Weekly Summary: November 8 – 12, 2021

Key Observations:

- Stronger than expected U.S. Consumer Price Index (CPI) and a “disappointing” 30-year Treasury auction dramatically lift interest rates and partly reverse yield curve flattening. Data (fundamentals) “win.”

- Consumer inflation expectations rise along with uncertainty about inflation. Consumer sentiment and real wages decline.

- Inflation vs. unemployment, risk vs. reward, Powell vs. Brainard judgement.

- We expect more volatility and uncertainty if Brainard is nominated as Federal Reserve (Fed) chair. Therefore, we believe that financial market preference should be for Powell to “stay.”

The Upshot: We believe that a more “rational” bond market prevailed mid-week. Inflation data in the form of CPI was just too compelling to ignore. We anticipate that rising consumer inflation expectations will lead to more-persistent and higher inflation. To what extent will the Fed risk higher inflation expectations becoming more entrenched in the hope of lowering the unemployment rate? To what extent is a higher than pre-pandemic unemployment rate becoming more “structural?” We believe that Brainard would be more inclined to risk a more entrenched consumer expectation of higher inflation.

Powell or Brainard?

In general, we believe that financial markets should prefer that Powell remains as chairman of the Fed. Perhaps this message could be most effectively conveyed to President Biden by Rihanna: we “want [Powell] to stay.” We know you’re going “round and around and around…[you] go,” about whether to nominate Lael Brainard – one of seven members of the Board of Governors of the Federal Reserve System (appointed for fourteen year terms) – as Fed chair instead of Powell. However, we really think that Powell should “stay” as chairman. Brainard was appointed by President Obama in 2014 and is the only registered Democrat on the Board. Besides the Fed chair position, President Biden will have three other open seats to fill.

Bond and Equity Volatility

As we indicated in last week’s commentary, the world’s bond markets are very closely linked and their day-to-day movements can be due to many factors other than ‘fundamentals.” The extreme volatility of the U.S. Treasuries of the past few weeks appears to have finally “spilled over” into equity volatility.

Non-Fundamentals Influencing Bond Markets

Many market participants, including ourselves, believe that the specific days over the past couple of weeks that were characterized by lower Treasury yields were mostly due to “non-fundamental” factors. These factors included extreme one-way positioning in the bond markets and expectations that yields will rise. A more recent reason appears to be the markets’ perception of the increasing probability of a Brainard nomination. In a November 9 story, Bloomberg reported that Brainard was interviewed to be Fed chair at the White House the previous week. Brainard is generally perceived to be more “dovish” than Powell, and, therefore, more likely to maintain easy monetary policies and to further delay the onset of rate hikes.

U.S. CPI

Mid-week the U.S. Labor Department released its CPI figures, which greatly exceeded expectations. Many measures were at multi-decade highs. Energy, shelter and vehicle costs led the inflation increases. Inflationary pressures appeared to be broad based. Although not part of its core inflation measures, the CPI report indicated that gasoline prices rose by 49.6% in October year-over-year. According to a CNBC report on November 10, consumers’ inflation expectations have been closely tied to gasoline prices.

Source: Citi, US Economics – CPI can see inflation is not transitory, but will the Fed? 911/10/2021)

Source: J.P. Morgan, US: October CPI is above expectations with another big month for rents (11/10/2021)

China PPI

China’s record setting October increase year-over-year in its Producer Price Index (PPI) might finally be peaking. However, considering China’s characterization by many as the “world’s factory,” we believe that its PPI increase still might exert upward global inflationary pressures. As Citi Research observed on November 10, China’s PPI might even have started to affect its own CPI measures in October as it increased by almost twice its September pace and was the fastest pace since September 2020.

Source: Citi, China Economics – Stagflation Concerns to Ease with PPI Inflation Around the Peak (11/10/2021)

Fundamentals Reasserted in Bond Markets

The latest inflationary data specified above evidently was able to finally overwhelm the non-fundamental bond market moves, and has pushed up Treasury yields mid-week. But this dramatic rise in Treasury yields was also greatly assisted by a very disappointing 30-year Treasury bond auction that same afternoon, which required an unexpected increase in the yield offered before those bonds could be sold. On November 10, J.P. Morgan (JPM) characterized this auction as, “one of the worst … in history.” JPM also remarked that the abrupt upward moves in U.S. Treasury yields were instrumental in the USD increasing by close to 1%, which was the largest positive absolute USD move since March 19, 2020.

Fundamentals According to Whom?

It was not surprising that abrupt market moves can occur when “reality” is not coincident with financial market levels. This brings to mind Powell’s explanation in his November 3 press conference when he indicated why the Fed’s taper was earlier and faster than they had expected. To reiterate Powell’s statement from our commentary of last week, his exact word were, “because policy was adapting to reality.” It is our belief that ultimately financial markets will reflect reality and/or fundamentals. But that of course begs the question, “What are the fundamentals, really?” Opinions will and do differ. Our short answer is that in the end, all we have to “go on” is whatever the latest data indicate.

What Type of Inflation?

This leads us back to the continuing debate of the persistence and the level of inflation. We have stressed for many months our working hypothesis that inflation would be more persistent and higher than most assumed. So far, so good. Now what? Among factors that would support continuing persistent inflation are increasing wage pressures and their pass through to the consumer, such as increasing prices of restaurant meals, as well as tight labor markets, “sticky” nature of strong shelter prices, energy and commodity shortages, normalization of airfares, apparent pricing power of many companies – especially the larger ones – and other factors. On the other hand, among factors that point to a lessening of inflationary pressures, are some indications that supply constraints might be lessening. These indicators include increasing auto sales last month in both the U.S. and Europe in spite of still remaining semiconductor shortages, and a drop in some shipping costs as most recently exemplified by the Baltic Dry Index (BDI). This index provides a benchmark for the price of moving major raw materials by sea. CNBC reported on November 10 that this index had declined by about 50% from its October 7 level to a level not seen since June. It should be noted that although shipping is an important source of bottlenecks, it is only one of many possible supply constraints that drive many extended delivery times.

Source: Goldman Sachs, Global Markets Analyst – Top Ten Market Themes for 2022: From a Sprint to a Marathon (11/9/2021)

Inflation Expectations and More Uncertainty

Inflation expectations and wage gains are critical components of more persistent types of inflation. The October Survey of Consumer Expectations (SCE), which is sponsored by the Federal Reserve Bank of New York and was released on November 8, is yet another survey that shows consumer inflation expectations are continuing their ascent. The median inflation expectations increased by 0.4% to 5.7% over a one-year horizon, which is a record high since the series started in June 2013. Inflation expectations over the next three years remained at 4.2%. Consumers’ uncertainty rose along with their heightened expectations. The difference between the 75th and the 25th percentiles of inflation expectations reached new series highs for both one- and three-year expectations. This phenomenon of increasing uncertainties with regard to inflation is widespread and growing among central bankers, investors, analysts, etc. Given the diversity of inflation expectations, we believe that most consumers will act like inflation will continue higher and be more persistent. This will further increase inflationary pressures. In contrast, even as many central bankers are becoming more uncertain about the future inflationary trends, they continue to resist a more persistent inflation scenario. The SCE is a nationally representative internet-based survey of a rotating panel of approximately 1,300 household heads.

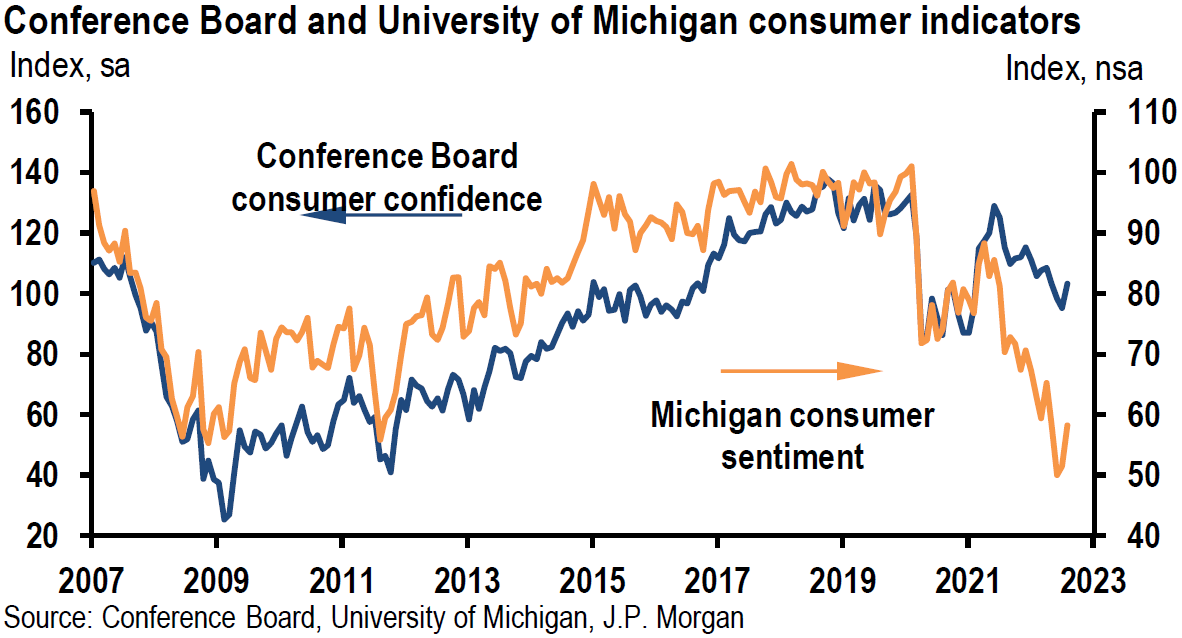

Lower Consumer Sentiment and Real Wages

Alongside with the increasing uncertain, but higher, inflation expectations, consumer sentiment appears to be sliding as impressive wage gains have failed to keep pace with inflation. According to the Labor Department’s November 5 report, real wages declined by 0.5% in October and by 1.2% over the past year. On November 10, CNBC quoted Joseph A. LaVorgna – chief economist for the Americas at Natixis – about the topic of negative real wage growth: “This is why when you look at consumer confidence, it’s really taking a beating. Households do not like the inflation story, and rightly so.”

The November 12 release of the surprisingly poor preliminary results of the University of Michigan’s consumer sentiment indexes confirmed the accelerating decline in Consumer Sentiment. The overall Consumer Sentiment reading in November dropped to 66.8, compared to October’s reading of 71.7 and an expected reading of 72.4. This was the lowest reading since November 2011. Both the Current Economic Conditions Index as well as the Index of Consumer Expectations registered dramatic drops. The latter declined to 62.8 from the previous reading of 67.9. The report attributed the decline of sentiment “to an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation…. Rising prices for homes, vehicles, and durables were reported more frequently than any other time in more than half a century.” Inflation expectations for the year-ahead increased to 4.9% from 4.8% previously. The five-year inflation expectations remained at 2.9%.

Risk/Reward – Inflation vs. Unemployment

We understand the Fed’s reluctance to adopt a less restrictive monetary stance. Powell has made it very clear over time that his ultimate goal is to maximize employment, which he believes would help alleviate income and opportunity inequalities. But given the persistence and increasing levels of inflation and the stubbornly low level of participation rates, the risk/reward of maintaining a very easy monetary policy should be increasingly questioned and scrutinized. Declining consumer sentiment is an indication that consumers are being adversely affected by higher inflation. Low participation rates may indicate that there is a structural impediment to reducing the unemployment rate back to pre-pandemic levels. Where should the balance be struck? Should we hurt the many in exchange for the possible benefit of the apparently diminishing number of unemployed who want to be employed? This obviously is a very difficult judgment call. As specified in our weekly of November 5, we believe that the Fed knows that it is behind the curve and will most likely end its taper program more quickly than many analysts and investors anticipate. The Fed would then be in a position to start hiking rates.

Possible New Approaches if Brainard Fed Chair

But this all changes if President Biden chooses Brainard over Powell for the Fed chair position. As we stated above, Brainard is generally considered to be more dovish than Powell and most likely would maintain an easier monetary policy stance relative to Powell’s position. Luckily, Brainard has provided some indications of how her policies might differ from Powell’s. On May 6, 2021, Fed Governor Lael Brainard, in an introductory statement to the Fed’s Financial Stability May Report, indicated that she was prepared to consider tools such as the Countercyclical Capital Buffer [CCyB] “to address risks to financial stability and enable monetary policy to focus on its maximum employment and average inflation goals.” Translation – Brainard will further regulate large banks, increase their capital and reserve requirements, which will at the margin possibly restrict their ability to lend towards helping to grow the economy. The CCyB is an adjustable capital requirement imposed on large banks over and above existing capital requirements. Brainard believes that the CCyB would counterbalance risks associated with low interest rates, which could contribute to asset price bubbles that could raise risks to financial stability.

Brainard – Climate Change as Financial Stability Risk

Brainard has been focused on risks to the U.S. financial system with respect to climate change for quite some time. Brainard focused on these issues in her November 2020 Statement, which accompanied the Fed’s Financial Stability Report of that month. Brainard also focused on climate change in an October 7, 2021, speech at a stress-testing research conference. “As part of our prudential and financial stability responsibilities, we are developing scenario analysis to model the possible financial risks associated with climate change and assess the resilience of individual financial institutions and the financial system to these risks,” Brainard stated. In general, it appears that Brainard would adopt a tougher stance on bank regulation, which of course would please Senator Warren.

Brainard – Reasserting Forward Guidance Policy? Increased Volatility

It is our opinion that the financial markets would become more volatile and even less predictable if Brainard becomes Fed chair. This assumes that she will in fact adopt a more dovish approach, which would put the Fed even further behind the curve. The use of CCyB in lieu of raising rates to rein in potential financial instability is an untested approach. The fact that this approach would even be considered indicates to us that Brainard would be willing to “live with” increased risks of financial instability to achieve her goals. Given her stance on the possible use of CCyB and her focus on climate change as another potential source of financial instability, it is our contention that bank regulation would become stricter and would cause banks to increase their purchases of Treasury securities. At the margin, all this would help keep downward pressure on interest rates.

Data Wins in the End

As we indicated in our previous weekly, we believe that the “forward guidance” policies of central banks are no longer viable policies. The financial markets have helped push central banks to become more data dependent. To the extent that Brainard would resist a data-dependent approach and delay raising rates for longer than a Powell-led Fed would do, the risks would increase that a more aggressive monetary ”tightening” approach might be necessary at a later date, which would more aggressively slow economic growth. The tug of war between economic data, market forces and Fed policies would become more unpredictable and would lead to greater volatility. In other words, we believe that financial markets should prefer that Powell remains Fed chair for another term.

Bottom Line

We maintain our stance that inflation will continue to persist well into 2022 at an elevated level. Even Powell appears to have moved closer to our assessment of inflation as he indicated in his November 3 press conference his expectation that strong inflation numbers most likely will persist into the second or third quarter of next year. The financial market reactions to the better-than-expected U.S. October CPI data clearly demonstrate that fundamentals, in fact, do matter. We also remain optimistic that global economic growth will continue to be robust well into 2022.

It appears that many central banks, including the Fed, are more willing to express their uncertainty in regard to inflation and economic growth rates. As revealed in the New York Fed’s latest survey, the dispersion of consumers’ inflation expectations would seem to corroborate this uncertainty. The current composition of the Fed appears to finally accept that it should be increasingly “data dependent” in its determination of monetary policy.

Based on Brainard’s history and public statements, we believe that she would tend to be less data dependent in her policy decisions. We believe that this would exacerbate uncertainty and create more financial market volatility. If adopted, a more dovish approach would leave the Fed further “behind the curve.” We believe that market sentiment would then begin to factor in a more aggressive and a more abrupt end to very easy monetary policies. This could bring about a sharper deceleration in economic growth rates than would otherwise be the case. We anticipate that this scenario would make navigating financial market a considerably more difficult challenge. Therefore, we think that financial markets should prefer that Powell would “stay” as Fed chair.

Based on our assessment of the possible policy differences between a Powell led Fed compared to a Brainard led Fed, our base case remains that Powell will “stay” as Fed chair. Our investment stance therefore remains unchanged.

Source: Goldman Sachs, Global Markets Analyst – Top Ten Market Themes for 2022: From a Sprint to a Marathon (11/9/2021)

INDEX DEFINITIONS

KBW Nasdaq Bank Index (BKX): The KBW Bank Index is designed to track the performance of the leading banks and thrifts that are publicly-traded in the U.S. The Index includes 24 banking stocks representing the large U.S. national money centers, regional banks and thrift institutions.

MSCI EM Value Index: The MSCI Emerging Markets Value Index captures large and mid cap securities exhibiting overall value style characteristics across 27 Emerging Markets (EM) countries.

MSCI EM Index: The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries.

NASDAQ: The Nasdaq Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange.

PCE: Personal Consumption Expenditures (PCEs) refers to a measure of imputed household expenditures defined for a period of time.

Russell 1000 Growth: The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted and historical growth values.

Russell 1000 Value: The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

S&P 500: The S&P 500 Index, or the Standard & Poor’s 500 Index, is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S.

VIX: The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options.

Z-Score: A Z-score (also called a standard score) gives an idea of how far from the mean a data point is. It is a measure of how many standard deviations below or above the population mean a raw score is.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC