“Everybody dance!” – Good News on Jobs is Good News for Investors

The first Friday of each month brings with it new information about the single most important piece of economic data anywhere in the world: the state of the U.S. labor market. Inflation held this title for a few years before price pressures rapidly receded. Investors and central bankers alike are back to poring over monthly payroll gains and stressing about tiny changes to the unemployment rate.

For those not familiar with the Christopher Guest classic, Waiting for Guffman, the film’s lovably pathetic protagonist, Corky St. Clair, inspired all the section header quotes in this article. His theatre production never did get the $100,000 he asked the Blaine Town Council for, nor did the titular critic, Mr. Guffman, ever turn up to watch it. But investors did get the news on jobs they were hoping for this week, and the corroborating data we’re waiting for will show up on schedule next month. We just don’t have a great idea, even after the strong September reading, what it will say or how investors and policymakers will react to it (much like the townspeople watching Corky’s “Red, White, and Blaine” for the first, and last, time).

“Wow…Really!” – A Blowout September Jobs Report

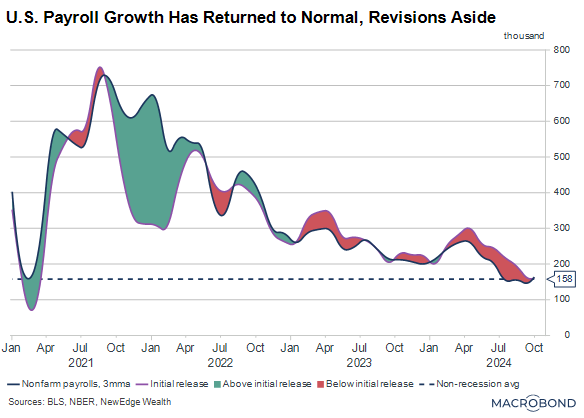

Still hot off the press, the September report shocked investors and economists alike with its unexpected strength, coming in at 254k vs. 150k consensus. The unemployment rate fell to 4.1% (nearly 4.0% given it was rounded up from 4.051%), while average hourly earnings growth over the past year rose to 4%. And, unlike other recent reports, revisions to prior months were strongly positive, adding 72,000 jobs to the total tally.

Revisions to prior employment reports are quite common and can be positive or negative. A combination of monthly and annual revisions has brought down total job creation over the past year compared to the initial estimates.

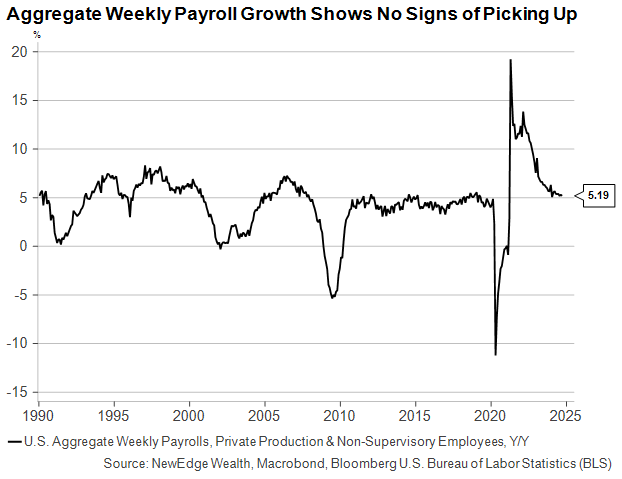

Importantly, despite impressive job gains in September, there is little reason to fear an overheating labor market is about to reignite inflation. The chart below shows aggregate payroll growth, which includes hours and wages in addition to net job creation, is coasting to a soft landing. A reacceleration here would indicate a tightening labor market and the possible return of high inflation. However, a glidepath down to levels comparable to the 2010s is hardly a harbinger of coming price pressures.

“You’re forcing me to do something I don’t wanna do.” – Jobs Are Driving Fed Policy Now

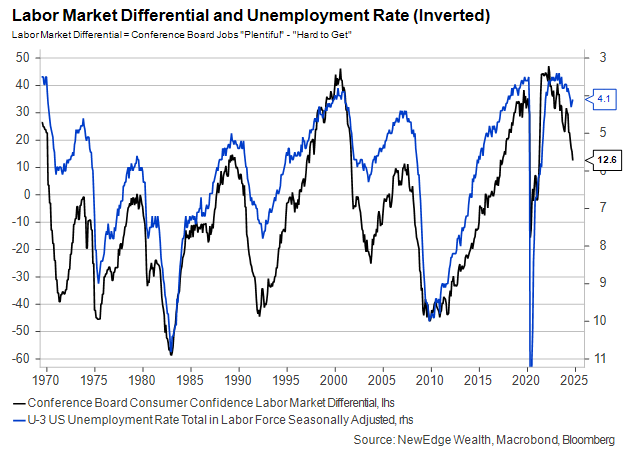

The Fed’s primary concern looking forward is that the labor market, which has cooled to a “normal” temperature, will cool further heading into 2025. Unfortunately, the full breadth of data is not currently giving us a clear reading as to how worried the Fed and recession watchers ought to be.

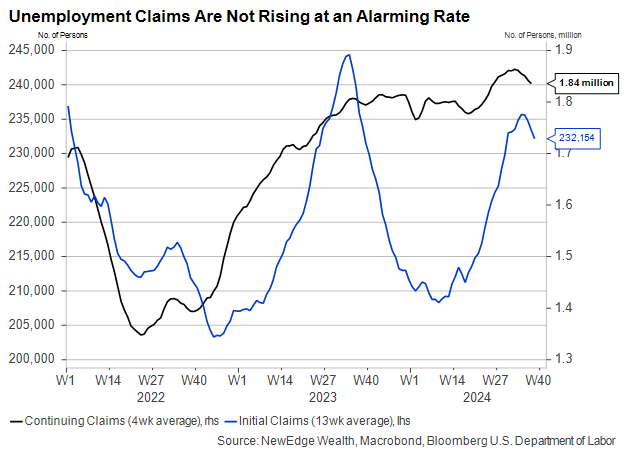

Optimists can point to the subdued – indeed, falling – level of initial and continuing claims for unemployment insurance. Initial jobless claims are a leading indicator of the labor market, albeit not one that provides particularly long notice about coming changes.

The number of people collecting unemployment insurance is higher than it was a year ago, but only by about 2%. This is consistent with data showing that finding work has become harder, even though layoffs remain relatively rare. But because people just entering the labor force are not eligible for unemployment insurance (because they haven’t been laid off), jobless claims could be understating the difficult that many workers, especially younger ones, are having finding open positions.

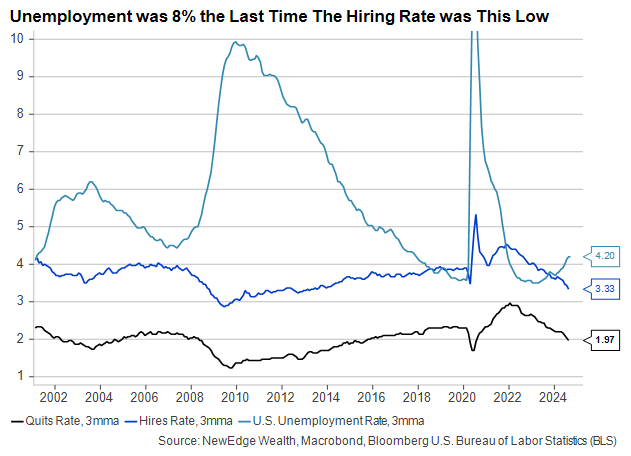

For pessimists, this slow rate of hiring has become a significant source of concern. It is currently the lowest it’s been since the mid-2010s when unemployment was close to double what it is today.

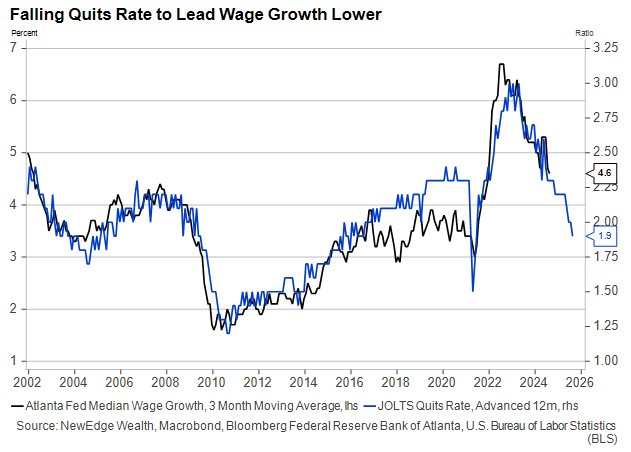

Lower hiring rates tell us that the labor market is softening from the employer’s perspective, and falling quit rates corroborate this view from the worker’s side. Economists have started to dub this period “The Great Stay” with very few workers entering or leaving new jobs. Such an environment is unlikely to constitute a stable equilibrium, however, and the next change in trajectory for growth will determine whether layoffs begin or hiring resumes.

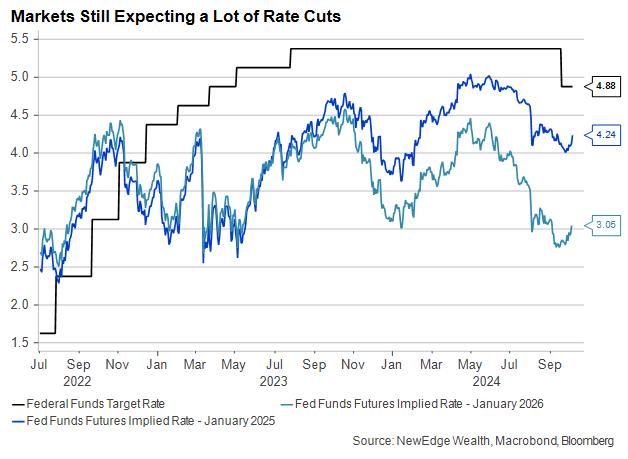

Monetary policy is largely reactive to employment data, and the September employment report should set the Fed to cut rates in November by 25bps instead of the 50bps reduction it made last month. However, expectations for further rate cuts from the Fed and its peers in Europe could serve as a floor for employment expectations.

The prospect of lower capital costs and, eventually, a stronger economic environment ahead may not be enough to stir new hiring and investment in 2024 (particularly with an election looming), but they could be enough to delay downsizing plans and spark optimism for a return to hiring in 2025. The cause-and-effect arrows go both ways between interest rates and job growth.

Futures markets still expect a lot of rate cuts from the Fed through the end of 2025, and the Fed’s own forecasts align with this pricing. However, a string of strong employment reports could lead to a reevaluation of that view.

A combination of faster working-age population growth and surging productivity has allowed the economy to run at a faster clip despite higher interest rates. Should these conditions endure, it could limit the extent to which the Fed can – or needs to – reduce interest rates to ward off further weakness.

We may simply be living in a world, for now, in which the current level of rates represents only a mild headwind for economic activity, not a recessionary threat. The problem with trying to estimate where “neutral” policy might be, however, is that you never really know where it is until you’ve been there for a while.

“This is my life we’re talking about here.” – A Softer Outlook for Wages

Our investment outlook for 2025 hinges on where we see the state of the labor market – and, by extension, consumer spending. Consumer sentiment polls are lining up with falling quits and hiring rates, with more respondents saying it’s getting harder to find a job.

With more workers feeling locked into their current positions, the outlook for wage growth in 2025 is not encouraging. The Great Stay should lead to smaller pay increases over the next year, as the graph below of Quits and Wage Growth strongly indicates. This limits the degree to which price inflation (another lagging indicator) is likely to rise, but both are a symptom of slower growth.

For every indicator, like falling quits and hiring rates, that hints at a weaker labor market in 2025, we see one – like subdued initial jobless claims – pointing in the other direction. The key variable to watch in the coming months will be the unemployment rate, which is up significantly from its 2023 lows but has ticked down in each of the past two months. Further weakness in hiring could cause it to resume its rise, but it is unlikely to spike higher in the absence of outright layoffs.

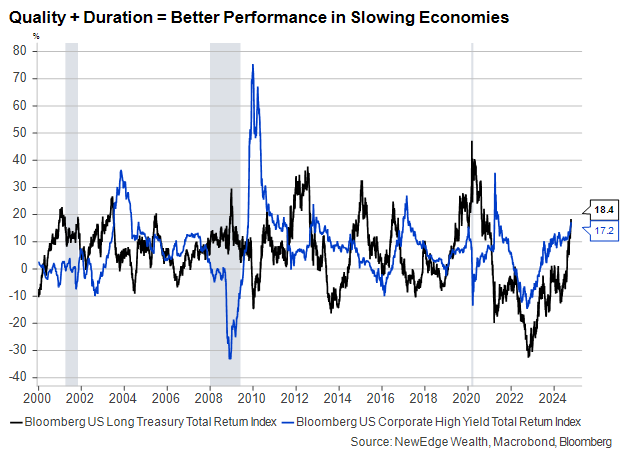

The risk of rising unemployment amid slower growth could have a significant impact on bond markets if these risks materialize. Increasing quality and extending duration are tried and true strategies for navigating periods of high volatility and falling growth rates, with the added benefit that these segments of the market still provide just about their best relative value in the last twenty years.

“What can I do with zero?” – Downside Risks to October Payrolls

The humanitarian tragedy of Hurricane Helene will also be an economic one for the American southeast, which will reverberate across the country. We will begin to see the impact of the storm and the damage it wrought in October’s economic reports, starting with the next employment report on November 1. Tens of thousands of workers in that area will remain at least temporarily unemployed this month.

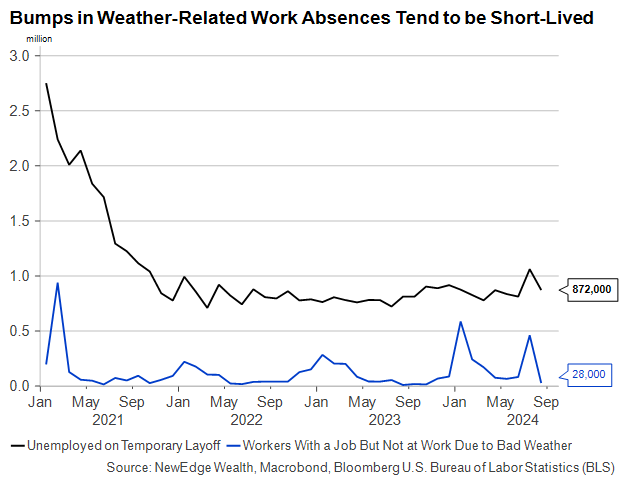

Of course, the Bureau of Labor Statistics accounts for these types of disruptions as it makes seasonal adjustments, and it often makes explicit estimates about the effects of non-economic factors it needs to. This graph shows that weather-related disturbances, while common, rarely last for more than a month or two. But they can have large impacts on single months.

The range of possible outcomes for October’s employment report is larger than normal, with risk clearly skewed to the downside. Markets might ignore distortions from noneconomic factors, especially if the hurricane recovery has made more progress by then. But the report will be the last major piece of economic news before the U.S. election the following Tuesday, and the Federal Open Market Committee (FOMC) meeting the next day.

Should the October data come in far off consensus, even for noneconomic reasons, it could both influence the election outcome and make the Fed’s job harder as it attempts to bring down interest rates without signaling undue alarm about the outlook. A very poor report could compel the Fed to make another large rate cut, even if it believes the data overstates the underlying weakness in the economy.

In light of the very strong September jobs data, investors see only about a 6% chance that the Fed will follow its 50bps September cut with another in November. Chair Jay Powell himself has pointed out that the median expectation of his colleagues seems to be for two smaller rate cuts in November and December. But the unusual uncertainty around the upcoming labor market data means we may, again, have to wait until the very last minute to find out.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC