“See the Stone Set in Your Eyes…”

Last week began with a bang as an apparent Artificial Intelligence (AI) breakthrough out of China called into question the narrative driving much of the recent U.S. equity market moves. By Friday morning, however, monetary policy, trade policy, and consumer data had taken back the reins to steer interest rates, currencies, and stocks.

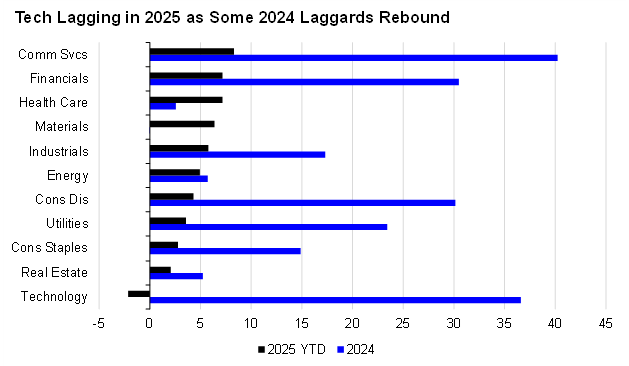

While Tech stocks came close to making a 10% correction last week, many of the sectors that lagged last year (yes, even international stocks) were among the leaders. With growth, led by personal consumption and a strong labor market, still solid heading into 2025, investors may be remembering the lead single from U2’s 1987 classic, The Joshua Tree, as they ask whether they can live “With or Without” the AI trade.

“And You Give Yourself Away”

News out of China last weekend indicated that a former hedge fund manager there had developed an AI Large Language Model (LLM) to rival those produced in the U.S. by firms like OpenAI at a fraction of the cost. Investors punished the stocks of Nvidia and other manufacturers of the advanced chips used to power these LLMs, along with those of Utilities and equipment firms that would benefit from a sharp rise in power demand.

Among the risks we cited coming into 2025 was investors’ focus on AI, which helped a historically small number of firms drive the S&P 500 Index to one of its highest valuations on record. While we are far from ready to declare the AI trade “over”, this week’s tremors validate our view that investors should look for opportunities to broaden their exposure, deemphasizing assets with the highest momentum, i.e., those that performed the best in 2024.

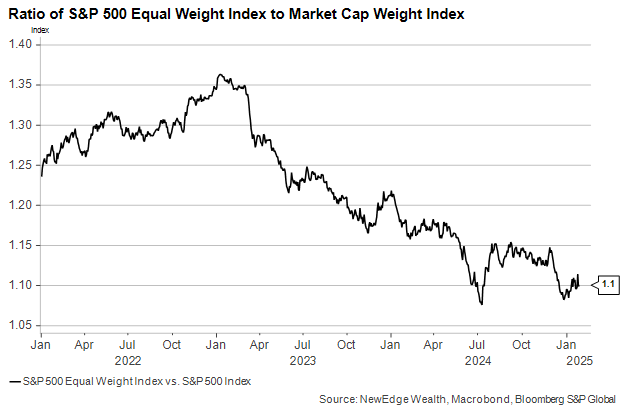

Monday’s market decline was unusual in that broad indexes like the S&P 500 were down 1% or more even as the prices of most stocks rose. This can occur when losses are concentrated in a small handful of large firms. While 2025 has seen better performance from equal-weight indexes than those that weight firms by their market capitalization, the average stock still has a lot of catching up to do to match the high performers of the past several years.

As we pointed out in our 2025 outlook, much of the outperformance in the so-called Magnificent 7 firms over the past two years has been a result of their superior earnings performance (125% vs. just 9% for the S&P 500 Equal Weight Index). While valuation swings like the one we saw last week can cause Equal Weight to outperform over short periods, this is less likely to be sustained absent a “catch up” in earnings growth.

“Through the Storm We Reach the Shore”

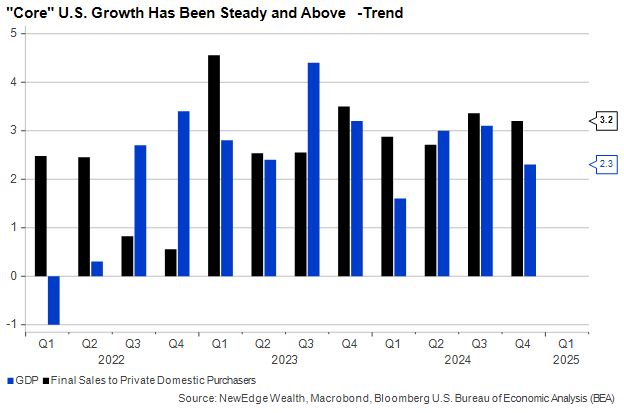

While investment in AI and other intellectual property has contributed positively to GDP over the past few years – and has obviously had a massive influence on the stock market – the near-term path for economic growth remains heavily dependent on the U.S. consumer. We need look no further than this week’s release of the Q4 U.S. GDP report, which showed the consumer adding a surprisingly hefty 2.82% to annualized GDP growth while intellectual property investment (including but not limited to AI) added just 0.15%.

The consumer has been more than up to the task of supporting the U.S. economy over the past two years despite flagging construction activity and drags from trade (thank you, strong dollar!) and inventory drawdowns at companies. As a result, “core” U.S. economic growth has been remarkably strong and steady since the brush with recession in 2022.

If there was anything concerning in the Q4 data, it was that the consumer may have been too strong at the end of last year. Surging spending on durable goods, forecasted accurately by consumer sentiment surveys taken just after the November election, may represent demand that was pulled forward from 2025 as households preferred to make large purchases ahead of anticipated price increases from tariffs and inflation.

Regardless of whether those price increases materialize, it’s unlikely that many families that bought a washing machine or a car in December will be in the market for another anytime soon. As such, there is some risk that Q1 consumer spending growth will slow.

“My Hands are Tied”

With growth above trend, unemployment low, and fiscal policy uncertain, the Federal Reserve has prudently become more reactive in its policy moves after cutting its benchmark rate by 100 basis points last year. This week’s statement sounded more upbeat about the labor market but less certain that inflation was on its way down. That makes further cuts unlikely anytime soon despite the president’s publicly professed demands for rates to come down.

For a majority of FOMC members to support lowering rates in 2025, the unemployment rate will almost certainly need to rise to 4.5% or higher from its current 4.1% level. While hiring has slowed and overall job churn is subdued, there is little in the data to suggest we are on the cusp of a labor market meltdown.

“I’ll Wait for You”

The benign macro setup should favor companies that perform well in a solid growth environment but are not overly dependent on low interest rates to keep their profit margins wide. So, it should not be a surprise that the best-performing segments of the equity market thus far in 2025, even before the Deepseek news, include Financials and Health Care. Momentum carried Tech and a handful of stocks in other sectors into the stratosphere in 2024, but our outlook for more dispersed returns and some reversion to the mean is, so far, coming to fruition.

For this performance to persist, however, we’ll need to see earnings grow faster in these lagging sectors. Analysts currently expect Health Care and Financials to grow earnings by 20% and 10%, respectively, in 2025. If these sectors cannot deliver on these EPS growth expectations, the resulting estimate cuts could cause sector leadership to revert to the trend of the past two years: narrow domination by Tech, whose earnings are expected to grow by “only” 23% this year.

“You Give it All, But I Want More”

Despite a torrent of news and a handful of bumps, January was a fruitful month for diversified investors, with the prices of both stocks and bonds ending higher despite the pullback in Tech stocks. But more shoes on tariffs, tax policy, and AI are likely to drop soon, and some are bound to hit investors.

We continue to view a sharp slowdown in growth as the most threatening “risk case” given how richly markets are valued. But with every week showing subdued jobless claims and every quarter of above-trend economic growth, any coming reckoning seems to be pushed further into the future, leaving a longer runway for positive – and widely shared – returns ahead.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC