Moving eight miles a minute for months at a time,

I began to find myself searching

Searching for shelter again and again,

I’m older now but still runnin’ against the wind

“Against the Wind” – Bob Seger

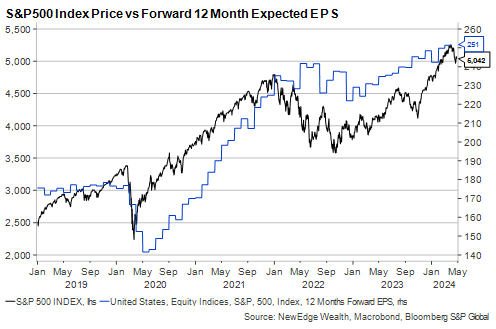

An aging economic cycle and equity markets that are facing renewed headwinds make Bob Seger’s 1980 classic a fitting analogy for this week’s Weekly Edge, where we are taking stock of the current U.S. equity earnings season. Recent volatility aside, U.S. equities have produced a historically strong run of performance over the past five months, with the S&P500 notching a 26% total return from the end of October through the end of March and posting the best first quarter since 2019.

Equity market performance has been driven by continued momentum among a handful of mega cap AI leaders, but also by a healthy broadening across index constituents. Broadening of performance is typically a bullish indicator, which has come despite renewed upward pressure on inflation, escalating geopolitical tensions, and overall a less supportive trajectory for both monetary policy and interest rates. As the last few weeks have demonstrated, investors are more on edge today and the shelter of a solid earnings season will be key if equity markets are to build on recent performance.

Where We Stand

The U.S. equity first quarter earnings season kicked into high gear this week, with 37% of the S&P500 market capitalization reporting results. The stakes are high this season as U.S. companies are up against lofty expectations, valuations that have front run expected earnings growth, and despite resilient economic activity, an overall climate that continues to present challenges to corporate profitability. Navigating these challenges will be key if markets are to regain their footing and continue “running against the wind.”

At this point, with roughly half of the index market capitalization having reported, our view is that this earnings season has once again been better than expected. As of early April, consensus expectations were for flat Q1 YoY earnings growth and 3% YoY revenue growth, representing a substantial decline from the mid-single digit growth rates in Q4 and illustrating renewed pressures on profitability. As of Friday, reported data and consensus expectations now point to 4% earnings growth and 4% YoY revenue growth. In addition, both the number of companies beating estimates (81% vs a 74% average over the past 10 years), and the magnitude of earnings beats (7.8% vs 6.7% average over the past 10 years), are indicating healthy momentum.

Narrow Leadership Continues

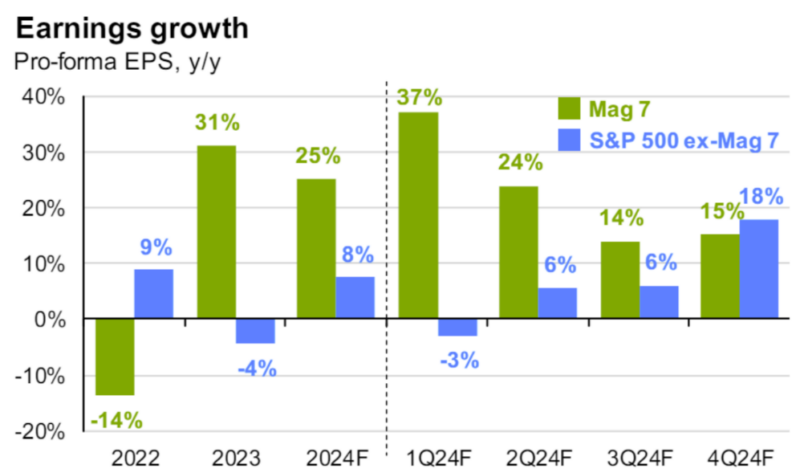

One theme that has held constant over the past several quarters and is continuing this quarter is the earnings leadership from the largest index constituents, in particular, the group of companies dubbed the “Magnificent Seven”, many of which are viewed as leaders in today’s AI ecosystem. While Tesla and Apple are relative earnings laggards, as a group, these stocks (which also include Microsoft, Amazon, Alphabet, Nvidia, and Meta) are expected to post aggregate YoY earnings growth of 37%, accounting for more than 100% of the S&P500 index earnings growth for the quarter. Excluding this group earnings growth for the other 493 companies would be -3% YoY.

As the chart below illustrates, this trend is expected to come into balance later this year as YoY comparisons get tougher for the Magnificent Seven, and comparisons get easier for the rest of the index constituents, who at the same time may benefit from incremental monetary easing and a modest acceleration in global economic growth (though it remains to be seen if both of those conditions can or will happen at the same time).

Earnings results this week from Microsoft, Alphabet, and Meta provide further evidence of this dominance, as these companies all posted better than expected results, averaging 60%+ earnings growth as a group.

These results were largely fueled by demand for AI infrastructure and cloud computing, but also healthy growth in more economically sensitive business segments like advertising. Microsoft and Alphabet both logged healthy share gains following their reports, however Meta fell 11%, mainly due to concerns around elevated capital expenditures in the coming quarters, which the company believes is necessary in order to maintain their competitive positioning in the AI arms race.

All in, the solid fundamental performance from mega cap names provides some of the shelter equity markets were looking for, although it’s clear that disciplined capital allocation continues to be favored by investors in the current environment.

Sector Level Trends

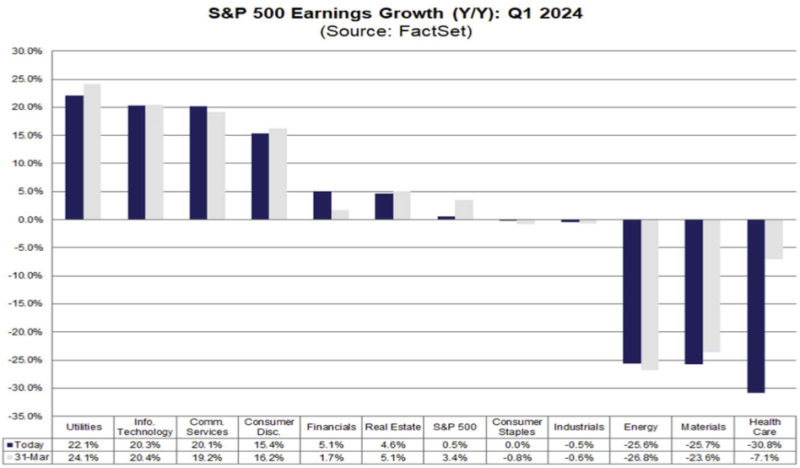

At the sector level, we are once again seeing a wide dispersion in earnings growth, with the Utilities, Technology, and Communications sectors all on pace to post over 20% earnings growth YoY. These results are helping to offset continued weakness in the Energy, Materials, and Healthcare sectors, all three of which are on pace to post more than -25% earnings declines YoY.

Healthy earnings growth in the Utilities sector is being driven largely by power producers, who are benefitting from upward pressure on prices, ultimately the result of increased energy demand and a strained electric grid across the country.

Meanwhile, the Communications and Technology sectors are on pace to post their third consecutive quarter of double-digit earnings growth, boosted by a recovery in advertising revenues, enterprise spend on cloud computing, and continued robust demand advanced semi-conductors. Nvidia and Meta alone account for more than half of their respective sectors’ total earnings growth for the quarter, underscoring the earlier point about the concentration of earnings contribution.

Of the sectors seeing the largest earnings declines in Q1, Healthcare stands out as one that has thus far posted results that are substantially worse than expected or where analysts have considerably reduced their expectations, from -7% YoY growth a few weeks ago to -30% YoY growth today. This is largely a function of sluggish pharmaceutical sales (aside from GLP-1 drugs), funding challenges weighing on biotech innovation and pipeline advancements, and renewed cost pressures on healthcare service and equipment providers. All these factors have resulted in the sector posting its lowest net income margin in over a decade.

One sector that has provided encouraging first quarter results has been Financials, which were among the first to report and have thus far posted aggregate earnings growth of 9% YoY, exceeding total estimates by 8%, and generating their best quarter of profit growth in over two years. In general, the country’s largest banks continue to benefit from elevated net interest margins and diligent capital allocation, while recently surging capital markets have helped fuel a recovery in debt and equity issuance, increased trading volumes, and a pickup in M&A activity.

Guidance & Profitability Trends

While the first quarter earnings results have illustrated better than expected trends, forward guidance is often the most dissected factor, and given how back end loaded earnings growth expectations are for this year (near double digit growth for the remaining three quarters for the S&P500), investors are highly tuned in to both revisions to guidance and management commentary. As of this week, more than half of index constituents have issued fiscal year 2024 guidance, and we find a roughly 50/50 split between those that have provided positive revisions to those that have provided negative revisions. Negative guidance is currently running below the 10-year average of 63%, suggesting a slightly more upbeat view from corporate management teams, and indicating that full year analyst expectations may not be overly optimistic.

The Path for Margins

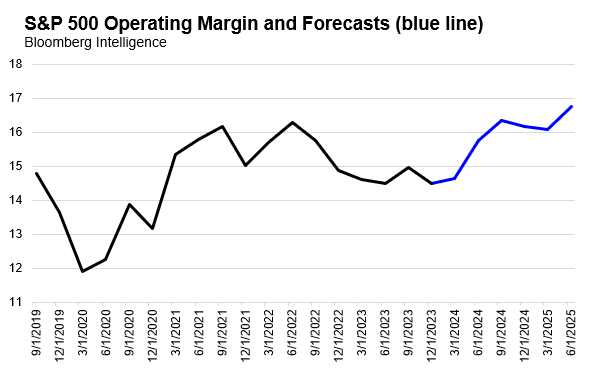

In order to meet these full year expectations, margin expansion will be key, especially if economic activity slows as a result of higher for longer interest rates. For the first quarter, consensus expects to see overall index level operating margins hold steady from the prior quarter at 14.6%. This level of profitability remains at the lowest levels since late 2020, but the fact that it is not deteriorating further suggests margins may be troughing. In fact, 6 of 9 sectors that report operating margins are expected to post a sequential improvement from the prior quarter, led by the more input price sensitive and labor-intensive industries of Utilities, Materials, and Consumer Discretionary.

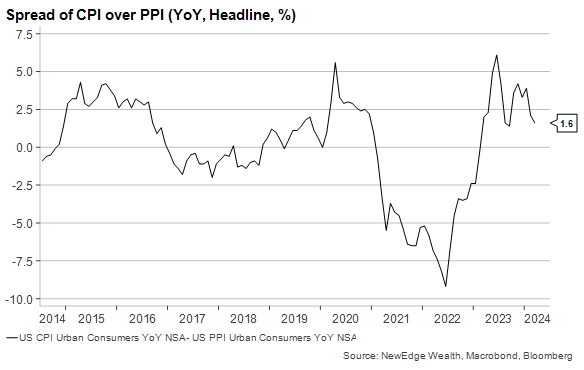

We are starting to see a more balanced labor market lead to slowing wage growth, while a persistent positive spread between consumer price and producer price inflation is beginning to act as a favorable tailwind to overall corporate profitability. This spread between CPI and PPI registered 1.4% in March, down from 3% a year ago, but representing 13th straight month above 1%. This is a heathy level that has historically led to operating margin expansion over the subsequent 12 months, as companies may be able to increase prices without the same degree of input cost inflation.

Closing Thoughts

Overall, we are once again encouraged by a better than expected first quarter earnings season, which provides greater confidence in the ability of companies to broadly deliver on full year expectations (which remain back-end loaded, with a big inflection in growth expected in 4Q24; this is a watch item for the coming quarters). While index and sector level results continue to be driven by a narrow subset of companies and price reactions have been mixed, we are seeing healthy trends under the surface. Both the percentage of earnings beats and the magnitude of earnings beats suggest analyst expectations were more conservative than warranted in today’s environment, meanwhile profitability trends are heading in the right direction. All of which suggests that full year earnings growth estimates of $243 per share or 9% YoY growth are achievable, and that equity markets can continue their ascent despite the prevailing macro headwinds.

IMPORTANT DISCLOSURES

Abbreviations/Definitions: AI: artificial intelligence; CPI: Consumer Price Index; PPI: Producer Price Index

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC