The time to hesitate is through

No time to wallow in the mire

“Light My Fire”, The Doors

One of our constant refrains is that valuation is not a catalyst, but it is the fuel that can amplify moves to the upside or downside.

Think of catalysts (a change in policy, earnings, sentiment, exogenous events, etc.) as the spark that lights the fire of a trend change and valuations as the fuel that drive the magnitude and duration of the fire.

To say this another way, valuations being cheap or expensive ae not enough on their own to cause a change in trend for a stock or index. The cheap often get cheaper and the rich often get richer, making investment calls based on valuation alone usually a “trap” for investors banking on a trend change. This is why valuation is such a poor timing tool for stock investing, as both cheap and rich valuations can persist far longer than a “rational” investor expects.

But this does not mean that valuations are not a vitally important consideration in the investment process.

Valuation can have a significant impact on investment outcomes because valuations can amplify moves to the upside or downside. When a stock/index is cheap and a positive catalyst occurs, there is ample room for a re-rating of valuations higher as investors reassess the investment’s prospects and often chase into the position. On the flipside, when a stock/index is expensive and a negative catalyst occurs, there is simply more room for valuations to fall as investors reign in expectations and oftentimes crowded positioning is unwound.

This dynamic of valuations amplifying moves has had a significant impact on markets YTD, with this impact intensified during Thursday and Friday’s market volatility.

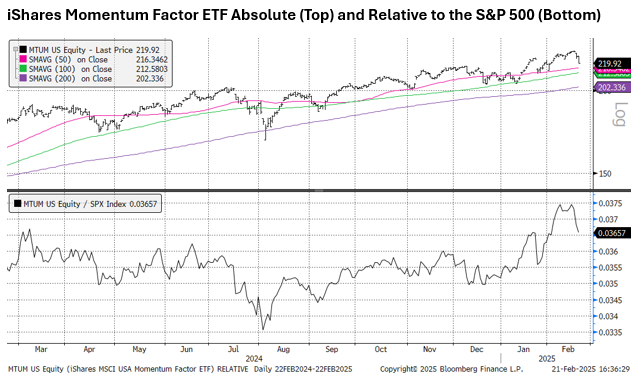

Thursday and Friday saw the beginnings of an unwind of the ultra-dominant U.S. large cap momentum trade (think of the momentum factor as the Newton’s First Law factor, “an object in motion stays in motion”, with momentum capturing the dynamic that if a stock has been performing well it will continue to perform well).

Below you can see the iShares Momentum Factor ETF underperforming over the last two days as large momentum stocks come under pressure. The biggest weights in this ETF are AVGO, WMT, COST, JPM, and NVDA, all names that experienced a bout of volatility this week.

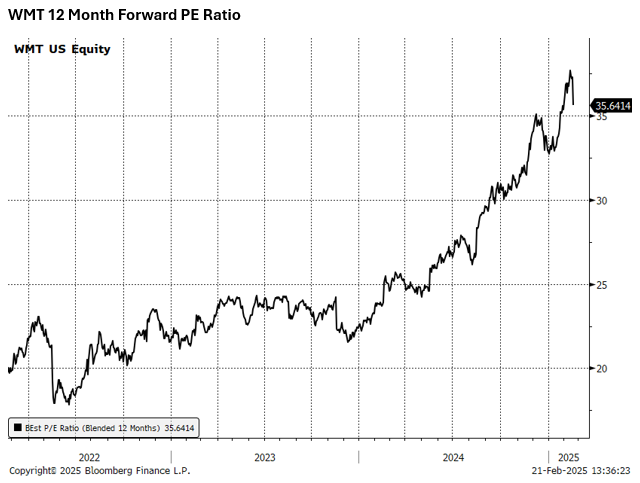

To highlight one of these momentum stocks that stumbled this week, we look at Walmart (WMT), which traded lower on results that were healthy but slightly lower than consensus. The challenge for WMT is that it has seen a huge re-rating in its valuation over the past year from 22x to a peak of 38x forward, without seeing a step change higher in the growth trajectory of earnings (the company steadily grows earnings high-single-digits to low-double-digits). The stock was caught in the winds of the momentum trade, which helped propel it to truly spectacular returns and valuations over the last year but left it vulnerable to an amplified move to the downside if a catalyst emerged.

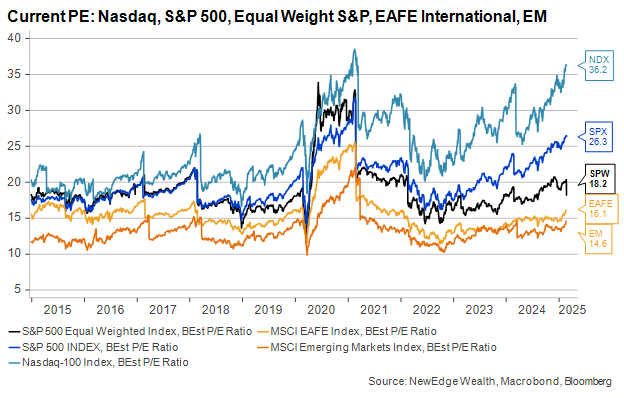

So, as valuations amplify the moves to the downside for U.S. large cap stocks, we are seeing valuations amplify the moves to the upside for non-U.S. stocks.

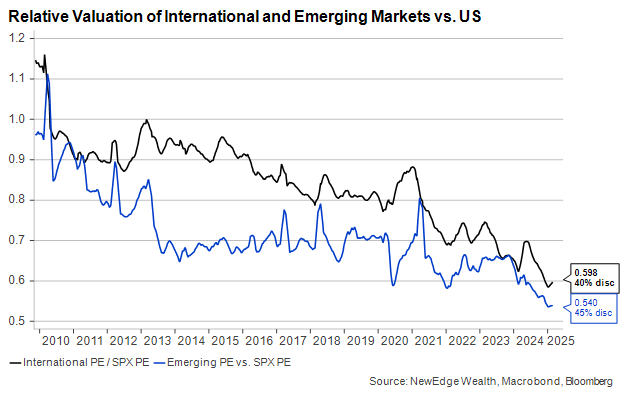

We must start by appreciating how cheap non-U.S. stocks have become over the last 15 years. Non-U.S. markets came out of the Great Financial Crisis trading at slight premiums to the U.S., but over the course of a truly brutal 15 years for international investing, these discounts have widened to 40% and 45% for International Developed and Emerging Markets, respectively.

A key point is that at any time in the last 10 years, you could have made a “cheap” valuation argument for non-U.S. stocks, but would have been caught in a true value trap as the discount grew ever wider and relative returns grew ever more disappointing (over the last 10 years, International Developed is +26%, EM is +10%, and the S&P 500 is +187%!).

Further, it should be noted that along the way there were many “head fake” rallies where non-U.S. markets attempted to make a comeback, but fundamentals never provided the catalyst for these valuation gaps to close, so any relative outperformance of non-U.S. over U.S. proved to be ephemeral.

But as we start 2025, we have seen a truly spectacular surge in cheaper non-U.S. markets, with their ample room for valuation expansion a key source of the pronounced upside.

For example, look at the contrast between Amazon (AMZN) and its Chinese peer Alibaba (BABA).

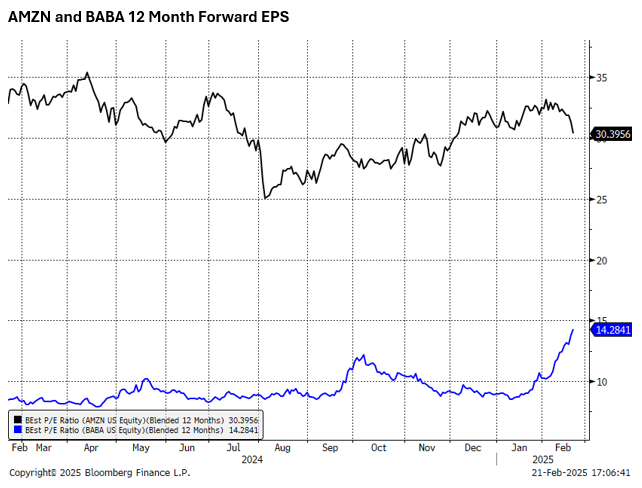

Here you can see the valuation difference between the two companies, with AMZN consistently trading at well more than 3x the valuation of BABA.

