Weekly Summary: August 2 – 6, 2021

Key Observations from the Past Week:

- Peaking economic growth rates do not mean that robust economic growth can’t continue.

- As investors “look through” the latest economic data their forecasts are often “not the same.”

- We remain optimistic that the Delta variant will prove to be manageable and that the Service sectors will continue to strengthen, but at a slower pace.

- We anticipate that low hospitalization rates will continue where vaccination rates are high and/or where the population has a high incidence of antibodies. Low hospitalization rates will obviate the need for general lockdowns.

- We are encouraged by the strong U.S. ISM Services PMI data and the better than expected U.S. July employment data.

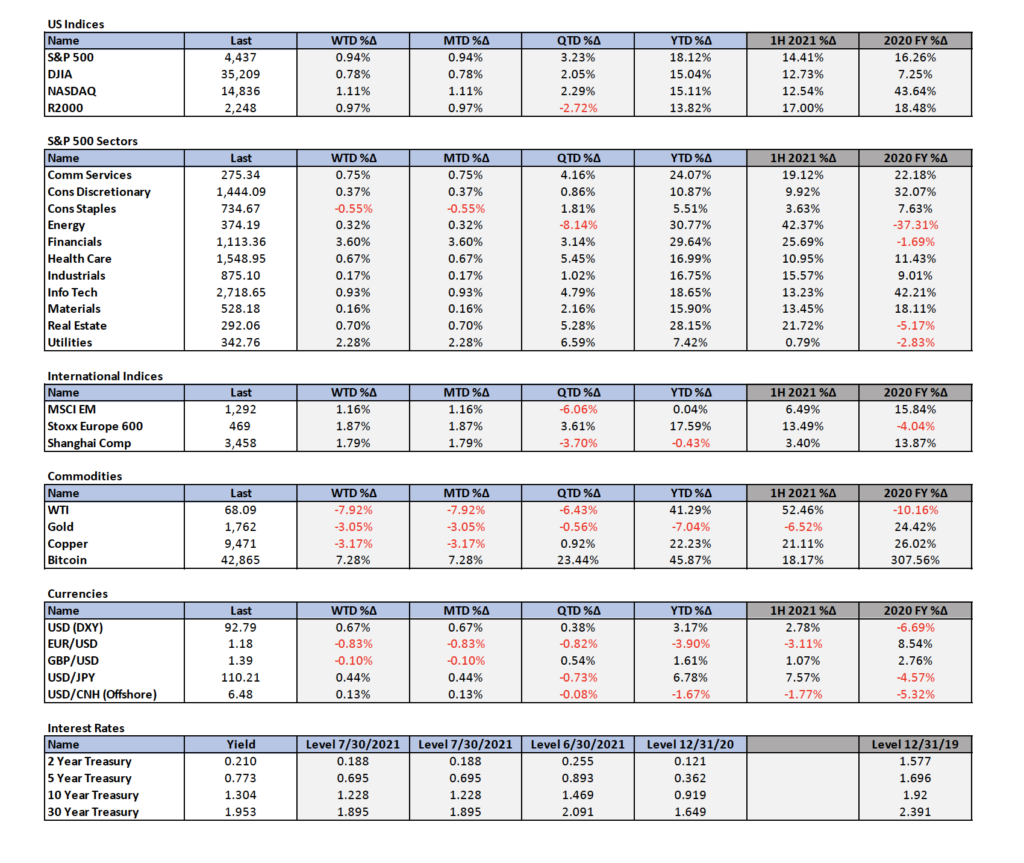

The Upshot: We believe that sector rotation will continue. We believe that Value and Cyclical stocks currently present a favorable risk/reward long opportunity. We believe that there is a high probability that the 10-year Treasury intraday low yield of 1.12% this week will be the lowest level over the short-to-intermediate term, and perhaps the long term as well.

We view the words that the Beatles first sang in their breakthrough album “Rubber Soul” as very apropos to investors’ current task at hand. We are all trying to “look through” the current data and forecast what lies ahead. But investors’ forecasts are very often “not the same.” Perhaps most importantly, the Federal Reserve (Fed) looks through the current high rates of inflation, sees such rates as temporary and forecasts lower and less persistent rates of inflation. We acknowledge that some parts of inflation are most likely temporary but believe that a significant part of inflation could be very persistent. In fact, the Delta variant could cause some of the temporary aspects of inflation to persist for a longer period due to continued supply disruptions and persistent labor shortages. Slower economic growth and higher rates of inflation could even mean a future of stagflation. After a while, it doesn’t matter how we characterize inflation. The longer even the “temporary” aspects of inflation persist, the more likely inflation expectations will increase and/or remain at elevated expectations. Increased wages should follow.

Rolling Economic Global Growth

The bond market currently does not seem to respond to high rates of inflation. Its focus is on what it perceives as slowing global economic growth. Slowing economic growth is due to the uneven effects from the pandemic, such as supply disruptions, rising materials and other input costs and labor shortages. We still believe that economic growth will remain strong and will be characterized as a “rolling” economic recovery that will probably be delayed due to the Delta variant. The real danger to continued economic growth is diminishing confidence about the future due to higher inflation and shortages. Loss of confidence has begun to appear in certain surveys of consumer sentiments, such as those conducted by the University of Michigan. We still anticipate strong global economic growth in spite of such concerns.

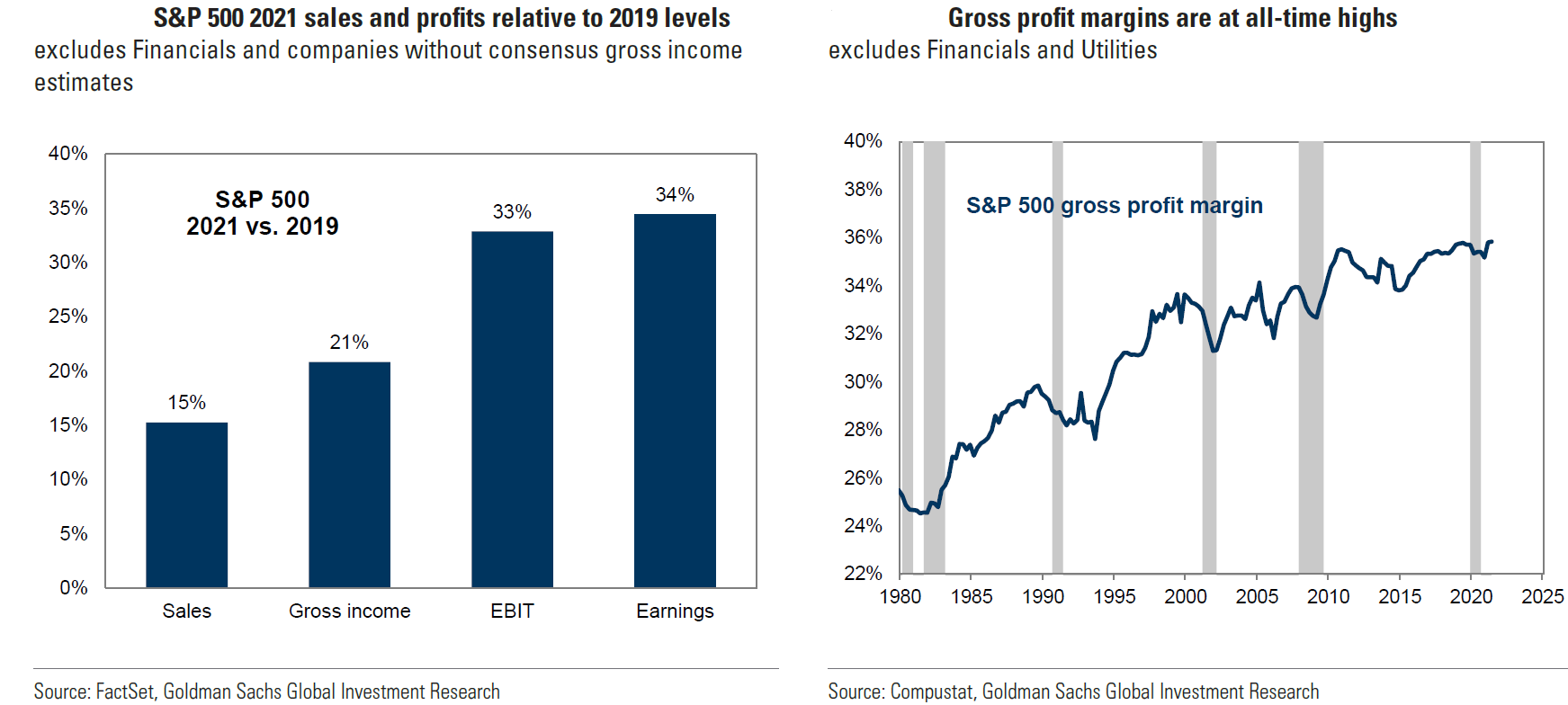

Source: Goldman Sachs, U.S. Equity Views: Raising our S&P 500 earnings and index targets. High-margin growth stocks will remain winners, (8/5/21)

The Services Sector is Presumed to be Sensitive to Delta, But July Data Don’t Show an Impact

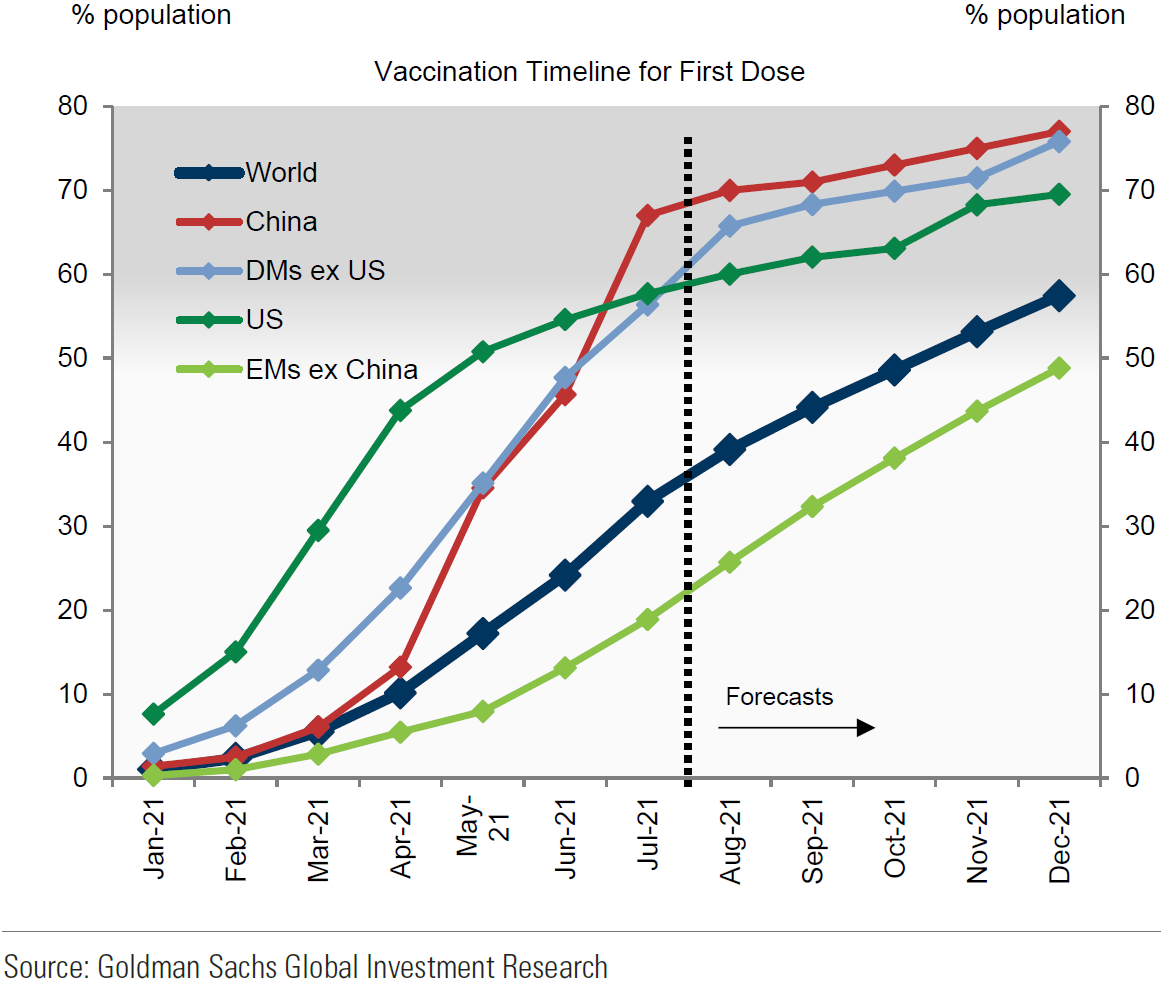

The unexpectedly strong July ISM Services Purchasing Managers’ Index (PMI) data for the U.S. announced this week supported our view of strong economic growth continuing in spite of the increase in Delta variant-related COVID-19 cases. (The PMI is generally viewed as a proxy for economic activity and growth). The Services sectors are obviously the most exposed to virus cases increasing. The Delta variant might cause a slowdown in services “reopening” and will probably make their projected growth rates more variable. But the high level of vaccinations in developed markets (DM) should keep the Delta variant manageable. The key to this will be the much lower hospitalization rates for those who contract the virus. Over 90% of the recent COVID-19 U.S. cases are of the Delta variant, and almost all hospitalizations are for those who are not vaccinated. We believe that there will be no general lockdowns in the U.S. given the low hospitalization rates relative to virus infection cases. But there might be localized lockdowns in those regions where vaccination rates are low. Emerging markets (EMs), with relatively low vaccination rates, of course are more prone to lockdowns and restrictions. Their increasing vaccination rates will hopefully preclude the need for widespread lockdowns. Asian countries, including China, seem willing to take a more aggressive approach in terms of restrictions and localized lockdowns so as to contain the spread of coronavirus infections. According to a J.P. Morgan August 4 report, India’s daily coronavirus infections are 40,000 per day currently, down from about 400,000 daily cases in May. India was the first country to detect the Delta variant in April. Although about only 7% of its population have even just one dose of the vaccine, two-thirds of its population have developed antibodies. Similarly, some EMs might have surprisingly low infection rates in the future.

Goldman Sachs Expects the Share of the World Population Vaccinated with a First Dose to Increase from 33% Now to 39% By the End of the Month.

Source: Goldman Sachs, Global Economics Comment: Vaccination Timelines: Steady EM Progress; DM Incentives; Upgrading France, (8/4/21)

Strong U.S. ISM Services PMI

The very strong July ISM Services PMI data told the same general story for the U.S.: longer delivery times, higher prices, increasing employment. The inventory sentiment index indicated that more survey respondents thought that their inventories were too low relative to their level of business. In contrast, the IHS Markit U.S. Services PMI, although still strong, unexpectedly decreased from its June levels. In the words of the chief business economist at IHS Markit: “The pace of U.S. economic growth cooled in July according to final PMI data, but remained impressively strong to suggest GDP will rise robustly again in the third quarter.” He further stated that, “future growth expectations mellowed considerably during the month. This waning of optimism in part reflected a rising concern over the potential for the Delta variant to disrupt the economy again.”

Instructive Differences Between ISM and IHS Markit Services Indexes

Almost all research reports focused on the more positive ISM Services PMI report. But we believe that it is very instructive to decipher why the dramatic difference from the IHS Markit report. The ISM survey generally focuses on larger companies, including multinational companies. It gives equal weighting to its subcomponents. The IHS Markit survey on the other hand, focuses on generally more numerous and smaller companies. The other important difference is that it gives more weight to its forward looking components. We believe that a very plausible explanation for these divergent survey results can be explained on two fronts: 1) The larger multinational companies are obviously exposed more to the rolling economic global growth progression, especially the European economies. This should boost the ISM readings relative to those of IHS Markit. 2) The IHS Markit’s increased weighting of more forward looking components which presumably incorporated future economic growth concerns led to a lower reading vs. ISM’s data. We believe that expectations with regard to economic growth will improve once again as the manageability of the Delta variant becomes more apparent and the rolling nature of global economic growth is more appreciated.

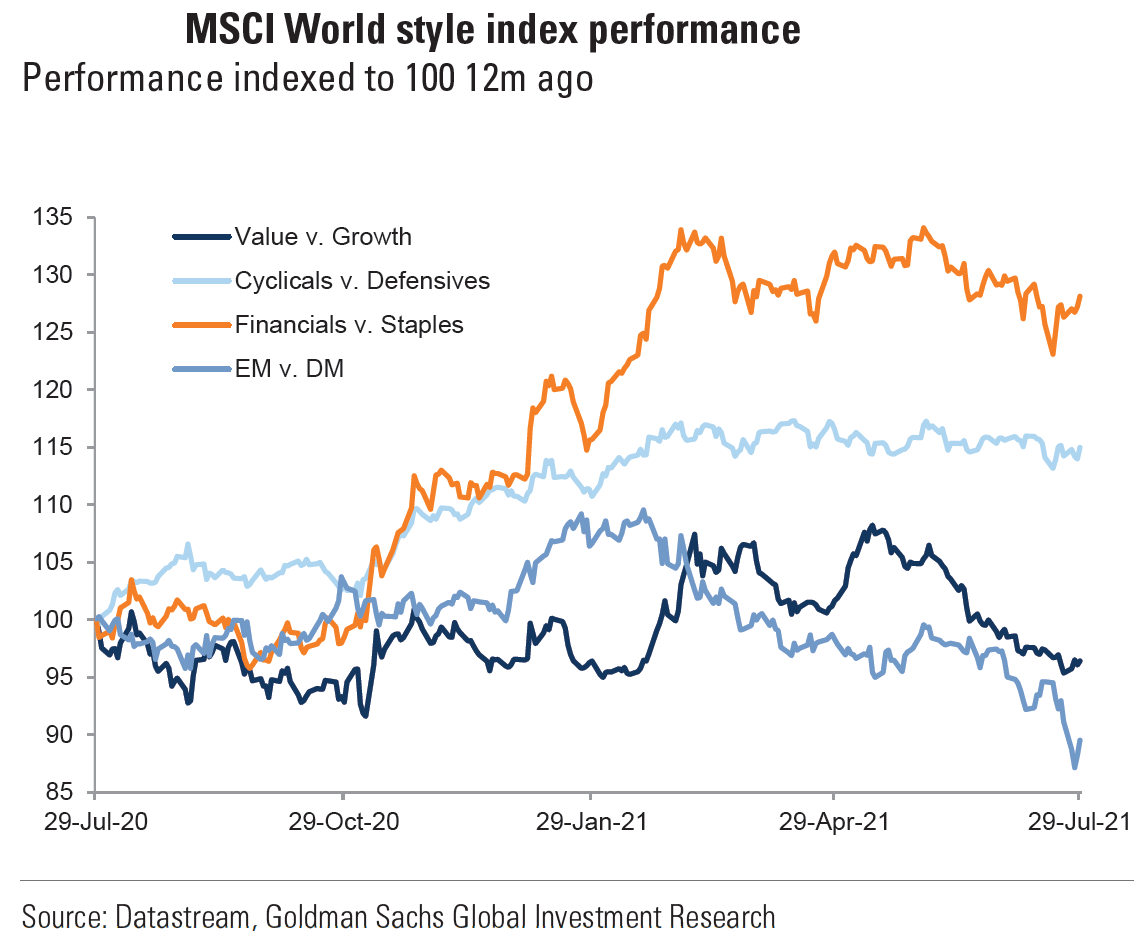

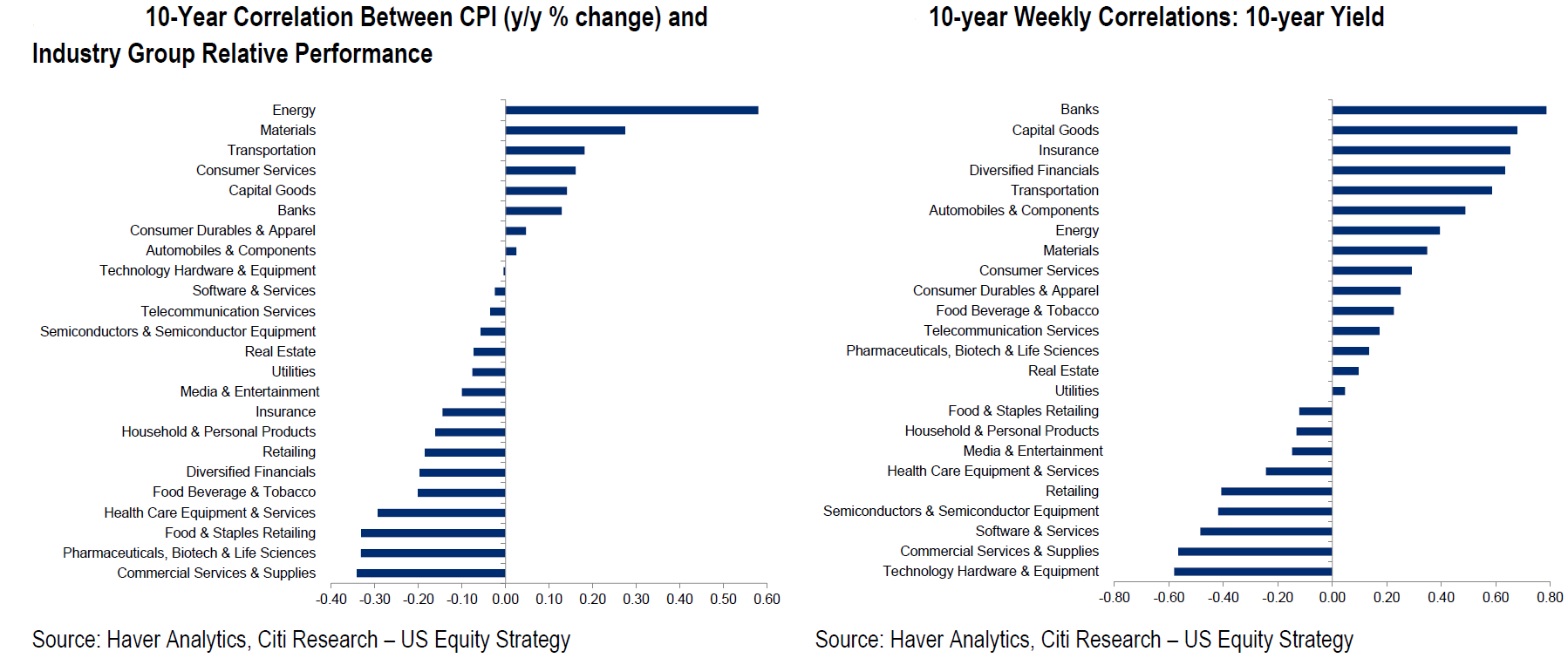

“Looking Through” and Sector Rotation

During Q1 this year, Value and Cyclical stocks outperformed most other sectors and interest rates rose as markets were able to “look through” the negative impact that coronavirus had on economic growth. Now, the reverse seems to be true. On the day when very positive July ISM Services PMI data for the U.S. was announced this week, most U.S. stocks traded lower. Evidently, many investors looked through the positive Services data and anticipated slowing economic growth rates. The bond market had a more positive view of economic growth after the services PMI data as interest rates recovered from a disappointed private employment report from ADP earlier in the day. But on the day just prior to the positive Services announcements, equities seemed to look through the rising coronavirus cases as the more Value and Cyclically oriented sectors led a generally positive equities day. In fact energy was the top performing sector that day even as the WTI oil price was lower by close to 1%. It seems that markets can be rather skittish as to when they chose to “look through” the current data. To make things even more unpredictable, what investors then “see” is often “not the same.” The Financial sector (generally considered both a Value and Cyclical sector) was the standout performer this week as interest rates rose.

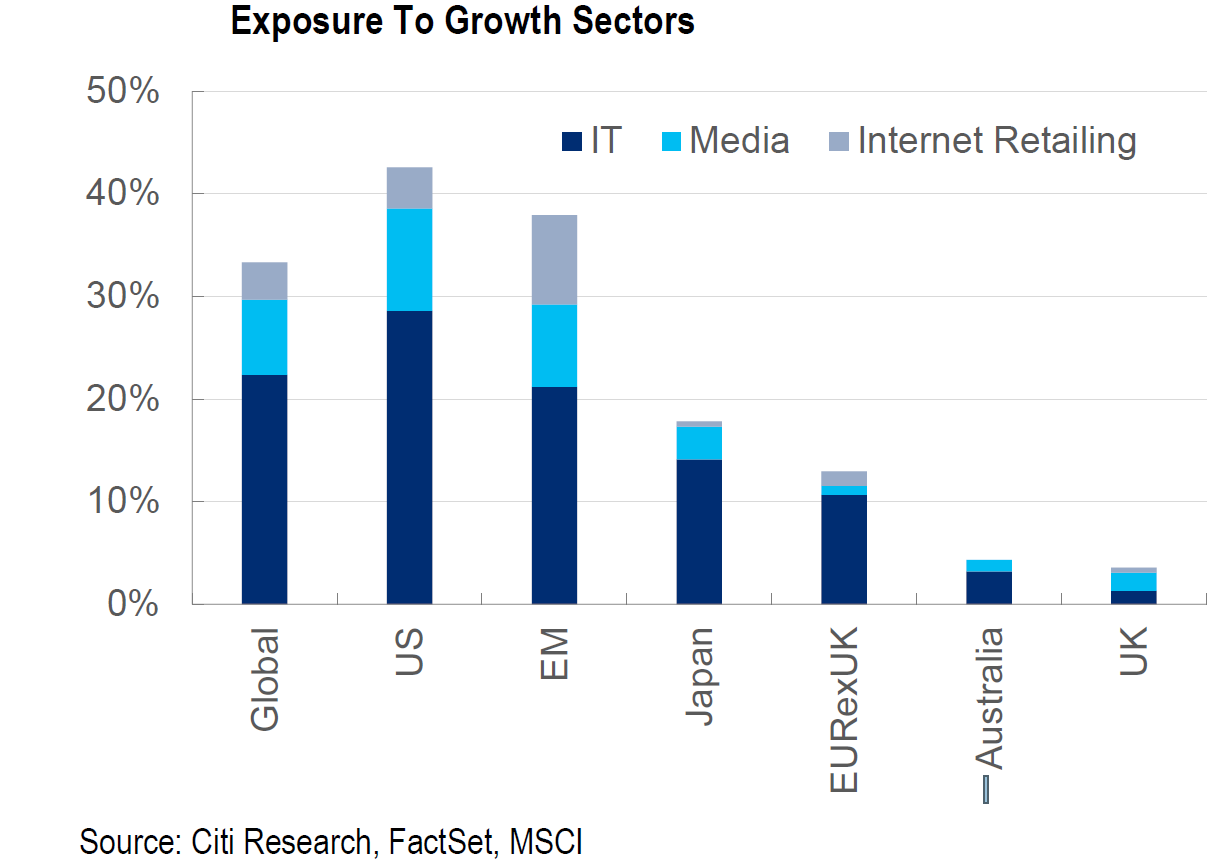

Source: Citi, Global Equity Strategy US 10Y Heading To 2.0%: What To Do, (8/4/21)

Most Opportune Time to “Look Through”

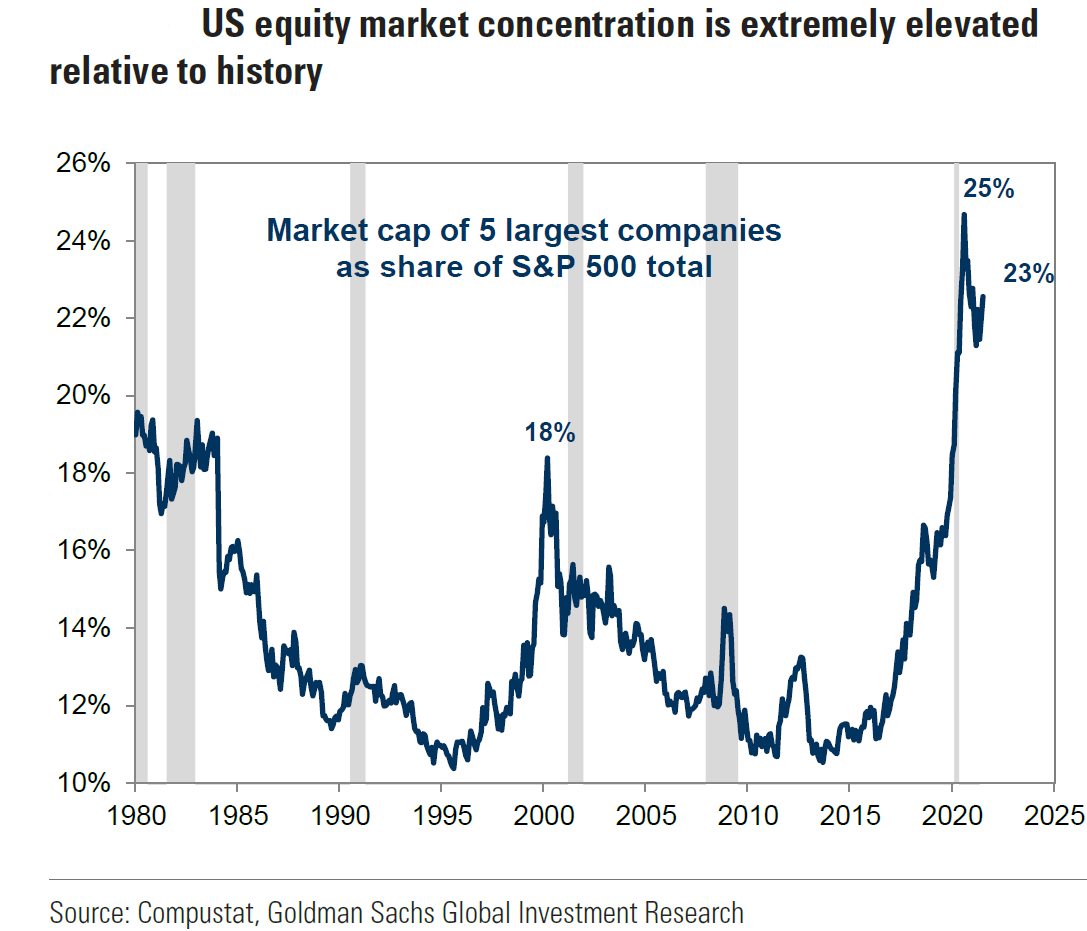

As we indicated in a prior weekly letter, patience is very important in determining when is the most opportune time to look through the current data to take advantage of opportunities. We believe that the time to “look through” is when the market has discounted a particular view over an extended time and when a different viewpoint becomes increasingly likely. This is also when a risk/reward analysis is most critical in determining when an investor should take advantage of opportunities. We continue to believe that now is the time to look to add to Value and Cyclical positions on downdrafts. Many of these stocks have lost as much as 15% since May and about 20% relative to the S&P 500. They have strongly discounted a slowing economic growth scenario. We believe that such a scenario has been overly discounted on a short-to-intermediate term basis. We also believe that at least in the short term, many high quality big cap growth stocks have discounted most, if not all, of the positive news. In fact, in the short term, even lower interest rates probably have lost much of their effectiveness in boosting the valuation of such stocks. Of course in the intermediate-to-long term, lower rates would once again be a tailwind to such stocks and to the overall equity markets as well. The five largest high-quality big cap growth stocks now comprise about 23% of the S&P 500 market cap.

Source: Goldman Sachs, U.S. Equity Views: Raising our S&P 500 earnings and index targets. High-margin growth stocks will remain winners, (8/5/21)

Source: Goldman Sachs, Reflation capitulation, correction risk and China agitation, (7/30/21)

Source: Citi, Monday Morning Musings: Time for a Check-Up, (7/30/21)

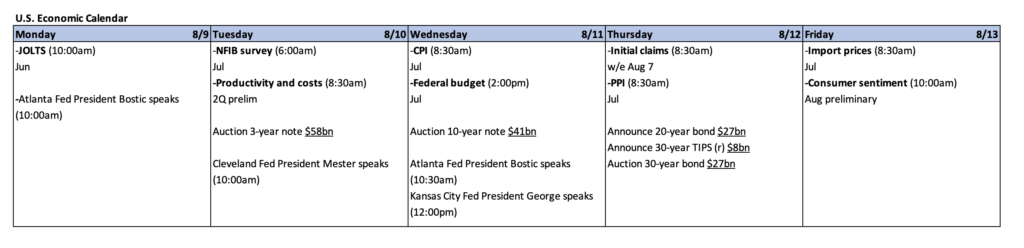

U.S. Nonfarm Payroll Employment

As expected, a very strong employment report finally did propel interest rates higher as the 10-year Treasury yield initially rose 6bp to 1.29%. U.S. nonfarm payroll employment rose by 943,000 in July vs. consensus in the mid-800,000 range. June and May employment totals were revised higher by a total of 119,000. The unemployment rate declined more than expected to 5.4% from 5.9% in June. Hourly earnings rose more than expected at a rate of 0.4% m/m and 4.0% y/y. The biggest contributor to the July increase in jobs was the 380,000 added by the leisure and hospitality sector. Two-thirds (+253,000) of this gain came from food services and drinking places. The increase in the Services sectors jobs was especially encouraging given the spread of the Delta variant. We continue to expect the Services sectors to show improvement. This employment report and the bond and stock market reactions, including the S&P 500 sector reactions, confirm our views and recommendations.

“Looking Through”: Our View on Continuing Global Economic Growth

Investors are always trying to look through the most recent data. If current data seems to show a slowing of economic growth, some investors just see that trend continuing and so might avoid Value and Cyclical stocks. We chose to view things differently. We believe that although many economies may have hit peak economic growth rates, the global economy should continue to grow at a very robust rate for quite some time. We believe that interest rates should soon begin to rise once again. Value and Cyclical stocks should benefit in such an environment. More investors need to be convinced that the Delta variant will be manageable, and that the Services sectors will continue to expand but perhaps at a slower and more unpredictable manner. The production of some goods should begin to slow as the Services sectors continue to reopen. But the replenishment of inventories should continue to boost the production of goods. In the meantime, the replenishment of U.S. inventories was partly responsible to boost June U.S. imports to a record level as the imports of goods also hit a record level. The June U.S. trade deficit was the highest since at least 1992. The strength of imports is a very good indication of strong U.S. economic demand and underlying economic strength.

Bottom Line

The pandemic effects continue to be “uneven’ and rather unpredictable. It is, therefore, not surprising that there remains a wide dispersion of what investors forecast. There is no consensus with regard to the trajectory of interest rates, economic growth, inflation, employment, wage increases, extent of future supply disruptions, regulations, taxes, fiscal and monetary policies.

The lack of consensus and the dispersion of expectations with regard to economic growth and employment should continue to affect sector performance and eventually interest rates as well. But to have a more lasting influence, a consensus will be required to develop, and we believe it will be the one that “looks through” the current economic data to see a more consistent pattern of economic growth that should favor Value and Cyclical stocks from their current price levels. Friday’s better than expected U.S. employment report could help to build a consensus more in line with our own expectations. As stock prices rise and fall, assumptions should be constantly evaluated and a risk/reward framework should be clearly defined.

Given the dispersion of expectations, we continue to forecast sector rotations. Our “barbell” approach should continue to serve us well in such an environment. A balanced equity portfolio should be comprised of at least some stocks that would benefit in rising or falling interest rate environments. We recommend that positions should only be added to on downturns when there are favorable risk/reward opportunities. We maintain that the most favorable risk/reward long opportunities at present stock price levels are in Value and Cyclical type stocks. We also believe that an evaluation of assumptions and a risk/reward analysis will conclude that interest rates should be higher.

INDEX DEFINITIONS

KBW Nasdaq Bank Index (BKX): The KBW Bank Index is designed to track the performance of the leading banks and thrifts that are publicly-traded in the U.S. The Index includes 24 banking stocks representing the large U.S. national money centers, regional banks and thrift institutions.

MSCI EM Value Index: The MSCI Emerging Markets Value Index captures large and mid cap securities exhibiting overall value style characteristics across 27 Emerging Markets (EM) countries.

MSCI EM Index: The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries.

NASDAQ: The Nasdaq Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange.

PCE: Personal Consumption Expenditures (PCEs) refers to a measure of imputed household expenditures defined for a period of time.

Russell 1000 Growth: The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted and historical growth values.

Russell 1000 Value: The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

S&P 500: The S&P 500 Index, or the Standard & Poor’s 500 Index, is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S.

VIX: The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options.

Z-Score: A Z-score (also called a standard score) gives an idea of how far from the mean a data point is. It is a measure of how many standard deviations below or above the population mean a raw score is.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC