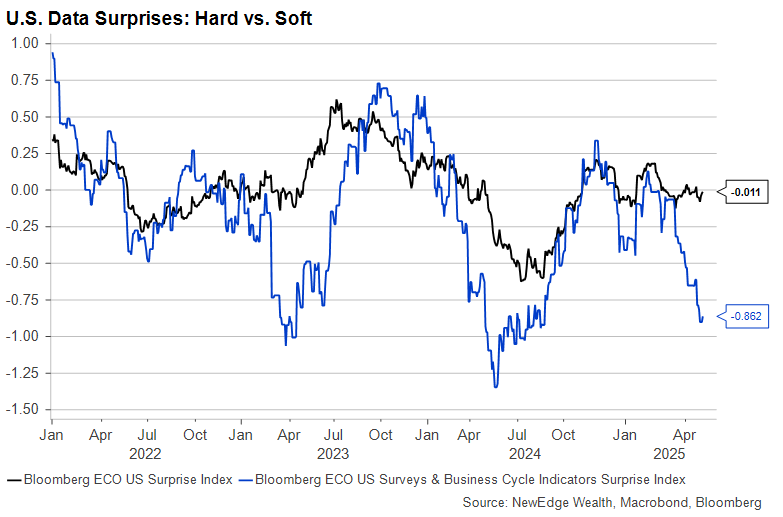

Last week, we rolled out our Q2 economic and market outlook, entitled The Space Between. The title of Dave Matthews Band’s biggest hit single is an apt metaphor for the macro environment in which we find ourselves. The U.S. economy sustained a significant shock on Liberation Day, one that has already shown up clearly in consumer and business survey data. We now brace for the impact on corporate earnings and real economic activity, assuming the tariffs are not withdrawn in the interim.

Against this uncertain backdrop, it may seem odd that equity and credit markets have managed to recover such a large share of their losses since April 2. Investors are willing to pay pre-tariff valuations to own the S&P 500 (over 20x forward) despite no concrete news on trade deals or tariff removals beyond the initial April 9th climbdown. As such, this week we are inspired by the dark and stormy 1948 Bogie/Bacall classic, Key Largo, as we analyze what may turn out to be the eye of the tariff hurricane. In short, tumultuous days may yet lie ahead.

“When your head says one thing and your whole life says another, your head always loses.” – Early Signs of Real World Struggles from Tariffs

Assuming the tariffs stay in place for the time being, we expect this Spring’s economic data to show the last gasps of aggressive consumer durables purchases and capital goods orders made in advance of the tariffs. As trade volumes evaporate and production that relies on Chinese imports grinds to a halt, inventories will fall, leading to a combination of higher prices and acute shortages. Businesses are likely to freeze their capital spending and hiring plans.

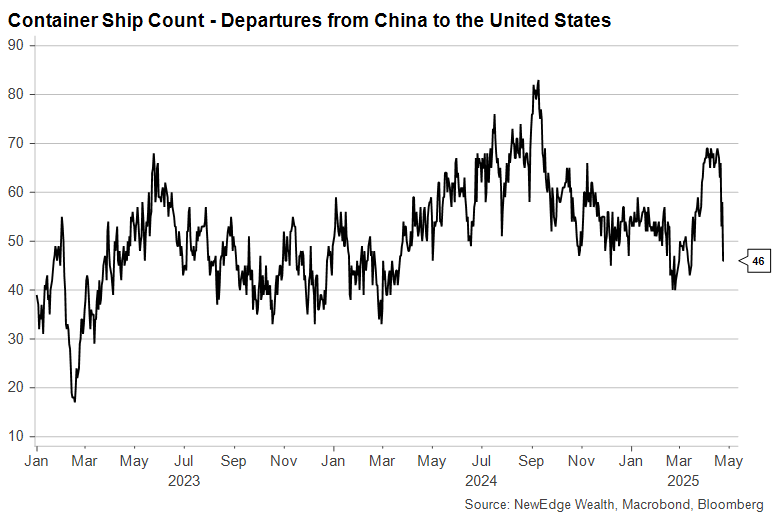

The first cracks in the hard data have shown up in shipping and transportation. The number of container ships coming from China to the US has dropped after surging earlier in the year. The only question now is how much lower the figure will fall from here:

Fewer container ships means fewer goods to drive out of U.S. ports. The volume of goods being shipped on trucks from the Port of Los Angeles has fallen to levels usually only seen on holidays (when most activity grinds to a halt):

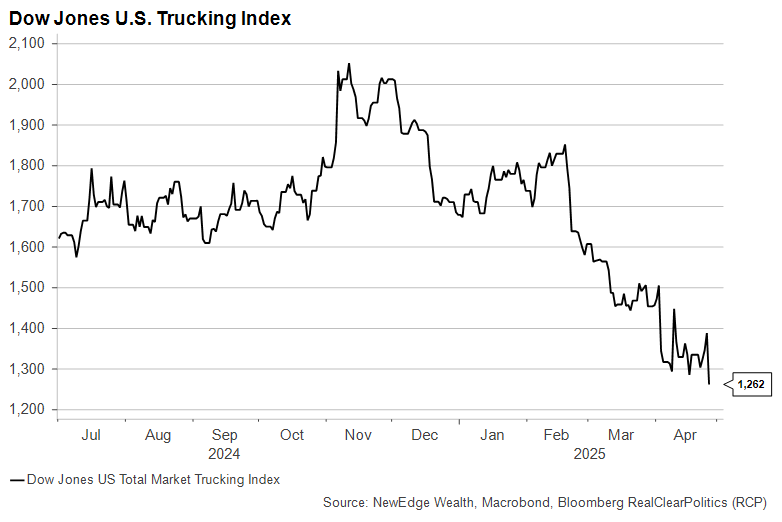

Why are we looking at shipping volumes on trucks out of Los Angeles? Because they are our first clear look at the economic consequences of the tariffs, which, it is now clear, investors had not come close to fully pricing in, as related stocks continue to fall. The Dow Jones Trucking Index has not participated in the broader equity market recovery:

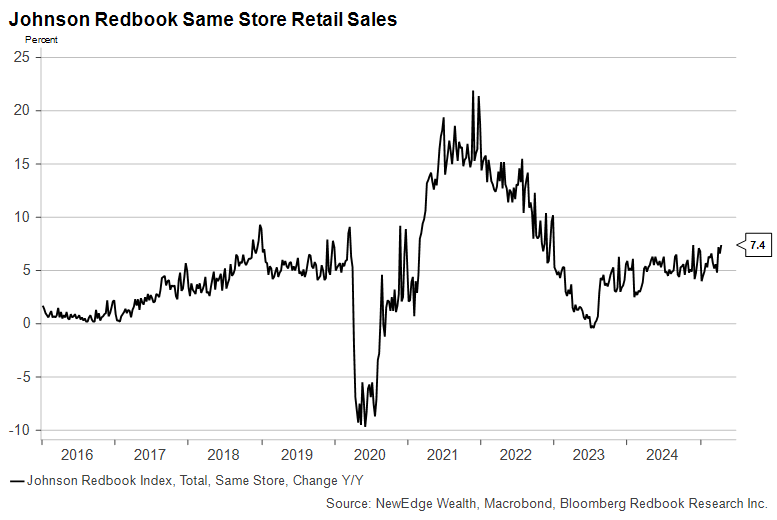

In areas not yet experiencing any impact from tariffs, stocks are doing just fine. High-frequency data on consumer behavior has, if anything, strengthened this month. Same store retail sales are growing at a 7%+ clip. The March retail sales data showed a lot of purchases of large durable goods like cars ahead of scheduled tariff increases. To the extent the weekly retail data for April represents more of that behavior, we could be due for a significant falloff in May and June:

Investors have not fallen out of love with consumer stocks just yet, however. Consumer discretionary stocks were among the best performing sectors in the S&P 500 last week and are now up for the month of April.

The first high profile test for April hard data will come on Friday with the release of the U.S. employment report. The lack of any jump in initial jobless claims during the month tells us not to expect a terrible report, but these weekly reports tell us little about the pace of new hiring, which was slowing even before Liberation Day. A further rise in the unemployment rate coupled with a weak (e.g., <100K) payroll gain will get the market’s attention, as it could represent the start of substantially weaker labor market data in the months ahead.

By the time we write our next Weekly Edge, the April jobs report will be out as will the Q1 U.S. GDP data. The latter will be wildly distorted by a burst of imports and inventory restocking ahead of the tariff announcements. But there is an even wider band of uncertainty around Q2 GDP, which could see a dramatic slowing in investment and consumption but a “boost” from import volumes, which are excluded from GDP because they are not produced domestically.

“I told him I’d kill him, but he did it just the same.” – Why Are Risk Assets Rallying?

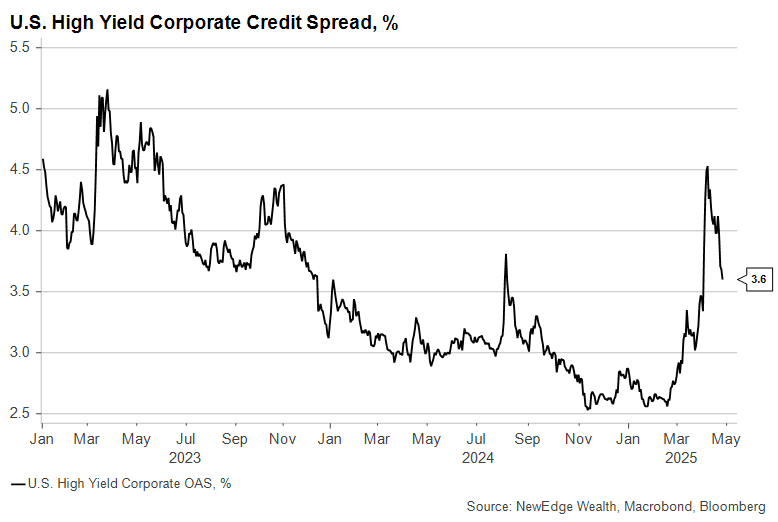

Even with modern technology, projecting hurricane paths is not an exact science. This is worth bearing in mind as we attempt to explain the strong rally in risk assets in the second half of April. The S&P 500 now trades at virtually the same price-to-forward-earnings ratio as it did on March 31st. We have also seen an abrupt reversal in high yield corporate credit spreads, even before they failed to approach the widest levels seen in the last market crisis in 2023:

The April 9th climbdown from the full slate of global tariffs helped avoid a financial crisis, and President Trump’s Oval Office comments indicating he will not dismiss the Chair of the Federal Reserve likely helped relieve some additional pressure, primarily in the bond market. Some members of the FOMC – not the Chair, notably – have even made some dovish-sounding comments indicating that a rate cut as soon as the June 18th meeting remains on the table, even as inflation concerns swirl.

While all of this has been helpful to risk assets, the remaining tariffs, particularly on goods from China, threaten the U.S. economy in a multitude of ways. Investors know this, and, judging by the unusually high percentage of companies downgrading their earnings outlooks, so do CEOs. So why have markets become more risk-on than they were two weeks ago? The inescapable conclusion is that investors simply believe the tariffs are likely to come down substantially and soon.

“You don’t like it, Rocco, do you? The storm.” – Mixed Signal from D.C.

We are not as hopeful as some about an imminent decline in bilateral U.S.-China tariff rates. The two sides seem to disagree even on seemingly basic matters such as whether they are already negotiating at all. A Wall Street Journal article that ran early last week laid out a radically different (i.e., more nuanced and measured) potential U.S. approach to China on trade. But it’s not clear whether it reflected a trial balloon for a policy change or wish casting from a frustrated executive branch official. Of course, the two are not mutually exclusive.

The Trump administration has adopted a practice of sounding optimistic about trade deals with countries like India and Japan in order to soothe investors’ concerns, but we have yet to see an outline of even one such deal. And many of the countries we seem to be negotiating with already have free trade deals with the U.S., making the best-case scenario perhaps a few more soybean purchases in exchange for lower U.S. tariffs.

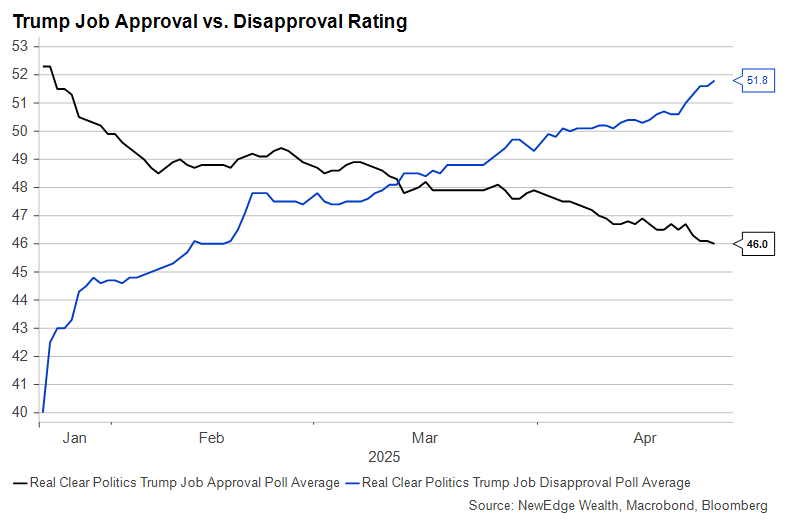

Political pressure may be mounting on President Trump to find an exit ramp from a trade war, as seen by the quick reversal in his job approval ratings:

As of this writing, however, the public comments from the Oval Office remain consistent: no lowering of tariffs or pause in their implementation without significant concessions first. For its part, China may feel it will be in a stronger negotiating position in a few months once most of the effects are felt in the U.S. This game of chicken could mean more pain in the interim.

“It’s better to be a live coward than a dead hero.” – Investing Amid the Chaos

Throughout the past few volatile months, our stance has been that policy uncertainty should not lead to investment paralysis. We have seen a variety of asset classes become more attractive in April thanks to a combination of lower valuations and changing balances of risk.

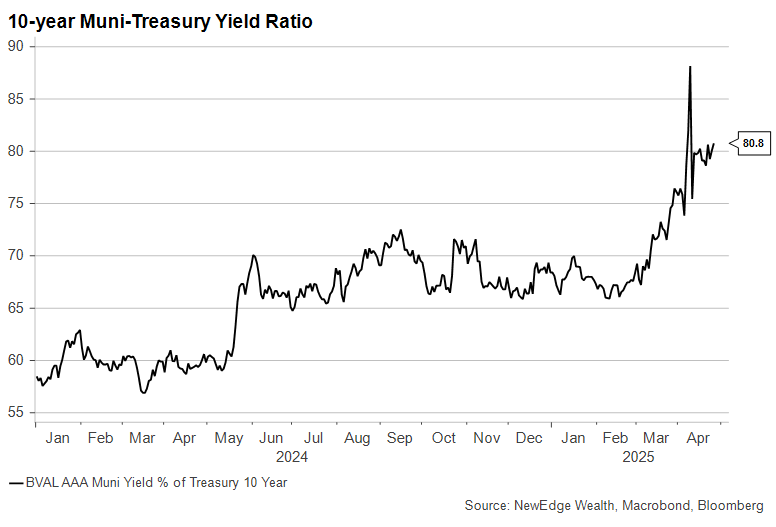

Let’s start with municipal bonds, which had their own scare a few weeks ago as liquidity in the market dried up following a period of record issuance as Treasury yields were spiking. The net result is a significant rise in municipal bond yields relative to taxable government bonds. Munis have gone from looking expensive to looking cheap in a matter of weeks. Their historically negligible default rates make investment grade munis ports in an economic storm, particularly when their preferred tax treatment is being offered at a discount.

We are also watching U.S. growth stocks, including at least some of the so-called “Magnificent 7”. These mega-cap tech and tech-adjacent names quickly lost their luster relative to the broader market earlier this year. But amid an otherwise challenging earnings season for many companies, Mag7 names have reported strong profits. While they are clearly not immune to volatility from here and are not as cheap following the past week’s rally, we believe investors who can stomach the tumult of the next few quarters could add exposure here with the knowledge they aren’t buying at the top.

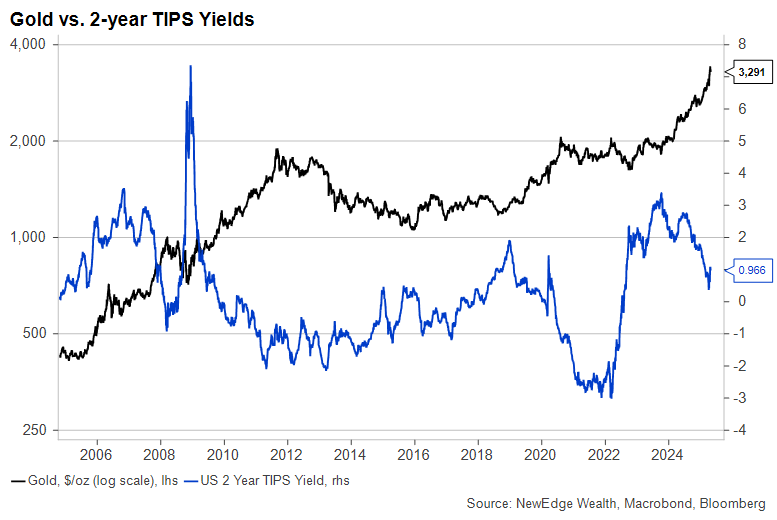

Lastly, given its run to record highs, we would be remiss to not mention gold. The yellow metal performs well in three types of environments:

• Panic (Check! At least at times this year)

• Negative or falling real interest rates (Check!)

• Falling demand for currencies (Check! The dollar is trading like a riskier asset)

Gold has had an extraordinary run and seems primed to pause for a breather. But the likelihood of higher inflation and weaker growth punctuated by the occasional market panic means it could remain well-supported.

“Now what you were saying, that’s the truth only you don’t believe it.” – Conclusion

We remain unconvinced that the past week’s market optimism was warranted, based as it was on a perceived change in rhetoric from the U.S. administration and several of its potential negotiating partners. As we have said from the beginning of this process, how long the tariffs last matters just as much – if not more – than how high the rates ultimately climb.

Should tariffs remain in place while lengthy and complex negotiations take place, the result would be a combination of higher goods prices, widespread shortages, diminished variety of products, and, eventually, layoffs in the logistics, shipping, and transportation industries that would undoubtedly seep into the wider economy. That we are already seeing stress in these sectors of the economy tells us that our remaining time in the eye of the trade hurricane may be short.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC