Weekly Summary: June 21 – 25, 2021

Now that the Federal Reserve has taken a more hawkish public position about when to taper asset purchases and start hiking interest rates, opinions on inflation and employment will matter more. Prior to its more aggressive stance, we could assume the central bank would be in no rush to moderate its easy monetary policies; after all, the Fed had assumed that inflation spikes would be transitory. But even though Chairman Jerome Powell still believes that price increases have been largely tied to the reopening of the U.S. economy (and thus likely to be temporary), the price increases were larger than the Fed expected. Further, Powell noted in testimony before Congress this week, the reopening effects that caused higher inflation “may turn out to be more persistent than we expected.” We are also leaning in the direction that a more persistent type of inflation is a distinct possibility.

In other words, the Fed admitted to uncertainty on inflation and now might react more quickly to it. The Fed pulled forward the expected timing and pace for asset purchase tapering and interest rate hiking. Even so, it won’t raise interest rates preemptively due to fears that higher employment could lead to inflation. Rather, Powell said, “we will wait for actual evidence of actual inflation or other imbalances.” The chairman added that policy will be tightened if needed to keep prices under control: “[The Fed] “is strongly prepared to use its tools to keep us around 2% inflation.” He also acknowledged that economic data are now more uncertain, given quirks in supply and demand as businesses open.

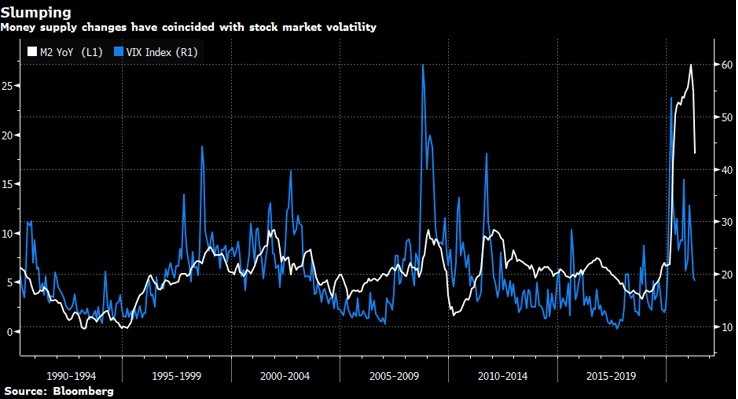

Despite the uncertainties, we believe the Fed would still prefer to err on the side of being accommodative for as long as possible because, as Powell put it, “[t]here’s a growing realization, really across the political spectrum, that we need to achieve more inclusive prosperity.” The Fed continues to view maximum employment as a “broad and inclusive goal.” It’s now much more a matter of opinion as to what tipping points on inflation and employment, and what circumstances, will convince the Fed to act sooner rather than later. In the meantime, expect more volatility in the financial markets in reaction to the latest inflation and economic data, as well as the latest from the Fed. Deciphering other investors’ opinions has also become more important. As we saw last week, “positioning” effects can produce quick and unexpected market volatility. Excess liquidity is often seen as contributing to volatility as well.

Source: Bloomberg – Bubble Expert Jeremy Grantham Addresses ’Epic’ Equities Euphoria – 6/22/21

Key observations:

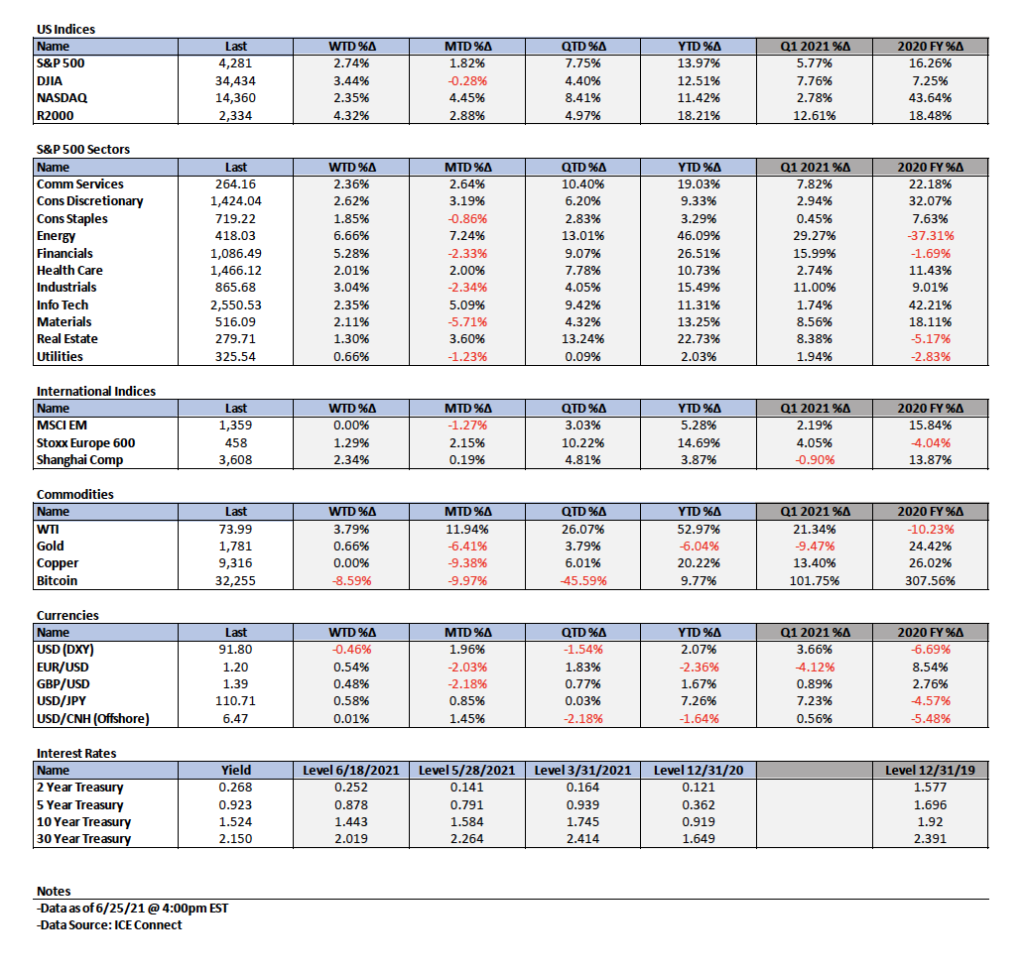

- By adopting a more hawkish posture on its monetary policies, the Fed increased the likelihood of volatility in financial markets, especially among interest rates and currencies. But not yet—predictable economic and inflation data kept interest rates and the U.S. dollar rather stable this week, and equities continued higher.

- Knowledge of investor opinions has become more important so that potential “positioning” effects can be better deciphered.

- Many investors and traders have shown that they can be very quick to change positions, underscoring a lack of conviction about specific investments.

- It’s now anybody’s guess as to which factors will finally change the Fed’s opinions enough for it to take action.

The upshot: Get ready for some interesting and potentially volatile times. Diversified holdings will likely be able to deal with myriad possibilities.

Market reactions and positioning

We can see uncertain positioning almost daily through the variable performance of S&P 500 sectors. Although this week’s first four trading days favored value and cyclical stocks overall, Tuesday’s activity mostly benefitted more defensive sectors. Nevertheless, tech put in a good showing as the fourth-best-performing sector through Thursday. Last week the more defensive sectors prevailed.

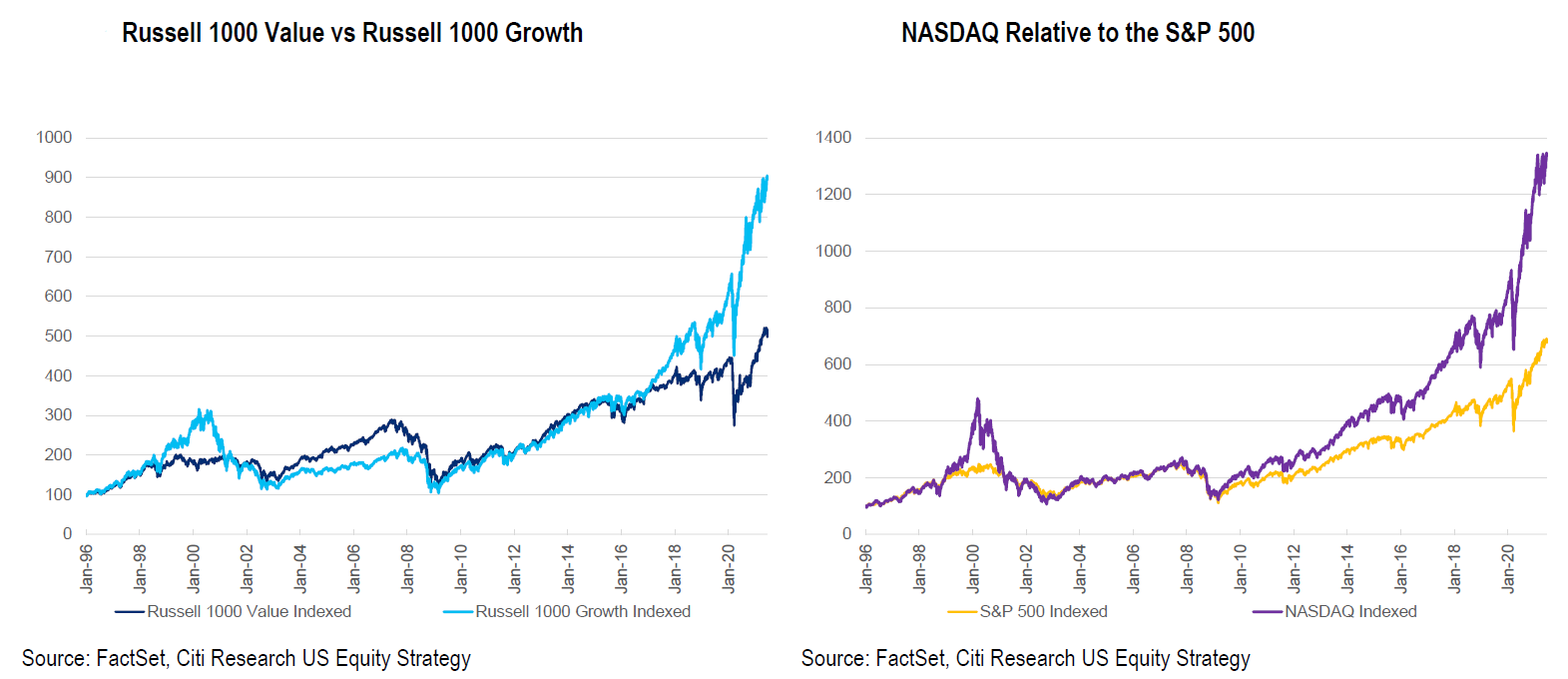

Interest rates were relatively stable through Thursday. The 10-year Treasury yield increased by 5 bps to 1.49% on Monday and subsequently fluctuated within a narrow range. According to a June 21 Citi Research report, the speed and “sharp nature” of the repositioning into Treasuries, big-cap tech/growth stocks and the U.S. dollar indicate little conviction on investment positions. Excess liquidity, price momentum and central banks’ balance sheets seemed to be more important than fundamentals.

Given many years of outperformance by the tech-laden Nasdaq (and growth stocks in general), uncertainty around inflation, and continued strong economic growth, many money managers probably became eager to gravitate to more familiar territory. In fact, on June 21 JPMorgan noted that this year’s largest net buying of U.S. mega-cap tech stocks happened the day after last week’s Fed meeting. As is often the case, the Fed’s more hawkish stance merely accentuated a trend that was already in place, as some investors had already reduced their inflation assumptions. Citi Research’s report suggested that this trend may have been reflected in the Russell 1000 Value index’s underperformance relative to its growth counterpart over the past month.

Source: Citi – United States Equity Strategy: Is The Best Offense, Defense? – 6/21/21

Taking it in stride

The Fed meeting and the subsequent market reactions did little to change investors’ views. If anything, opinions have grown even more divergent since. In a June 21 report, JPMorgan characterized last week’s bond rally as technically, not fundamentally, driven—and said the Fed meeting was not a “game changer.” JPM views current market prices as an opportunity to add to exposure to cyclicals, value stocks, and commodities. It still expects inflation and interest rates to resume their ascent. But JPM does see the Fed’s more hawkish stance as a “bullish watershed” for the U.S. dollar since the Fed took away its assurance of policy inaction. In fact, although the dollar has been generally lower this year, JPM noted that two-thirds of global currencies were already lower vs. the dollar YTD. Once again, the Fed was merely accelerating and confirming a trend already in place.

In a June 23 report, Goldman Sachs had a rather different perspective on the U.S. dollar, which it views as 10% overvalued. Goldman remains bearish on the dollar—but only for the medium term; in the near term, we could see further upside.

For its part, Morgan Stanley has remained more cautious, especially about value and more cyclical stocks. At least for the next quarter or two, the firm believes that cyclicals—along with GDP growth, inflation, PMIs and yields—will underperform as the sequential rate of change in consumer confidence slows. In a June 21 report, although MS’s economic growth forecast for 2021 remains quite positive, they see “pent up demand” only for services; in their view, the “overconsumption” of goods is an under-appreciated risk going forward. Indeed, recent corporate earnings call transcripts and other commentary have increasingly cited references to the pulling forward of demand. Whether in growth or cyclical stocks, Morgan’s chief U.S. equity strategist prefers lower-volatility, higher-quality and more-liquid stocks as he awaits his anticipated correction in major U.S. equity indexes.

As indicated in its June 21 report, Citi’s views remain more aligned with those of JPM. Citi still sees more upside in Value and “reopening” trades despite such stocks’ relative underperformance over the past month. It remains steadfast in its forecast that the10-year Treasury yield will reach 2% by December, which should be accompanied by a steeper yield curve. Citi also remains constructive on commodities, including base metals, noting that energy held steady while many other commodities were hit hard recently.

By his own statements, Powell seems more accepting of the possibility of a more persistent inflation. He is coming closer to our own leanings in that direction. The divergence of opinions on Wall Street are rather obvious. This very divergence almost assures volatility when some views are proven wrong. We believe that a “barbell” approach could make sense in this environment. This approach would encompass quality growth stocks and a cyclical exposure such as energy in a portfolio which is overweight risk assets.

Caution: Objects in the mirror…

According to Goldman Sachs in a June 18 report, the Fed’s average inflation targeting (AIT) approach should be reinterpreted as more backward-looking given the bank’s more hawkish views. Goldman therefore expects interest rates to show greater sensitivity to incoming labor market and inflation data—again surprising the Fed versus its expectations. Further good economic news won’t necessarily mean a steepening yield curve. Perhaps the Fed will taper and/or raise rates more quickly than anticipated. In addition to medium-term bearishness on the U.S. dollar, Goldman still sees inflation spikes as transitory; it remains bullish on commodities, especially energy.

Goldman’s current views are another example of how investors’ views get modified but have not really changed due to the Fed’s new approach. On June 9, before the most recent Fed meeting, Goldman said it expected value stocks to outperform in the short run before growth stocks regain their leadership role late this year. But based on its June 22 report, Goldman now appears to view the world as more complex, with many factors coalescing to blur distinctions between value and growth. As we noted last week, a more idiosyncratic, less formulaic approach is now preferred.

Survey of investors’ views, concerns

On June 22 JPMorgan summarized a survey of 3,200 investors, representing some 1,500 institutions worldwide, who attended the firm’s June 11 Macro, Quantitative & Derivatives Conference. Among the findings:

- 75% of investors would expect pressure on equities if the 10-year Treasury yield reached about 2.5%.

- As an inflation hedge, 46% prefer commodities, 27% choose energy/materials stocks, and 10% mitigate exposure through rate products.

- More than six in 10 (62%) consider cryptocurrencies the riskiest asset, followed by electric vehicles/green tech (17%).

- Only a few believe that bond proxies are in bubble territory.

- Central bank tapering (46%) and inflation (30%) are considered major risks.

- One-third expect inflation pressure to subside within six months, while 48% think it will happen in six–12 months.

Myriad of factors influencing investment decisions

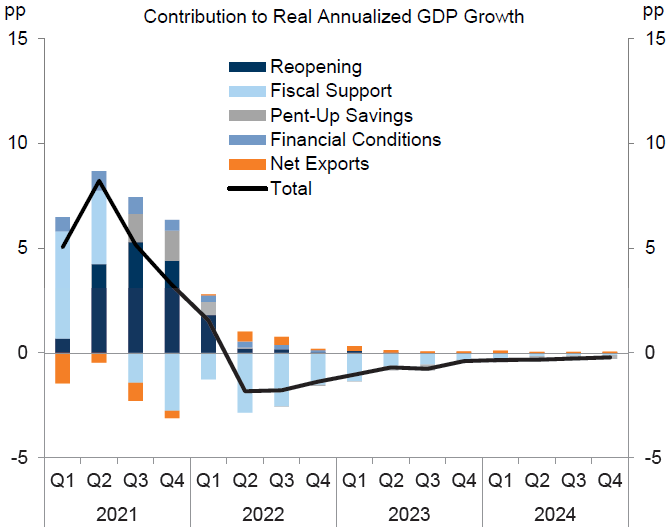

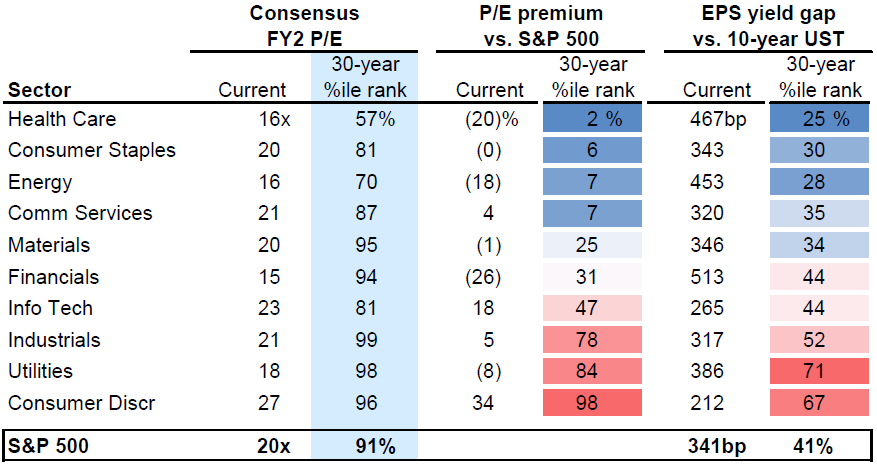

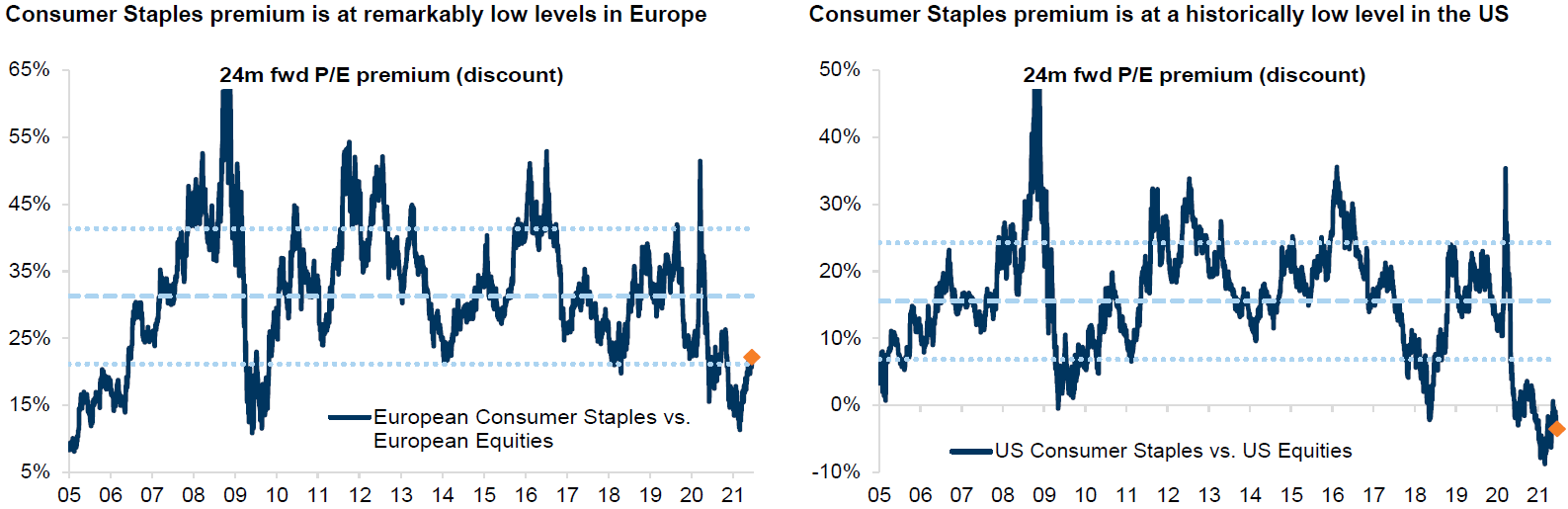

Further complicating investment decisions is that the drivers of GDP growth are in a state of flux. To determine appropriate levels of risk vs. reward, it helps to look at how different sectors have performed in the past. For example, the (defensive) consumer staples sectors in both Europe and the U.S. are at historically low relative valuations. Likewise, certain key ratios comparing emerging markets (EMs) with the S&P 500 are at historic lows. For long-term investors, EMs look attractive on a total-return basis but not as much on a risk-adjusted one. Meanwhile, value stocks continue to look relatively cheap compared to growth stocks, and some “momentum”-type stocks continue to outperform.

Relative valuation metrics might be useful in constructing a portfolio as well. Problem is, a given sector’s relative underperformance can persist for many years. Low overall volatility of an index (such as the S&P 500) might mask underlying volatility among the index’s components. Divergences might continue for an indeterminate time. Real interest rates (which take inflation into account) can also be key to determining the attractiveness of individual securities, sectors, and asset classes. Liquidity might also affect volatility, since excess liquidity might lead to trading and investing that is not based on fundamentals, but instead on such factors as “momentum.”

Which of these elements best serve the construction of an investor’s portfolio? Not surprisingly, opinions vary—a lot. What’s consistent is that risk tolerance, liquidity, and investment goals must all be assessed carefully.

Source: Goldman Sachs – Global Markets Daily: Dollar Outlook in the Wake of the Fed (Pandl) – 6/23/21

US sector valuations relative to history

Source: Goldman Sachs – Growth vs Value and the shift to Alpha – 6/22/21

US & Europe Defensives relative valuations are at historically low levels

Source: Goldman Sachs – Growth vs Value and the shift to Alpha – 6/22/21

Source: Bloomberg – Bubble Expert Jeremy Grantham Addresses ’Epic’ Equities Euphoria – 6/22/21

Source: Bloomberg – Bubble Expert Jeremy Grantham Addresses ’Epic’ Equities Euphoria – 6/22/21

Everything new is old again

It’s been amazing how the pandemic has accelerated, confirmed and clarified many trends already in place. The most talked about is the digitization of many of the world’s economies. Very often, trends go largely unnoticed until a specific event focuses attention on them. For example, we were all aware of the ongoing digitization trend. But how many of us fully comprehended its potential impact?

Likewise, the Fed’s recent hawkish stance only accelerated a trend toward slightly lowered inflation expectations and a rotation into more predictable, high-quality growth stocks. It also laid bare investors’ increasing uncertainty and low conviction regarding many of their holdings. It could even be said that the Fed merely reflected what the markets already knew.

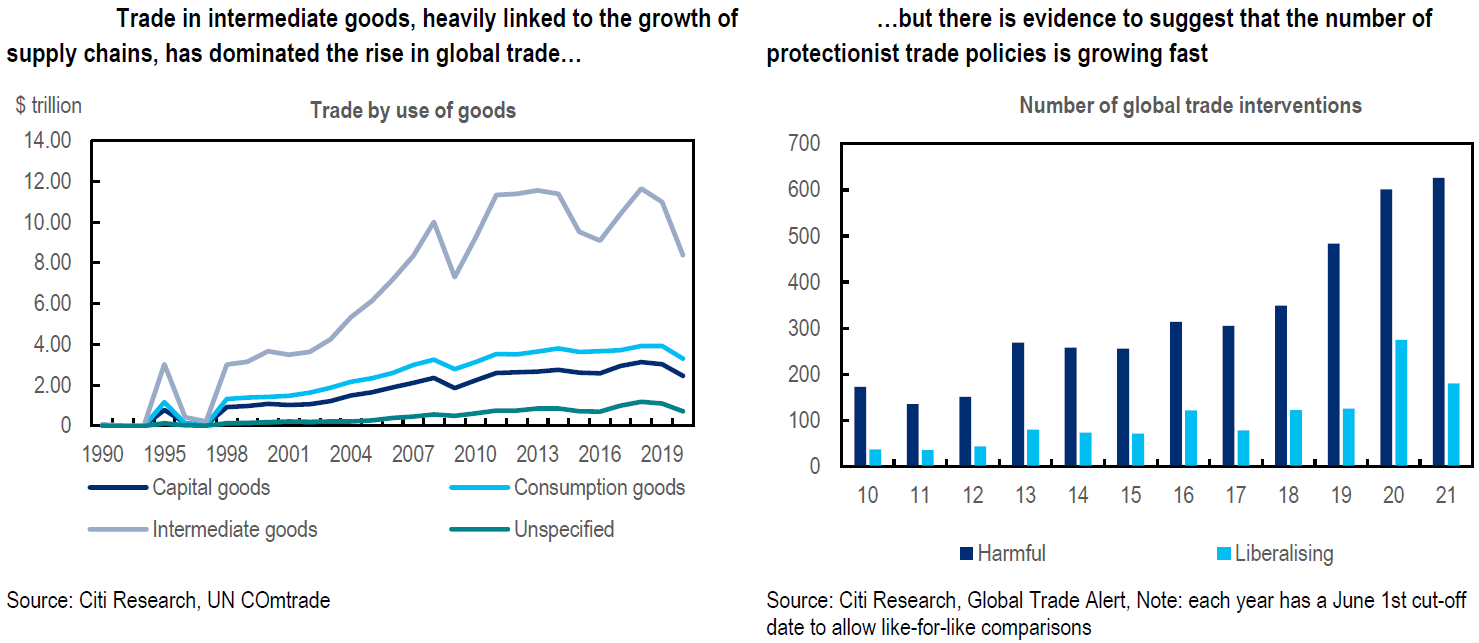

Global trade and investment trends

In a June 23 report which focuses on China’s role as the world’s dominant driver of investment growth over the past decade or so, Citi Research examined the consequences of a more diverse set of global investors. From 2010 to 2019, the report noted, China accounted for 47% of global investment growth—but only 33% of the world’s GDP on average. Partly due to the pandemic, Citi expects investment spending to increase in many countries and regions. This includes broad-based private-sector capital expenditures (CapEx) and rising public investment, especially by the U.S. and Europe. Cheap and available funding as well as a global push toward decarbonization will likely expand such efforts.

Unintended consequences?

But to the extent economic nationalism is behind such investments, global trade might actually diminish. De-globalization has been in place for many years, as highlighted by increasingly protectionist trade policies. The pandemic, however, forced companies and countries to focus on the resilience of their supply chains. Pursuant to an executive order issued by President Biden in February, this month the White House published a report that analyzes how to reduce U.S. supply-chain vulnerabilities (and resulting disruptions) in four key areas. European policy makers also support such initiatives.

Trouble is, switching supply chains to ensure more certainty will probably lead to more persistent inflation. Reducing global trade might also reduce global GDP growth rates. Consider the irony: Besides potentially increasing persistent inflation, the global pandemic has accelerated the trend toward de-globalization.

Source: Citi – Global Economic Outlook & Strategy How the global investment cycle will lose its China-dependence – 6/22/21

Confirmation bias

Most economic data this week confirmed recent trends. Input and output prices continued to rise, and most production disappointments were linked to supply chain issues. Long lead times and difficulty in attracting qualified workers persisted. Low inventories and high prices were typically behind disappointing sales figures.

According to the June 23 IHS Markit Flash U.S. Composite PMI’s, higher input costs were passed on quickly in June through a “steep rise in output charges,” and work backlogs were among the highest in a decade. IHS Markit’s chief business economist commented, “While the second quarter will likely represent a peaking in the pace of economic growth, a concomitant peaking of inflation is far less assured.”

Companies were broadly upbeat about the next 12 months. As we noted last week, it’s often the case that when businesspeople aren’t confident about what the current environment means for the future, it corresponds to uncertainty about the future of inflation and their ability to attract qualified workers. (The IHS Markit Composite index for European purchasing managers showed very similar patterns to those of the U.S.)

Bottom line

The Fed’s new hawkish position regarding when it might become less accommodative will likely increase volatility in financial markets, especially around interest rates and the U.S. dollar. Since this new approach can be characterized as more backward looking, the Fed might be compelled to react—that is, to revise its opinions very quickly—to unexpected changes in inflation and economic trends. Because market reactions would be just as swift, it helps to have a solid understanding of how most investors are thinking as well as how they’re positioned. Last week showed the possible severity of positioning effects. The excess liquidity in the financial system will probably exacerbate volatility even more severely. In such an environment, there’s a strong possibility that many investments are held with little conviction. The recovery from the pandemic continues to surprise. Portfolio construction will be more critical than ever.

Many investors interpreted the Fed’s new approach in ways that did not substantially change their views about interest rates, the dollar, commodities, sectors, etc. Some just had to adjust the timing of when their views would be realized. Prior to the Fed’s pronouncement, we could just wait to see whether inflation would be transitory or more persistent. But now the Fed might decide to act whenever it changes its opinion of what the “reality” is—or might become.

Index Definitions:

VIX: The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options.

Russell 1000 Value: The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

Russell 1000 Growth: The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted and historical growth values.

NASDAQ: The Nasdaq Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange.

S&P 500: The S&P 500 Index, or the Standard & Poor’s 500 Index, is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S.

MSCI EM Value Index: The MSCI Emerging Markets Value Index captures large and mid cap securities exhibiting overall value style characteristics across 27 Emerging Markets (EM) countries

MSCI EM Index: The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries

S&P 500 Value Index: Index constituents are drawn from the S&P 500® using three factors: the ratios of book value, earnings, and sales to price.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2021 NewEdge Capital Group, LLC