But as sentiment has improved around Chinese shares YTD (potentially due to China tech innovations in areas like AI, a more favorable stance towards big China tech companies from the Chinese Communist Party and unwinding of the dominant “American First” trade/positioning), this has allowed for a rethink of these wide discounts that Chinese shares carry.

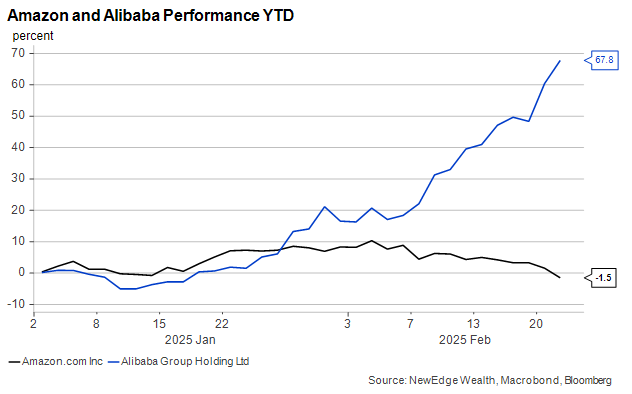

Because the valuation started from such a low base, BABA has seen a 60% increase in its forward PE multiple, but this multiple is still just 14x. This multiple expansion has driven a truly spectacular surge in the stock YTD, +68%, contrasting with AMZN’s -1.5%.

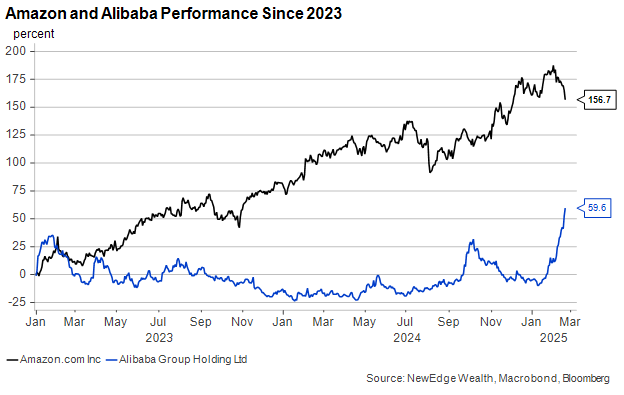

This of course is barely closing the gap in the last two years of outperformance of AMZN over BABA, with the peak spread in this AMZN outperformance over BABA in the last two years being 197% in early January!

We have also seen a similar dynamic of a sharp re-rating in shares in markets like Germany, where the DAX saw its forward PE multiple expand by over 12% in a month and a half alone, bringing it to just 15x forward (notably near the high end of its pre-pandemic range).

It remains to be seen if any of these “underdog” moves in non-U.S. stocks can or will be sustained. We think that earnings/fundamentals need to support these re-ratings, otherwise this could be yet another “head fake” rally. A key factor in supporting the fundamentals is a weaker USD, with a major USD bear market a key condition for a sustained major non-U.S. equity relative bull market, a topic we have written about extensively over the last two years of pronounced non-U.S. underperformance. Further, we are monitoring indicators like ETF flows and sentiment surveys to see how aggressive investors are chasing these recent moves in order to gauge when they may have run their course.

Overall, these moves highlight the importance for portfolio diversification and how violent leadership rotations can be incredibly rapid, making timing the turns perfectly incredibly difficult. In our tactical allocations, we upgraded International indices to a “neutral” weighting in late 2023, after being persistently “underweight” in years prior, noting the huge valuation discounts that would prove helpful once a catalyst eventually emerged. This move was of course abundantly early, as the stocks laid dormant compared to U.S. stocks for over a year, but as we have emphasized selectivity in non-U.S. markets, this dormant state allowed for opportunities to find high quality investments that had strong fundamentals that would eventually warrant smaller valuation discounts versus the U.S.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC