There are several tailwinds to investing in private companies, also known as private credit, today. There are fewer public companies today than there were 20 years ago (~6000 in the mid-1990s and only ~4200 today1,2) and private companies are increasingly staying private for longer. As the number of private companies grows, the opportunities to invest in them, whether through debt or equity, grow as well.

Trends in Funding

When considering the range of possibilities in private credit— primarily those in the private sector via investment funds as opposed to traditional banking channels — it’s beneficial to understand why companies are choosing to remain private and why access to traditional bank capital has become more challenging.

For companies, part of the impetus for this shift from going public to staying private has been increased access to capital throughout the business lifecycle. This private capital provides an alternative to raising funding through public markets (for example, through initial public offerings or bond market issuance), which historically has been the primary source of capital for large scale financing rounds. Further, as legal and regulatory requirements for public companies have become more onerous, more companies are opting to stay private and turn to private equity and private credit for their financing needs.

Looking at access to capital through traditional banking channels, in the past year, the broadly syndicated market has been essentially closed. This is largely due to “failed financings” that result in “hung loans”, which are loans that banks are not able to sell to other investors upon issuance and thus sit on bank balance sheets, often at losses. This “hung loan” risk is most common in non-investment grade debt and serves to effectively drive lower credit quality businesses towards alternative, or private funding channels. A recent example is the acquisition of Citrix, which was bought by a private equity firm and funded through banks. Following the deal, the funding banks were unable to sell a significant portion of the bond offering, forcing the banks to mark down the bonds in order to attract investors. Failed financings like this, along with a general tightening of credit standards due to economic uncertainties, have resulted in banks being less willing and able to serve as a funding source for private companies.

The Case for Private Credit

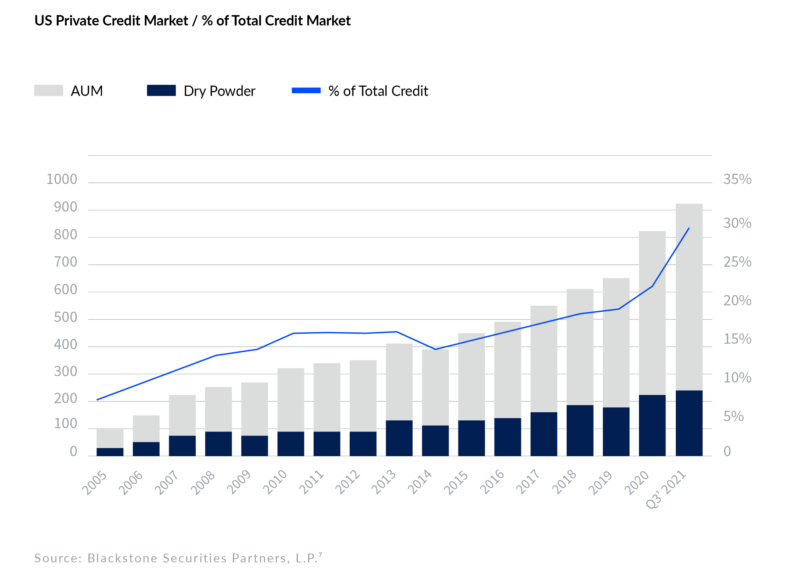

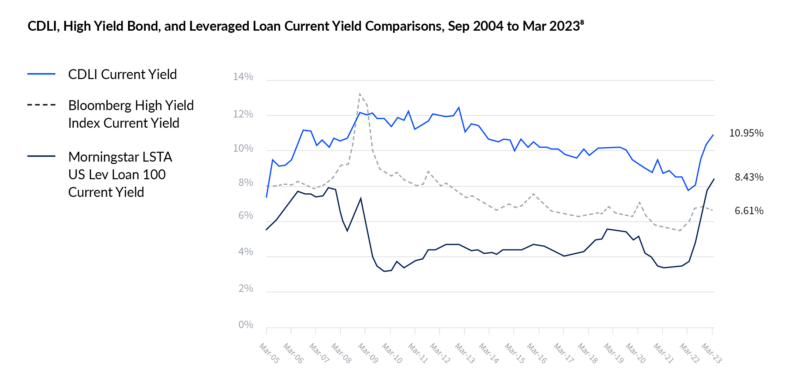

As a result of these trends, private markets and funds have experienced remarkable growth, gaining exposure to private companies through both private equity and private credit avenues. In recent years, the growth of private equity has gained a great deal of attention with private equity assets surging from $2T in 2013 to an impressive $4.4T in 2022.3 However, private credit has experienced even faster growth, with a 6x increase since the Great Financial Crisis to $1.2T as of 2022.4 The recent acceleration in private credit growth has also been boosted by the higher interest rate environment as the Federal Reserve has significantly raised short-term interest rates that act as the base rates for private credit yields. The recent higher “all-in” rates for private credit have made the private credit asset class more attractive.

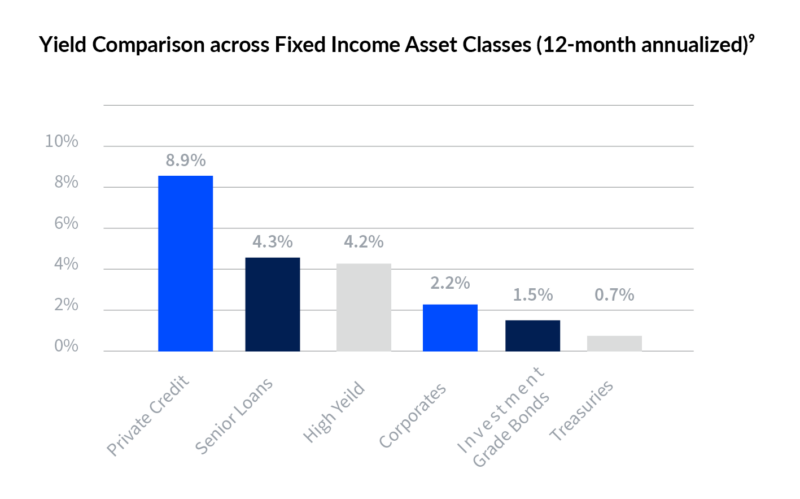

For investors, we believe private credit can play an important role in a client’s asset allocation. Not only can it provide increased safety by potentially ranking higher on the capital stack, sitting above equities in the case of bankruptcy, but it can also provide a higher potential yield than traditional fixed income, sometimes with lower risk in the form of covenants.

A key characteristic of private credit is that the funds themselves structure the credit deals. This is in stark contrast to traditional fixed income strategies that trade/invest in public market securities and must accept the debt terms that are outstanding. Because private credit funds hold debt that is structured by the fund itself, the funds tend to have far more in-depth knowledge of the underlying assets, and greater ability to influence the borrowers’ decisions.

Oftentimes for a private credit borrower, private credit is the first time the company has taken on debt, which enables the private credit lender/fund to “sit at the top of the capital stack”, or in the senior secured position. Senior secured creditors are typically paid off first and will likely be the last to experience impairment in the event of a negative credit event.

Most of the loans in private credit structures have a floating rate, meaning they are sensitive to where the Federal Reserve moves its overnight loan rate to. This is important to note because it is one of the features that we believe make it attractive in rising interest rate environments. The SOFR rate, or secured overnight financing rate, is a broad measure of the cost of borrowing cash overnight, backed by treasury securities, which was 5.30% as of 8/4/23.5 Typically, private credit loans are priced at a level above the SOFR rate (previously the preferred interest-rate benchmark was LIBOR) and the value of that spread is equivalent to the risk. Funds investing in private credit instruments will typically either pay out income as they receive it from the underlying companies, or they will aggregate and pay it regularly throughout the year (typically, quarterly).

With the benefit of higher yields, floating rate exposure, greater knowledge and control over deals, and senior secured positioning, we believe private credit does have multiple attractive merits versus traditional fixed income. The most notable tradeoff for private credit funds is that they tend to be illiquid, meaning private credit investors must plan to lock-up capital for multiple years in order to gain exposure to the asset class. While private credit funds can have shorter lives than their equity counterparts, it should be noted that they can still carry 8+ year lockups. Semi-liquid private credit funds are available but may be subject to early redemption penalties and “gates”, or limits on how much investors can redeem on a quarterly basis.

Risks of Private Credit

While higher interest rates and more investor protections are some of the key selling points for private credit strategies, there are also a number of risks in this asset class.

One of the greatest risks of private credit is born from infrequency of mark to market. If the marks are frequent, larger swings are unlikely and are usually caused by significant underperformance of positions. As long as the underlying companies maintain their performance, there’s typically no need for frequent valuation adjustments, which can lead to substantial price fluctuations during marking periods. Otherwise, volatility is virtually non-existent. Over the course of an economic cycle, we would expect private credit to only experience significant volatility in the face of distress at the underlying company level. While private credit does help protect investors in some ways, it does not protect against default or bankruptcy entirely.

Though illiquidity and valuations remain central concerns, numerous other risks also warrant attention. One particularly significant aspect is the fact that a substantial portion of companies resorting to private credit sources often lack access to conventional fundraising platforms. This could stem from various factors: being privately held, aiming to avoid the uncertainties associated with syndication (such as pricing adjustments influenced by loan sales), or merely lacking the essential fundamentals demanded by the market to appropriately value their debt offerings when engaging in fundraising activities. This is an advantage to private credit firms and a basis for why the fees in this segment tend to be higher than traditional fixed income managers. Generally, we look for these funds to charge between a 1% and 2% management fee and between 10% and 20% carried interest.

Furthermore, the lack of access to traditional funding markets is an indicator of potential risks as the companies that do have access to traditional markets tend to be of higher quality. Private credit lenders are often tied to private equity firms and their ability to create value. When the underlying companies are non-performing, the private equity firm may choose to write down their investment allowing or forcing the private credit firm to take ownership of the underlying company. This can add an additional risk tied to fund manager selection. By choosing managers that do not have expertise in running and resolving positions, a risk of total default and loss of principal is present.

While the benefits of investing in private credit in an environment like this are significant, it is important to consider the risks alongside the benefits. A higher rate environment may lead to higher interest payments but can also cause a higher default rate on loans.

Allocations to Private Credit

Depending on a client’s differentiated goals and risk tolerances, we believe there is a benefit to having a private credit allocation within certain portfolios. Not only can this allocation provide income to support lifestyle and provide a ballast against volatility of principal, but in the current market environment, it also allows investors to take advantage of rising rates and closed public funding markets. Private credit interest payments are paid out much in the same way traditional bonds pay out, with cash payments at regular intervals.

When we think about where private credit fits into an asset allocation, understanding the investor profile and his/her needs are the most important factors in determining how to balance a portfolio across private market allocations. We believe that private credit should consist of anywhere from 30%-50% of a private market allocation and should be balanced across various forms of private credit for diversification. Private credit can be thought of as an alternative to fixed income. It can provide a more protected and usually cash-based return, which can be used for further investments or non-investment uses. It differentiates itself from traditional private credit through infrequent marks to market and illiquidity of securities which are compensated for by higher yield and greater investor protections through structure. Private credit funds often sit next to traditional fixed income products in both their risk and return profiles, with the added consideration of illiquidity for private credit.

Comparing Private Credit Funds

We separate private credit into three parts based on liquidity and risk:

- More liquid and less risky strategies, like specialized and generalist business development corporations (BDCs).

- Draw down illiquid strategies focusing on providing credit in lower risk opportunities, such as lending to high quality sponsors and companies.

- Illiquid strategies where lenders focus on parts of the market with higher risk and commensurately higher payouts, like lending to companies with complex operations or financials.

Note that as funds become more liquid and less complex, returns both on a yield and absolute return basis tend to fall. As such, investors face a trade-off between liquidity/risk and potential return.

Direct Lending: Direct lending is primarily focused on providing loans to back private equity firms in their purchasing of companies. These transactions, often described as sponsor-backed in reference to the private equity buyer, come in many different forms. They can be drawdown funds, which are less liquid but provide more flexibility for the fund to see the full effect of their investments by never being forced to sell. There are also evergreen vehicles, which are more liquid and often have quarterly or annual repurchase windows, which in circumstances of increased redemptions can require managers to have to sell positions earlier than planned. These structures are also always open to investment at regular intervals, allowing the funds to grow rapidly in size. There are also funds that fall in between evergreen and drawdown in their liquidity terms, sometimes carrying a temporary lockup or a redemption penalty.

Large Lenders

- Larger funds tend to be more insulated from risk as they can lend to larger, better-capitalized companies and tend to have far more diversified portfolios. In addition, larger funds tend to have the leverage to create more protection for larger investments. These protections can come in the form of covenants, which are contractually obligated investor protections, as they enter transactions and have a greater ability to work with borrowers on potentials for default. Warrants can take the form of requirements for revenue, earnings before interest, taxes, depreciation, amortization (EBITDA), or net income, as well as requirements around the levels of indebtedness of the company. The recompense for violating covenants can be anything from default on the debt to a sweep allowing the lender to absorb cash flow.

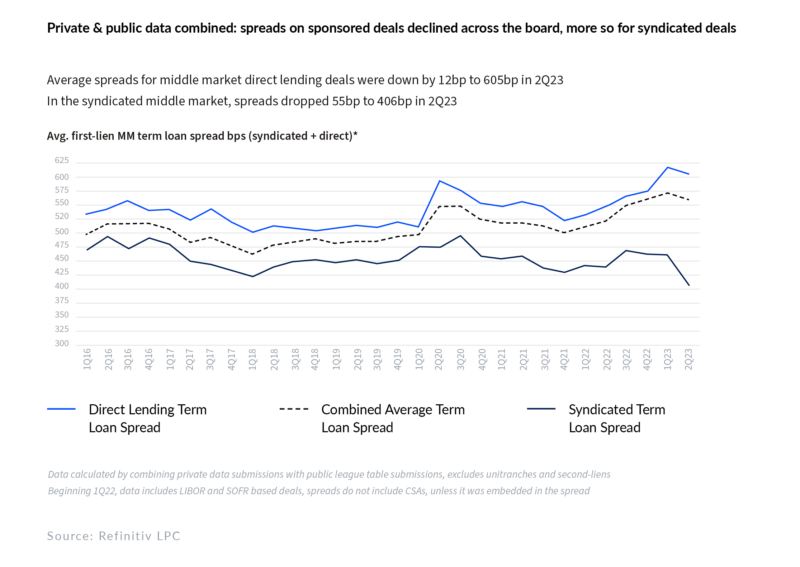

- However, there is always the risk of default. As with any other form of debt, there is a fine balancing act by private equity funds, who are the primary borrowers in this segment, between lending at high enough rates to be attractive to investors and reasonable enough rates that businesses can withstand the debt load without hurting growth or destroying value through overleverage. We believe sitting atop the capital stack has significant advantages. The senior secured lender is the first to be paid out in the event of a default. While the rates for senior secured lending are often lower than for subordinated lenders, the current interest rate environment has led to increasing concerns on defaults. With the current rates being offered to borrowers at anywhere from 450-750bps over SOFR, or a 100-200bps spread over where the syndicated bank loans are priced, the ability to cover those interest payments is diminishing which could lead to much higher rates of loss of principal which are far less likely for senior secured lenders.

- One kind of large lender is business development companies. BDCs look to make investments in various kinds of companies, often through debt or credit instruments. Qualifying as a BDC involves rigorous requirements that are regulated by the SEC. BDCs must have at least 70% of their assets in private or public U.S. firms with market values of under $250M. Further, much like real estate investment trusts (REITs), BDCs must pay out at least 90% of their taxable income to shareholders each year to qualify as a registered investment company and avoid additional taxes. For investors, this can be a more liquid way to get access to private and relatively illiquid markets through a regulated structure. In addition to increased liquidity, many of these structures come with lower minimums in line with those of many mutual funds and other ‘40 Act structures.6 The largest risk caused by these structures is volatility of principal as BDCs have frequent marks to market (daily for publicly traded BDCs). In weak market or economic environments, BDCs can experience market volatility far greater than their underlying portfolio loan fundamentals.

Small Lenders

- As large private equity firms have turned to private credit firms to fulfill the role that the bank debt market has traditionally played, the same goes for smaller firms and companies. The key difference here is that the risk profiles of these lenders are inherently different as they can mirror the challenges of the underlying companies. Lower and middle market companies are often operating in fragmented markets and focus on more niche areas of business. They can have idiosyncratic risks in addition to the general risk of not being able to grow and expand the business or being over-levered. While we call them smaller lenders, the fund sizes can still be considerable. The “small” moniker really comes into play for the size of underlying companies and therefore, the size of loans they are making. These funds often make loans as small as $10M.

Specialty Lenders

- Specialty direct lenders tend to focus on situations that can be riskier, more complicated, and more difficult to underwrite than traditional direct lending. These are the deals that many of the players in the previous two categories may have passed on due to the complicated nature of the loan structures. This category is considered the riskiest and thus has the potential for higher returns. These funds can include venture debt (our thoughts on which can be found here), as well as lending to highly distressed companies. Examples of these complex situations could result from operations across a wide range of geographies or geographies with difficult operating environments, companies that are in transition periods that may have become temporarily unprofitable, or even companies that are looking to sell off parts of their business and need bridge financing to continue operations. Each of these opportunities, while offering higher yields (potentially reaching upwards of SOFR + 800bps0 also carry the commensurate higher risks, reflected in the riskiness of the companies in need of the capital.

The Private Credit Market Today

As rates have risen and the syndicated loan market remains effectively closed, except for large, very safe deals, the opportunity for private lenders to provide needed capital has increased. Deal flow has grown substantially across private credit providers at all levels as companies and sponsors look for new funding sources and accept the stricter terms, both in terms of rates and covenants, put forth by the lenders. In addition, private credit has become a substantially higher percentage of the total credit issued and shows few signs of slowing.

We believe there are several key features that have made private credit more attractive in the past year:

- Pricing of private debt has risen drastically; not just as base rates have grown but also as expanding their premium to bank debt providers moving towards the upper bound of the 100-250bps range. This means private credit has been pricing at SOFR +500-900 bps.

- Reintroduction of financial covenants, which had been bid out in the prior low-rate environment. In a zero-rate environment, there was a constant downward pressure on yields and investor protections for creditors, as investors accepted less attractive terms in the reach for yield. As the rate environment has changed and liquidity has become tighter, we have seen the re-emergence of covenants like those around EBITDA and leverage multiples.

- The opportunity for rescue and distress financing has allowed for even greater protections and return potential as specialty creditors step in to either take over where traditional lenders have pulled back or to help provide bridging to more permanent financing and right siding of business models.

While the benefits of this environment are pronounced, they do not come without renewed risks:

- While rates have risen considerably, we have started to see the cracks caused by a full year of higher interest costs. Many companies and private credit investments that were underwritten in the low-rate environment are now starting to fail or see distress as they fail to meet their current obligations.

- The banking crisis caused by the failure of Silicon Valley Bank (SVB) failure had ripple effects throughout the industry. On a direct level, it limited or eliminated entirely the provisioning of debt to the earliest stages of businesses and financing to founders backed by their illiquid shares in their startups. The ripple effects, however, have also caused an overall tightening in the requirement of regional banks to make loans of any kind except for the highest quality and safest options.

- Private credit offerings, while having significantly more protection than their equity cousins, still have considerable risks. Positions are still not marked to market frequently and can be held at cost, leading to mismatches between true market value and fund marks.

Potential Implementation of the Strategy

In our pursuit to express our views on private credit and still incorporate the liquidity needs associated with such investments, we have carefully selected and approved two BDCs for our platform that we believe are strong ways to manifest our favorable view of private credit.

Blackstone’s Private Credit Fund (“BCRED”)10, is a diversified private credit portfolio that provides “beta”, or market exposure, to private credit. The vehicle is very large with more than $47.7B in investments and is significantly rate sensitive with ~98% of the portfolio being floating rate loans. The current annualized yield, paid monthly, is 10.1% in Class I.

- The three largest sector weightings in order are Software, Professional Services, and Healthcare, which make up 26%, 12%, and 12% of the portfolio, respectively. 89% of the portfolio is first lien senior secured, meaning it sits at the top of the capital stack and is the most protected.

- Liquidity is a potential consideration when investing in BCRED. It has an investor level gate that limits repurchases to 5% per quarter (either by number of shares or aggregate NAV). Up to that level, all investor requests will be met and after the 5% total is reached, investor requests are met pro rata. In addition, shares held for less than one year and tendered for repurchase will be repurchased at 98% of NAV.

Blue Owl Core Income Corp (“OCIC”)11 is a subsidiary of Blue Owl, a leader in GP solutions across real estate and private markets. Blue Owl’s Core Income Fund is a BDC, which focuses specifically on lending to leading sponsors for their acquisitions of companies through leveraged buyouts. Blue Owl, as a leader in the GP stakes space, has a unique vantage point to help choose deals and organize a more rigorous due diligence process. This is a far more targeted strategy and smaller vehicle with $10.3B in AUM and 90% of the portfolio being senior secured instruments. A key differentiator that separates this strategy from others is the quality of the borrowers and the backers for those companies. These loans sit atop the equity private equity firms that take on the portfolio company level.

- We believe OCIC is a less risky investment than some of its BDC peers. Given the private equity backing, they have a far more specific mandate and focus on taking risks only at the lowest end of the spectrum.

Special Situations

- Piney Lake is a specialty direct lender.12 They structure their loans like many BDCs but in a part of the market that is considered too risky for most managers. Piney Lake’s ability to reach down into these more complicated and potentially “hairy” (greater distress or uncertainty) scenarios primarily stems from CIO Michael Lazar’s experience in workouts and the firm’s focus on underwriting to the worst-case scenario, a takeover, at the outset of their process. We like Piney Lake as an addendum to a core private credit allocation. The portfolio and risk profile are such that the yields are much higher, around 12.5% presently. They have also built in a significant total return uplift through warrants and similar structures.

For more information, please reach out to your financial advisor.

SOURCES

1 McKinsey & Company

2 TheGlobalEconomy.com

3 Ernst Young

4 Goldman Sachs

5 Federal Reserve Bank of New York

6 A ’40 Act structure is a pooled investment vehicle offered. by a registered investment company as defined in the Investment Company Act of 1940 (commonly referred to as the ’40 Act).

7 Blackstone

8 Cliffwater

9 Blackstone

10 All data provided by Blackstone as of 6/30/2023.

11 All data provided by Blue Owl as of 6/30/2023.

12 All data provided by Piney Lake as of 6/30/2023.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC